Hong Kong has the world's most expensive skyscrapers: report

Skyscrapers in Hong Kong are the most expensive commercial property assets in the world, according to a report by Knight Frank released on Wednesday (19 July).

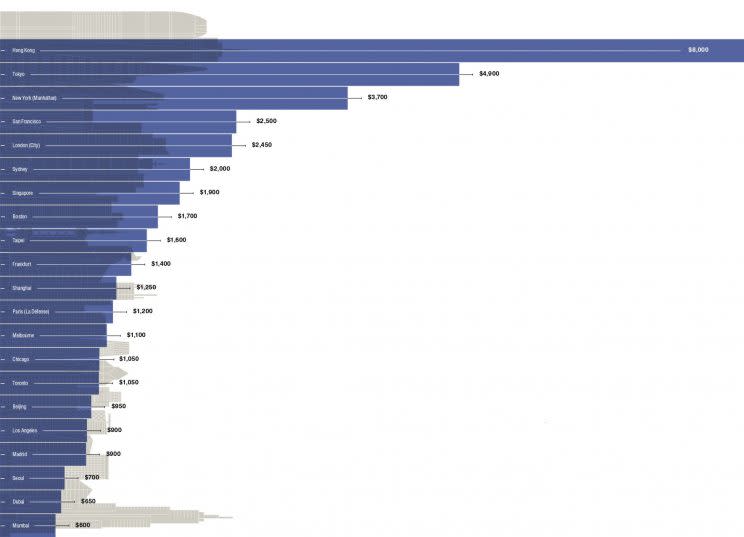

The property consulting firm valued Hong Kong’s tallest commercial towers at US$8,000 per square foot based on rental values as at the fourth quarter of 2016 and prime yields.

In comparison, skyscrapers in Tokyo were a distant second at US$4,900 psf. Manhattan/New York came in third at US$3,700 psf, ahead of San Francisco (US$2,500 psf) and London (US$2,450 psf).

Singapore was seventh with a valuation of US$1,900 psf while Mumbai came in last on the list of 21 cities at $600 psf.

On the premium values of Hong Kong’s skyscrapers, Nicholas Holt, Head of Research for Asia Pacific at Knight Frank, said, “Capital values of Asia’s tallest towers showed significant divergence at the end of Q4 2016…In Hong Kong, continued strong demand and a lack of new land supply continues to push values higher.”

The report came amid frenzied demand in Hong Kong’s property market with developer Henderson Land recently paying US$3 billion for an old five-storey car park.

Read more:

Yahoo Finance

Yahoo Finance