Hilton Grand Vacations Inc. (HGV) Q1 2024 Earnings: A Mixed Financial Performance with ...

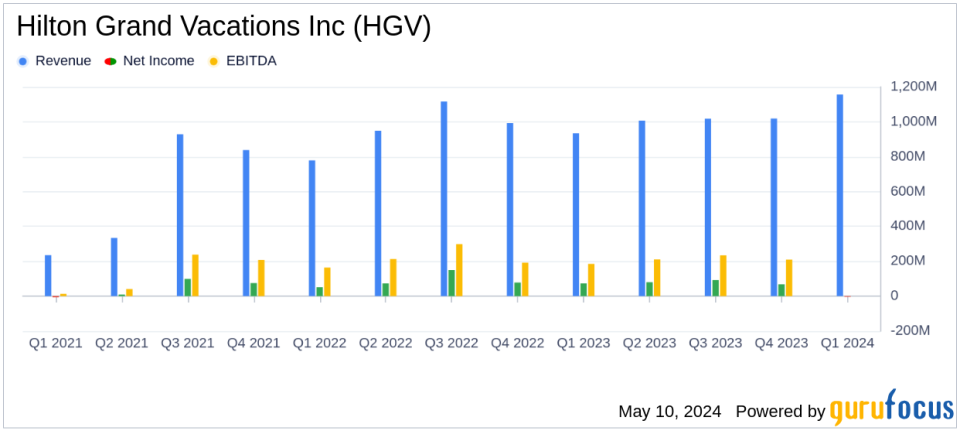

Revenue: $1,156M, a 23.8% increase from $934M in the previous year, surpassing estimates of $1,116.21M.

Net Loss: $(4)M, a significant decline from a net income of $73M in the prior year, falling short of estimates of $81.53M net income.

Net Loss: $(4)M, a significant decline from a net income of $73M in the prior year, falling short of an estimated net income of $81.53M.

Diluted EPS: $(0.04), compared to $0.64 in the same period last year, falling significantly below the estimated EPS of $0.72.

Adjusted Diluted EPS: $0.95, an increase from $0.79 year-over-year, exceeding estimates of $0.85.

Adjusted EBITDA: $273M, up 25.2% from $218M in the previous year, indicating improved operational efficiency.

Share Repurchase: Repurchased 2.3 million shares for $99M during the quarter, highlighting ongoing shareholder return efforts.

Guidance: Reiterated full-year 2024 Adjusted EBITDA guidance in the range of $1.2B to $1.26B, affirming positive outlook for the fiscal year.

Hilton Grand Vacations Inc. (NYSE:HGV) disclosed its first quarter 2024 financial results on May 9, 2024, revealing a complex quarter marked by strategic expansions but also a notable net loss. The company's detailed earnings can be accessed through its 8-K filing. HGV, a leading timeshare company under the Hilton brand, operates primarily through its Real Estate Sales and Financing, and Resort Operations and Club Management segments.

Financial Highlights and Performance Analysis

HGV reported a total revenue of $1,156 million for Q1 2024, a significant increase from $934 million in the same period last year. This growth was bolstered by the integration of Bluegreen Vacations and increased sales activities. However, the company faced a net loss of $4 million, a stark contrast to the $73 million net income from Q1 2023. This loss was primarily due to various adjustments and the costs associated with ongoing construction projects, notably in Japan.

Adjusted net income stood at $99 million, up from $90 million year-over-year, reflecting a more favorable view of the company's operational efficiency when excluding one-time costs. The diluted EPS was $(0.04), down from $0.64 in the prior year, while adjusted diluted EPS improved to $0.95 from $0.79, indicating underlying profitability amidst financial adjustments.

Adjusted EBITDA also saw an increase to $273 million from $218 million, driven by robust performance in both primary business segments. The Real Estate Sales and Financing segment alone contributed $687 million in revenues, up from $550 million in the previous year, with adjusted EBITDA for this segment at $206 million.

Strategic Developments and Market Positioning

The quarter was notable not just for financial outcomes but also for strategic initiatives. January 2024 marked the completion of the acquisition of Bluegreen Vacations, enhancing HGV's market presence and product offerings. The company also emphasized its commitment to expanding its lead channels and tour flow through a new partnership with Great Wolf Lodge, aiming to provide more diverse vacation options to its members.

CEO Mark Wang commented on the quarter's results and strategic direction, stating, "We started the year on a positive note, and were very encouraged by the momentum we built as we progressed through the quarter. Our owner business continued to outperform, and our package activations returned to near-record levels, leaving us optimistic that consumers intention to travel remains strong." This optimism is also reflected in the company's reiteration of its full-year 2024 guidance for Adjusted EBITDA in the range of $1.2 billion to $1.26 billion.

Challenges and Forward Outlook

Despite the positive adjusted earnings and revenue growth, the net loss highlights ongoing challenges, particularly related to construction deferrals and the integration costs of recent acquisitions. These factors are critical as they impact the net earnings and could influence investor sentiment. Moreover, the company's strategic expansions, while promising, will require careful management to ensure they contribute positively to the bottom line.

As HGV continues to navigate a complex market environment, its ability to maintain operational efficiency while expanding its footprint will be crucial. Investors and stakeholders will likely watch closely how well the company manages its growth strategies against the backdrop of its current financial health.

For detailed financial tables and further information, refer to the original 8-K filing linked above.

Explore the complete 8-K earnings release (here) from Hilton Grand Vacations Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance