High Insider Ownership Growth Stocks On The UK Market For May 2024

As the United Kingdom's financial markets navigate through fluctuating inflation rates and public finance figures, investors continue to assess the broader economic landscape. In such a context, stocks with high insider ownership can be particularly noteworthy as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.6% | 50.8% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Energean (LSE:ENOG) | 10.7% | 22.4% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Plant Health Care (AIM:PHC) | 26.4% | 94.4% |

Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 198.2% |

Let's uncover some gems from our specialized screener.

Mortgage Advice Bureau (Holdings)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mortgage Advice Bureau (Holdings) plc operates in the United Kingdom, offering mortgage advice services through its subsidiaries, with a market capitalization of approximately £532.66 million.

Operations: The company generates its revenue primarily from the provision of financial services, totaling £236.92 million.

Insider Ownership: 20.2%

Mortgage Advice Bureau (Holdings) showcases moderate growth potential with forecasted earnings growth of 19.33% per year, outpacing the UK market average. The company's revenue is also expected to grow at 13.6% annually, again exceeding the UK market forecast of 3.7%. Recent executive appointments, including Emilie McCarthy as CFO and Rachel Haworth as independent Non-Executive Director, may bolster strategic initiatives and governance. However, its dividend coverage by earnings raises concerns about sustainability despite no substantial insider selling in recent months.

Hochschild Mining

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile, with a market capitalization of approximately £0.89 billion.

Operations: The company generates its revenue primarily from three key mines: San Jose contributing $242.46 million, Inmaculada adding $396.64 million, and Pallancata providing $54.05 million.

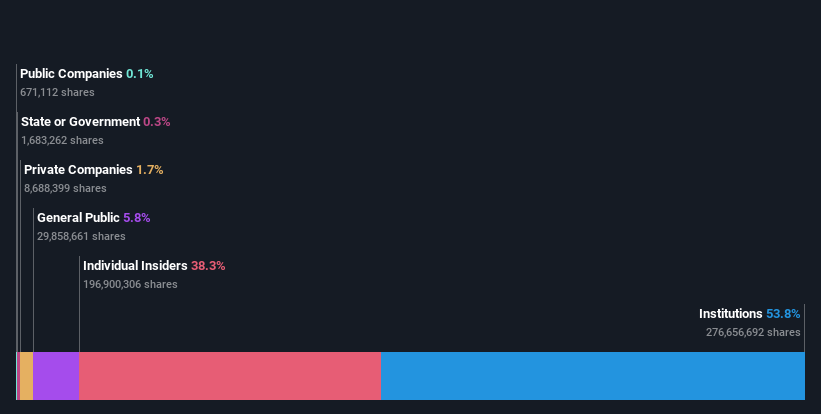

Insider Ownership: 38.4%

Hochschild Mining, amidst a challenging financial landscape with a recent net loss of US$55.01 million, is taking strategic steps towards profitability and growth. The company anticipates becoming profitable within three years, supported by an expected annual earnings growth of 57.16%. Despite slower revenue growth projections at 8.3% per year, this rate still surpasses the UK market average of 3.7%. Insider activity reflects confidence, with more shares bought than sold recently, aligning with their proactive approach in seeking value-accretive mergers and acquisitions to bolster future prospects.

Click to explore a detailed breakdown of our findings in Hochschild Mining's earnings growth report.

IWG

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IWG plc operates globally, offering workspace solutions across the Americas, Europe, the Middle East, Africa, and Asia Pacific with a market capitalization of approximately £2.06 billion.

Operations: The company generates revenue through its workspace solutions, primarily in the Americas (£1.05 billion), Europe, the Middle East, and Africa (£1.32 billion), and the Asia Pacific (£0.27 billion).

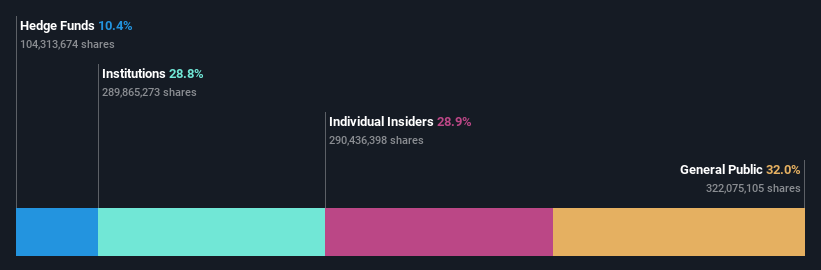

Insider Ownership: 28.9%

IWG, a company in the UK, is expected to see earnings grow significantly at 101.7% per year. Despite a modest return on equity forecast at 11.6%, its revenue growth of 7.8% annually outpaces the UK market's 3.7%. Recent financials show a slight increase in quarterly revenue to £912 million from £911 million year-over-year, but also reveal a substantial net loss of £215 million for the last fiscal year, indicating challenges ahead despite growth prospects and strategic buybacks totaling £1 million recently.

Summing It All Up

Dive into all 66 of the Fast Growing UK Companies With High Insider Ownership we have identified here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:MAB1 LSE:HOC and LSE:IWG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance