High Insider Ownership Growth Stocks On TSX To Watch In June 2024

As the Canadian market experiences a phase of stabilization and potential recovery, bolstered by recent rate cuts from the Bank of Canada, investors are turning their attention to growth companies with high insider ownership on the TSX. In current conditions where economic and market normalization is underway, stocks with significant insider stakes can be particularly compelling, as they often signal confidence from those most familiar with the company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Payfare (TSX:PAY) | 15% | 57.7% |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Vox Royalty (TSX:VOXR) | 12.4% | 77.3% |

Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

Aritzia (TSX:ATZ) | 19% | 51.2% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 65.3% |

Artemis Gold (TSXV:ARTG) | 31.8% | 48.8% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

Let's review some notable picks from our screened stocks.

Aritzia

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc. is a company that designs, develops, and sells women's apparel and accessories in the United States and Canada, with a market capitalization of approximately CA$4.17 billion.

Operations: The company generates CA$2.33 billion in revenue from its apparel and accessories segments.

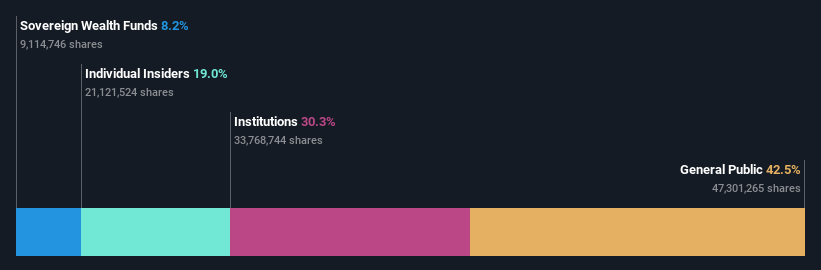

Insider Ownership: 19%

Aritzia, a Canadian retailer, has demonstrated a robust financial trajectory with significant anticipated growth. Despite a recent dip in net income and profit margins—CAD 78.78 million and 3.4% respectively from higher figures last year—the company is poised for recovery. Fiscal 2025 guidance suggests revenue growth between CAD 2.52 billion to CAD 2.62 billion, an approximate increase of up to 14%. Insider ownership remains static with no new purchases reported, aligning with cautious but optimistic corporate forecasts for substantial earnings expansion over the next three years.

Unlock comprehensive insights into our analysis of Aritzia stock in this growth report.

Our valuation report here indicates Aritzia may be undervalued.

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. is a mining company focused on the development and exploration of minerals and precious metals, primarily in Africa, with a market capitalization of approximately CA$23.26 billion.

Operations: The company primarily generates its revenue from the mining, development, and exploration of minerals and precious metals in Africa.

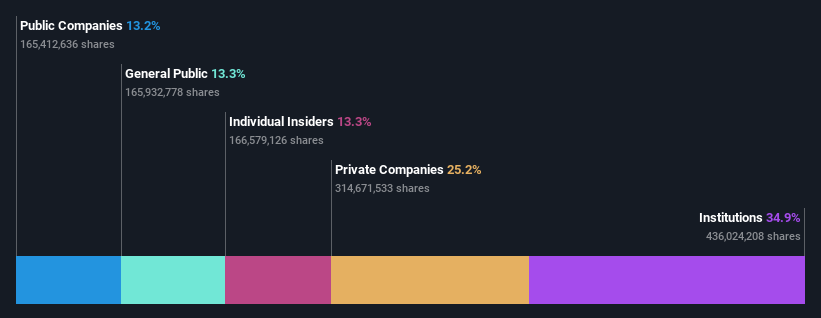

Insider Ownership: 13.1%

Ivanhoe Mines, a growth-focused mining company with high insider ownership, recently celebrated the early and on-budget completion of its Phase 3 concentrator at the Kamoa-Kakula Copper Complex. This expansion is set to significantly increase copper production, enhancing Ivanhoe's position as one of the world’s largest copper producers. Despite a recent net loss of US$65.55 million in Q1 2024, revenue and earnings are expected to grow substantially due to increased operational efficiency and strategic mergers and acquisitions pursuits.

Savaria

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation specializes in accessibility solutions for the elderly and physically challenged, operating across Canada, the United States, Europe, and internationally, with a market cap of approximately CA$1.28 billion.

Operations: The company generates revenue primarily from its Patient Care segment, which accounted for CA$183.82 million.

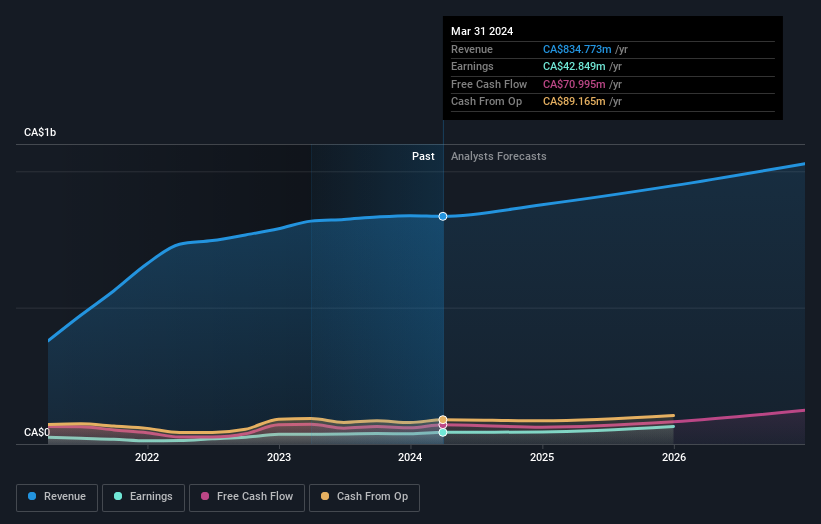

Insider Ownership: 19.6%

Savaria Corporation, with significant insider buying recently, demonstrates robust growth potential. Earnings have increased at a rate of 13.1% annually over the past five years and are expected to rise by 24.87% annually going forward. Despite some shareholder dilution last year, the company's revenue growth is anticipated to outpace the Canadian market average. Additionally, Savaria has appointed Pernilla Lindén to its Board, enhancing governance with her extensive financial expertise.

Next Steps

Get an in-depth perspective on all 30 Fast Growing TSX Companies With High Insider Ownership by using our screener here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:ATZ TSX:IVN and TSX:SIS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance