High Insider Ownership Growth Companies On US Exchanges For June 2024

As of June 2024, the U.S. market is experiencing a mix of cautious optimism and volatility, with recent data indicating potential for Federal Reserve rate cuts amid fluctuating job market signals. This backdrop makes it an intriguing time to consider growth companies with high insider ownership, as these entities often demonstrate alignment between management’s interests and those of shareholders, potentially offering stability in uncertain economic times.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.1% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Celsius Holdings (NasdaqCM:CELH) | 10.4% | 21.8% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

BBB Foods (NYSE:TBBB) | 23.6% | 99.4% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Atlassian

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation operates globally, focusing on the design, development, licensing, and maintenance of software products, with a market capitalization of approximately $41.50 billion.

Operations: The company generates its revenue primarily from software and programming, amounting to approximately $4.17 billion.

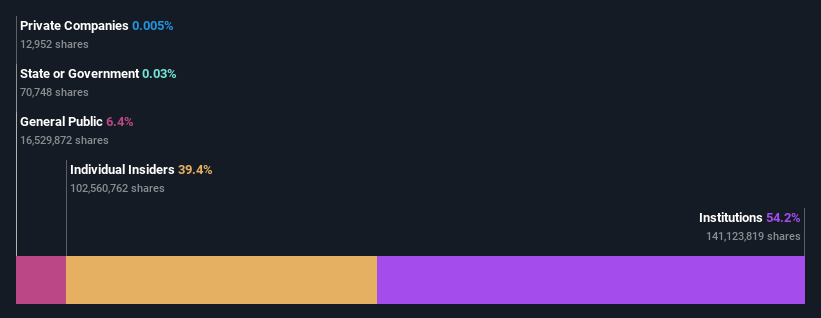

Insider Ownership: 39.3%

Revenue Growth Forecast: 17.5% p.a.

Atlassian, a growth-oriented company with significant insider ownership, recently issued US$1 billion in senior unsecured notes to strengthen its financial position. Despite this debt financing, Atlassian maintains robust revenue growth, with recent figures showing a substantial increase from the previous year. The company's integration of AI tools through expanded partnerships promises enhanced product offerings and customer engagement. However, it's worth noting that while insider transactions have been active, the balance has tipped slightly more towards buying than selling in recent months.

Get an in-depth perspective on Atlassian's performance by reading our analyst estimates report here.

Palantir Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palantir Technologies Inc. develops software platforms for the intelligence community to support counterterrorism efforts in the U.S., the U.K., and globally, with a market capitalization of approximately $47.48 billion.

Operations: The company generates revenue through two primary segments: Commercial, which brought in $1.07 billion, and Government, contributing $1.27 billion.

Insider Ownership: 13.4%

Revenue Growth Forecast: 16% p.a.

Palantir Technologies, a company with substantial insider ownership, has recently expanded partnerships and secured significant contracts that underscore its growth trajectory. Notably, collaborations with Eaton and Proxet Group enhance its AI capabilities across global operations. The company reported a sharp increase in Q1 earnings to US$105.53 million from US$16.8 million year-over-year, with projected annual revenues reaching up to US$2.69 billion. Despite these positives, shareholder dilution over the past year and a forecasted low return on equity could temper investor enthusiasm.

Spotify Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Spotify Technology S.A. operates globally, offering audio streaming subscription services with a market capitalization of approximately $62.20 billion.

Operations: The company generates revenue primarily through its Premium segment, which brought in €12.10 billion, and its Ad-Supported segment, which contributed €1.74 billion.

Insider Ownership: 18%

Revenue Growth Forecast: 12.2% p.a.

Spotify Technology has demonstrated a robust turnaround with its Q1 2024 earnings, reporting a net income of EUR 197 million, reversing from a net loss the previous year. This positive shift is supported by significant sales growth to EUR 3.636 billion. Looking ahead, Spotify anticipates continued expansion with forecasts suggesting strong user growth and an operating profit of EUR 250 million in Q2. However, despite these gains, shareholder dilution over the past year may raise concerns among investors regarding equity value erosion.

Taking Advantage

Navigate through the entire inventory of 179 Fast Growing US Companies With High Insider Ownership here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:TEAM NYSE:PLTR and NYSE:SPOT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance