High Growth Stocks To Profit From

Investors seeking to increase their exposure to growth should consider companies such as Valuetronics Holdings and Fu Yu. Analysts are generally optimistic about the future of these stocks, based on how much they’re expected to earn and return. Whether it be a well-known tech stock or a risky small-cap, I believe diversification towards growth can add value to your current holdings. Below I’ve compiled a list of stocks with a bright future ahead.

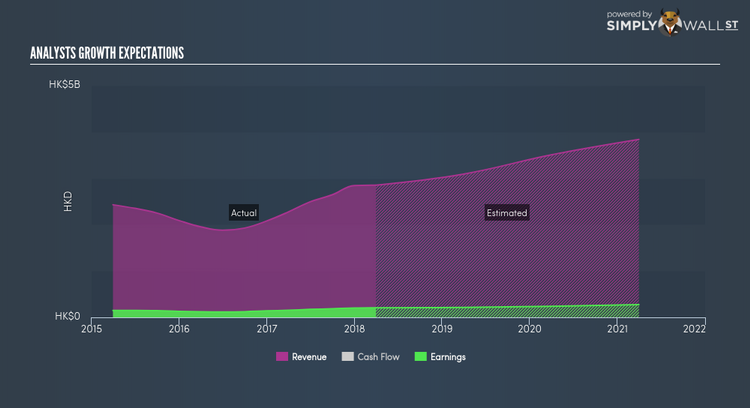

Valuetronics Holdings Limited (SGX:BN2)

Valuetronics Holdings Limited, an investment holding company, provides integrated electronics manufacturing services (EMS) in the United States, the People’s Republic of China, Poland, Canada, the Netherlands, and internationally. Valuetronics Holdings was founded in 1992 and with the market cap of SGD SGD341.10M, it falls under the small-cap stocks category.

BN2 is expected to deliver a positive top-line growth of 22.87% over the next couple of years, according to market analysts. Furthermore, the triple-digit growth in operating cash flows indicates that a large portion of this revenue increase is high-quality, day-to-day cash generated by the business, rather than one-offs. The market’s bullish sentiment on BN2’s capacity to grow at such high rates makes it an interesting stock to dig into deeper. Should you add BN2 to your portfolio? I recommend researching its fundamentals here.

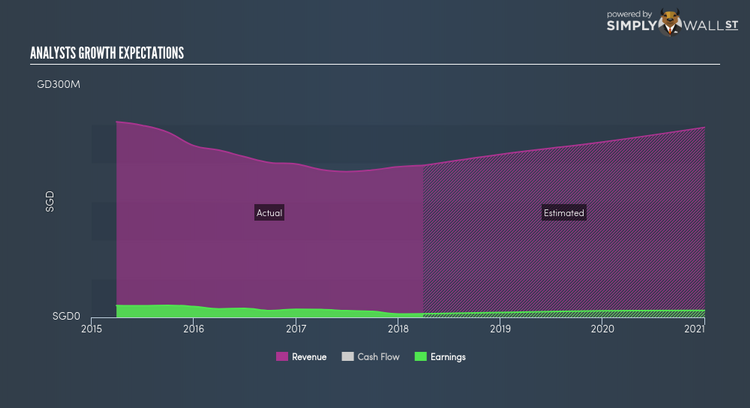

Fu Yu Corporation Limited (SGX:F13)

Fu Yu Corporation Limited, an investment holding company, engages in the manufacture and sub-assembly of precision plastic parts and components in Singapore, Malaysia, and China. Started in 1978, and currently lead by Lien Lee Hew, the company now has 2,241 employees and with the company’s market capitalisation at SGD SGD135.54M, we can put it in the small-cap category.

F13’s projected future profit growth is a robust 23.25%, with an underlying 17.84% growth from its revenues expected over the upcoming years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 5.40%. F13’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. A potential addition to your portfolio? Check out its fundamental factors here.

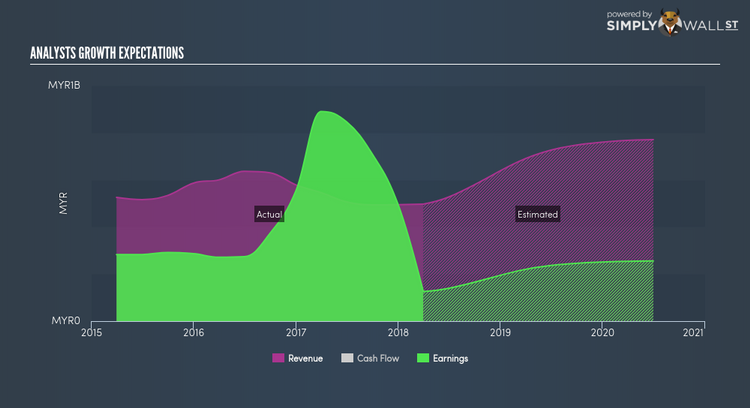

Silverlake Axis Ltd (SGX:5CP)

Silverlake Axis Ltd., an investment holding company, provides digital economy solutions and services to the banking, insurance, payment, retail, and logistic industries. Silverlake Axis was started in 1989 and has a market cap of SGD SGD1.46B, putting it in the small-cap category.

5CP’s projected future profit growth is a robust 31.55%, with an underlying 52.90% growth from its revenues expected over the upcoming years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 25.25%. 5CP’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add 5CP to your portfolio? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance