Here's Why We Think ValueMax Group (SGX:T6I) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in ValueMax Group (SGX:T6I). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide ValueMax Group with the means to add long-term value to shareholders.

View our latest analysis for ValueMax Group

ValueMax Group's Improving Profits

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So EPS growth can certainly encourage an investor to take note of a stock. In previous twelve months, ValueMax Group's EPS has risen from S$0.062 to S$0.066. That amounts to a small improvement of 5.9%.

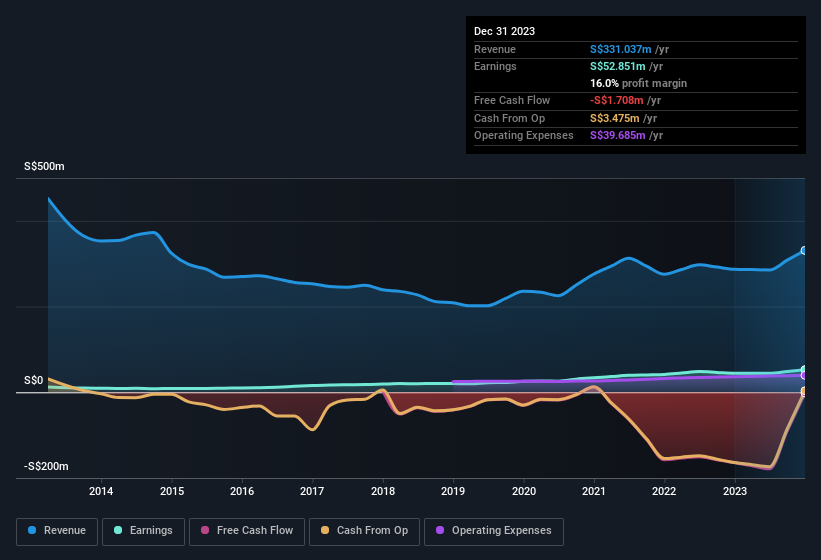

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for ValueMax Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to S$331m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

ValueMax Group isn't a huge company, given its market capitalisation of S$285m. That makes it extra important to check on its balance sheet strength.

Are ValueMax Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First and foremost; there we saw no insiders sell ValueMax Group shares in the last year. But the really good news is that Executive Chairman Hiang Nam Yeah spent S$606k buying stock, at an average price of around S$0.34. Big buys like that may signal an opportunity; actions speak louder than words.

Along with the insider buying, another encouraging sign for ValueMax Group is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at S$63m. That shows significant buy-in, and may indicate conviction in the business strategy. As a percentage, this totals to 22% of the shares on issue for the business, an appreciable amount considering the market cap.

Does ValueMax Group Deserve A Spot On Your Watchlist?

One positive for ValueMax Group is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with ValueMax Group (at least 1 which is significant) , and understanding these should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, ValueMax Group isn't the only one. You can see a a curated list of Singaporean companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance