Here's Why We Think Centurion (SGX:OU8) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Centurion (SGX:OU8). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Centurion

Centurion's Improving Profits

In the last three years Centurion's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Impressively, Centurion's EPS catapulted from S$0.085 to S$0.18, over the last year. It's a rarity to see 114% year-on-year growth like that.

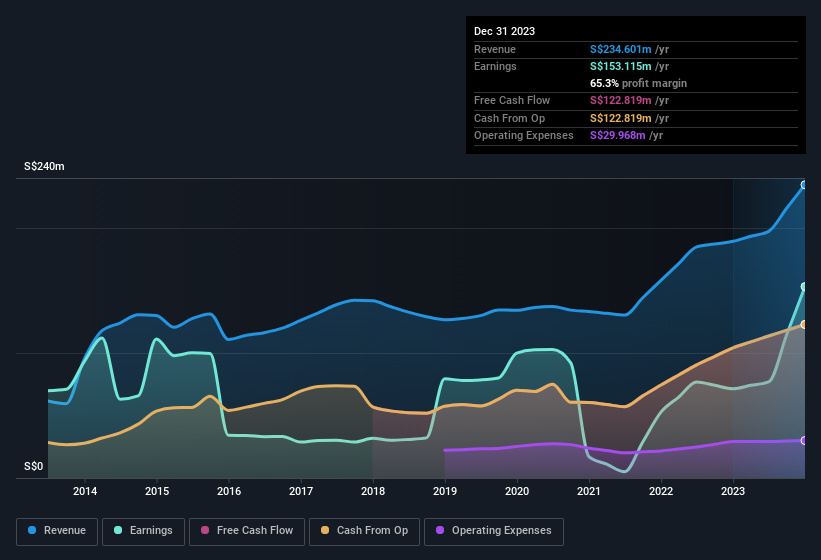

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Centurion's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The music to the ears of Centurion shareholders is that EBIT margins have grown from 55% to 63% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Centurion?

Are Centurion Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it Centurion shareholders can gain quiet confidence from the fact that insiders shelled out S$579k to buy stock, over the last year. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. It is also worth noting that it was company insider Kim Kang Loh who made the biggest single purchase, worth S$531k, paying S$0.43 per share.

On top of the insider buying, it's good to see that Centurion insiders have a valuable investment in the business. With a whopping S$84m worth of shares as a group, insiders have plenty riding on the company's success. That holding amounts to 20% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Chee Min Kong is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between S$273m and S$1.1b, like Centurion, the median CEO pay is around S$1.2m.

Centurion's CEO took home a total compensation package worth S$1.1m in the year leading up to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Centurion To Your Watchlist?

Centurion's earnings per share growth have been climbing higher at an appreciable rate. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Centurion belongs near the top of your watchlist. We don't want to rain on the parade too much, but we did also find 4 warning signs for Centurion (2 make us uncomfortable!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Centurion, you'll probably love this curated collection of companies in SG that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance