Here's Why You Should Retain Veeva Systems (VEEV) Stock for Now

Veeva Systems Inc. VEEV is well-poised for growth in the coming quarters, courtesy of a slew of product launches over the past few months. The optimism led by a solid third-quarter fiscal 2023 performance, along with strong product adoption, is expected to contribute further. Stiff competition and forex woes persist.

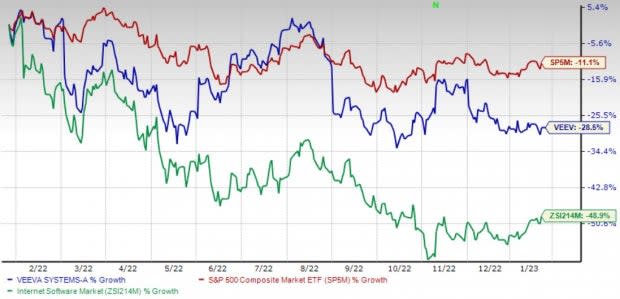

Over the past year, this Zacks Rank #3 (Hold) stock has lost 28.6% compared with the 48.9% fall of the industry and 11.1% fall of the S&P 500 composite.

The renowned provider of cloud-based software applications and data solutions for the life sciences industry has a market capitalization of $25.29 billion. The company projects 15.7% growth for the next five years and expects to maintain its strong performance. It has delivered an earnings surprise of 4.4% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Product Launches: Veeva Systems has introduced few products in the market over the past few months, raising our optimism. The company, in October 2022, announced Veeva Vault CRM for Medtech, a unified customer relationship management (CRM) and content management application.

The same month, Veeva Systems announced the availability of Veeva ePRO, a key advancement in patient-centric digital trials.

Product Adoption: We are upbeat about Veeva Systems registering a robust adoption for its products over the past few months. The company, in January, announced that contract development and manufacturing organization Adare Pharma Solutions selected Veeva Vault Quality Suite to harmonize quality systems across the organization.

In October 2022, Veeva Systems announced that 40 contract research organizations selected Veeva Vault CTMS to deliver faster and more efficient trials to sponsors.

Strong Q3 Results: Veeva Systems’ solid third-quarter fiscal 2023 results buoy optimism. The company saw an uptick in the overall top and bottom lines and robust performances by both segments during the quarter. The company continued to benefit from its flagship Vault platform. Veeva Systems’ continued strength in its Commercial Solutions, with new SMB customer additions and enterprise seat expansions in Asia Pacific and North America, looked promising. The continued strength in Veeva Link Key People and positive feedback for its Veeva Compass auger well for the company.

Downsides

Forex Woes: Veeva Systems derives a major share of its revenues from international operations. Some of its international agreements provide for payment denominated in local currencies, and the majority of its local costs are also denominated in local currencies. Fluctuations in the value of the U.S. dollar versus foreign currencies may impact its operating results when converted into U.S. dollars.

Stiff Competition: Veeva Systems operates in a highly competitive market. In new sales cycles within the company’s largest product categories, it competes with other cloud-based solutions from providers that make applications inclined toward the life sciences industry. The company’s Commercial Cloud and Veeva Vault application suites also compete to replace client-server-based legacy solutions offered by large companies and other smaller application providers.

Estimate Trend

Veeva Systems is witnessing a positive estimate revision trend for fiscal 2023. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 0.7% north to $4.19.

The Zacks Consensus Estimate for the company’s fourth-quarter fiscal 2023 revenues is pegged at $552.2 million, suggesting a 13.7% improvement from the year-ago quarter’s reported number.

This compares to our fiscal fourth-quarter revenue estimate of $551.6 million, suggesting a 13.6% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Cardinal Health, Inc. CAH and Merit Medical Systems, Inc. MMSI.

AMN Healthcare, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 10.9%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has lost 0.8% compared with the industry’s 22.3% decline in the past year.

Cardinal Health, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.7%. CAH’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average beat being 3%.

Cardinal Health has gained 49.2% against the industry’s 1.9% decline over the past year.

Merit Medical, flaunting a Zacks Rank #1 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 22.2% against the industry’s 1.9% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance