Here's Why You Should Purchase Valero (VLO) Stock Right Now

Valero Energy Corporation VLO has witnessed upward earnings estimate revisions for 2024 and 2025 over the past seven days.

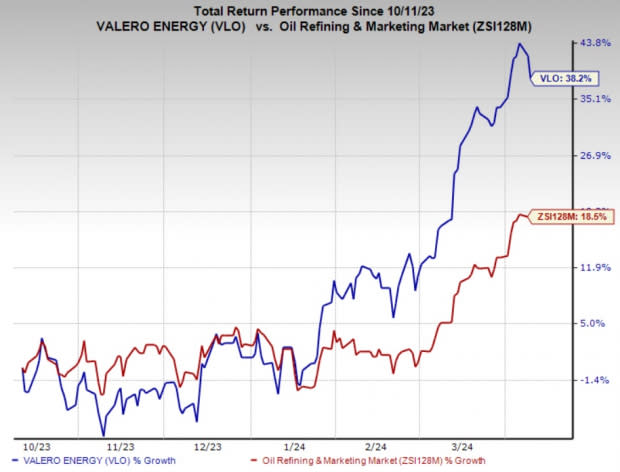

The company, with a Zacks Rank #2 (Buy), has gained 38.2% over the past six months compared with 18.5% growth of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

What’s Favoring the Stock?

Valero demonstrated strong financial resilience and adaptability by posting significant earnings in the fourth quarter of 2023. Its EPS of $3.55, surpassing expectations by $0.60, reflects the company's operational efficiency and ability to navigate market dynamics effectively. This robust performance, especially in a challenging economic environment, marked by a 15.17% year-over-year decrease in revenues, underscores Valero's solid management and strategic positioning within the energy sector.

The company's refining system achieved a remarkable 97.4% mechanical availability in 2023, setting a new record for VLO. This exceptional reliability is indicative of Valero's commitment to operational excellence and safety. High mechanical availability ensures consistent production capabilities, mitigating the risks associated with unplanned downtime and enabling the company to capitalize on favorable market conditions more effectively.

VLO continues to invest in strategic growth projects that enhance its long-term competitive advantage. Notably, the Sustainable Aviation Fuel (SAF) project at Port Arthur, which is on track for completion in the first quarter of 2025, positions Valero as a key player in the emerging SAF market. This diversification into sustainable fuels aligns with the global trends toward cleaner energy sources and opens up revenue streams for the company, potentially providing a hedge against the volatility of traditional fuel markets.

Valero's commitment to returning value to shareholders is evident through its generous dividend payouts and share repurchase programs. In the fourth quarter of 2023, the company returned 73% of adjusted net cash provided by operating activities to shareholders, demonstrating its strong cash generation capabilities and shareholder-friendly policies. This level of return, coupled with a 5% increase in the quarterly cash dividend, makes Valero an attractive investment for income-focused investors.

The company anticipates refining margins to remain supported by tight product supply and demand balances. With industry-wide heavy turnaround activity expected in the first quarter of 2024, product inventories are likely to be constrained, further supporting refining margins. Moreover, Valero expects global demand growth to outpace supply additions despite new refinery startups, suggesting a favorable long-term outlook for the refining sector. This expectation of sustained demand growth, especially in the context of limited capacity additions, positions Valero well to benefit from favorable market dynamics.

Other Stocks to Consider

Investors interested in the energy sector may take a look at the following company that presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

SM Energy Company SM is an independent oil and gas company engaged in the exploration, exploitation, development, acquisition, and production of oil and gas in North America. SM currently has a Momentum Score of A and a Value Score of B.

The Zacks Consensus Estimate for SM’s 2024 and 2025 EPS is pegged at $5.99 and $6.44, respectively. The stock has witnessed upward earnings estimate revisions for 2024 and 2025 in the past seven days.

Enerplus Corporation ERF is an independent oil and gas production company with resources across Western Canada and the United States.

Enerplus has witnessed upward earnings estimate revisions for 2024 and 2025 in the past seven days. The consensus estimate for ERF’s 2024 and 2025 earnings per share is pegged at $1.95 and $2.25, respectively.

Global Partners GLP is a leading operator of gasoline stations and convenience stores. Over the past 30 days, GLP has witnessed upward earnings estimate revisions for 2023 and 2024, respectively.

The Zacks Consensus Estimate for Global Partners’ 2024 and 2025 EPS is pegged at $3.90 and $4.47, respectively. GLP currently has a Zacks Style Score of A for Value.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

Global Partners LP (GLP) : Free Stock Analysis Report

Enerplus Corporation (ERF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance