Here's Why Investors Should Retain Yum! Brands (YUM) Stock Now

Yum! Brands, Inc. YUM is benefiting from continued focus on off-premise channels, strategic investments in digital technology and robust same-store sales. However, high costs remain a concern for the company.

This currently Zacks Rank #3 (Hold) company has an impressive long-term earnings growth rate of 11.1%. Its earnings and sales in 2024 are likely to witness improvements of 10% and 10.7% year over year, respectively.

Growth Drivers

The company continues to focus on deploying technologies to enhance the guest experience. It has been working toward accelerating its delivery services and the results have been positive so far. In 2023, the company reported digital sales of more than $30 billion (up 22% year over year), with a digital mix of more than 45%. Moreover, YUM reported solid adoption of Dragontail Systems. The initiative paves the path to tap the powers of Artificial Intelligence to streamline the end-to-end food preparation process, as well as improve delivery capabilities. The company expanded its global adoption of the platform to 28 markets across both KFC and Pizza Hut brands.

Despite the challenging macro environment, the company impressed investors with robust same-store sales growth in fourth-quarter 2023. It reported consolidated same-store sales growth of 1% year over year. The upside was primarily backed by a rise in dine-in traffic, digital initiatives and strategic third-party partnerships. During the quarter, same-store sales at Taco Bell and KFC rose 3% and 2% year over year, respectively. The company has been benefiting from robust growth in emerging markets. Given the emphasis on consumer value proposition, expanded digital access and franchise partners, management anticipates this momentum to continue in the upcoming periods.

On the other hand, Yum! Brands aims to revamp its financial profile. This, in turn, will improve the efficiency of its organization and cost structure globally. It believes that a “slimmer Yum Brands” would lead to efficiency gains. Considering its existing footprint of more than 58,000 restaurants worldwide, Yum! Brands believes it can roughly triple its current global presence over the long term and consolidate franchisees in Latin America and the Caribbean to drive growth.

In 2024, significant milestones are on the horizon as the company surpasses 30,000 restaurants at KFC, exceeds 20,000 locations at Pizza Hut and achieves a global presence of more than 60,000 establishments for Yum! Brands.

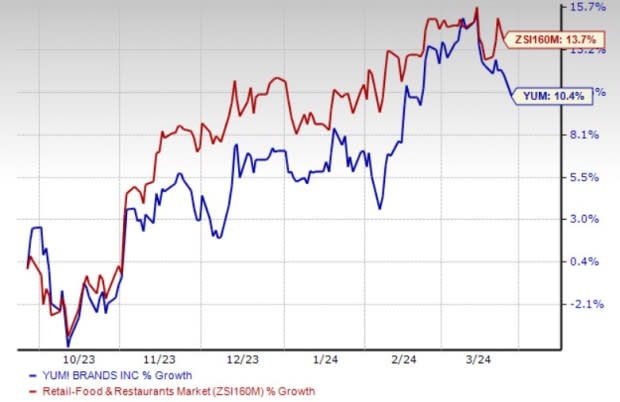

Image Source: Zacks Investment Research

Concerns

An increase in the cost of employee wages, benefits and insurance, and other operating costs such as rent and energy costs, puts significant pressure on margins. A competitive retail environment weighed on restaurants’ costs. The company is susceptible to profit margin pressure due to relentless expansion.

In 2023, its net costs and expenses amounted to $4.76 billion, up 2% year over year. Costs associated with brand positioning in all key markets and ongoing investment initiatives are likely to weigh on margins in the near term. The company remains cautious of the uncertain macro environment.

Key picks

Some better-ranked stocks in the Zacks Retail-Wholesale sector are:

Brinker International, Inc. EAT sports a Zacks Rank #1 (Strong Buy) at present. The company has a trailing four-quarter earnings surprise of 212.7% on average. Shares of EAT have surged 26.2% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for EAT’s 2024 sales and earnings per share (EPS) indicates 4.9% and 30.4% growth, respectively, from the year-ago period’s levels.

Texas Roadhouse, Inc. TXRH carries a Zacks Rank #2 (Buy) at present. It has a trailing four-quarter negative earnings surprise of 3.9%, on average. The stock has gained 45.4% in the past year.

The Zacks Consensus Estimate for TXRH’s 2024 sales and EPS suggests rises of 14.1% and 25.8%, respectively, from the year-ago period’s levels.

CAVA Group, Inc. CAVA currently carries a Zacks Rank of 2. It has a trailing three-quarter earnings surprise of 533.3%, on average.

The Zacks Consensus Estimate for CAVA’s 2024 sales and EPS indicates 19.8% and 14.3% growth, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Texas Roadhouse, Inc. (TXRH) : Free Stock Analysis Report

CAVA Group, Inc. (CAVA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance