Here's Why Investors Should Retain MGM Resorts (MGM) Stock for Now

MGM Resorts International MGM is likely to benefit from the increased business volume at MGM China, sports betting prospects and development projects. Also, its focus on digital strategies bodes well. However, a volatile macroeconomic environment poses threat.

Let us discuss the factors that highlight why investors should retain this Zacks Rank #3 (Hold) stock for now.

Factors Driving Growth

MGM Resorts is benefiting from increased business volume and travel activity at MGM China. In the first quarter of 2024, the company witnessed high contributions from MGM China due to the removal of COVID-related travel restrictions, a rise in visitation and solid growth in casino revenues. During the quarter, MGM China's net revenues surged 71% year over year to $1.06 billion. MGM China casino’s revenues were up 66% year over year to $920 million. MGM China's adjusted property EBITDAR amounted to $301 million compared with 169 million in the prior-year quarter. The company is optimistic about MGM China’s prospects, backed by strength in premium mass.

Sports betting and iGaming remain core growth catalysts for the company. BetMGM is expected to generate significant free cash flow in the coming years, and LeoVegas is anticipated to begin yielding returns from its investment period. This free cash flow should support future growth opportunities, including international and digital expansion and brick-and-mortar development.

Digitally, MGM is focused on product integration with BetMGM and Angstrom, launching new offerings and improving user experience to drive growth. Also, it has initiated the soft launch of BetMGM in the Netherlands. The company focuses on becoming self-sustaining with site features, including producing proprietary games. Going forward, MGM Resorts intends to launch the live dealer operation in Las Vegas, extending the brand globally. Also, it emphasizes on expansion opportunities in LatAm, Eastern Europe, Texas and Thailand.

In the long term, the company has a pipeline of license development projects in New York, Japan, and potentially the United Arab Emirates. Other key developments include the connectivity between Cosmopolitan, Vdara, and Bellagio, creating a luxury campus. The closure of Tropicana and the upcoming A's stadium further enhance the company’s positioning with more than 1 million seats accessible to sports and entertainment events monthly.

These projects are expected to drive free cash flow growth over the next decade and diversify the company’s geographic reach and earnings. The company intends to return excess cash generated to shareholders through share buybacks. It intends to achieve free cash flow per outstanding share at a compound annual growth rate of mid-teens, through 2028.

Concerns

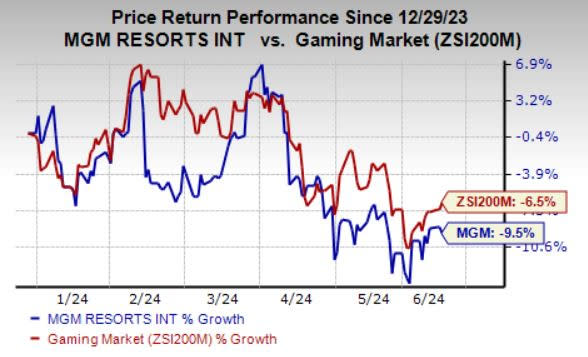

Image Source: Zacks Investment Research

Shares of MGM Resorts have lost 9.5% year to date compared with the industry’s 6.5% decline.

MGM Resorts is facing challenges in China, with only about 30% recovery in terms of volume of people. The inability to fly over Russia imposes an economic burden, affecting packaging, tours and leisure activities. This issue is expected to persist until the situation in Ukraine is resolved.

MGM functions within fiercely competitive sectors in Las Vegas and Macau. The rise in hotel openings and promotional initiatives has intensified competition within these markets. Despite consecutive improvements, the company remains vigilant due to the prevailing uncertain macroeconomic conditions. Additionally, a rise in corporate expenses poses a concern.

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are as follows:

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has surged 46.2% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share (EPS) indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has rallied 64.4% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS calls for growth of 16.8% and 63.8%, respectively, from the year-earlier actuals.

Hasbro, Inc. HAS presently flaunts a Zacks Rank of 1. The company has a trailing four-quarter earnings surprise of 17.5%, on average. The stock has risen 14.2% in the year-to-date period.

The Zacks Consensus Estimate for HAS’ 2025 sales and EPS suggests an improvement of 4% and 14%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance