Here's Why You Should Invest In DuPont (DD) Stock Now

DuPont de Nemours, Inc.’s DD stock looks promising at the moment. It is benefiting from strong end-market demand, cost-management actions and innovation-driven investment. We are positive on the company’s prospects and believe that the time is right for you to add the stock to portfolio as it looks promising and is poised to carry the momentum ahead.

Let’s take a look into the factors that make this Zacks Rank #2 (Buy) stock an attractive choice for investors right now.

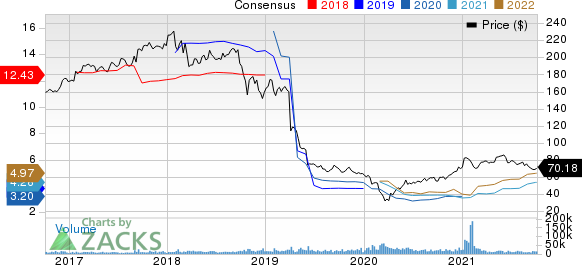

Price Performance

Shares of DuPont have gained 25% over the past year, outperforming its industry’s rise of 19.1% over the same time frame.

Image Source: Zacks Investment Research

Estimates Northbound

Over the past two months, the Zacks Consensus Estimate for DuPont for the current year has increased around 14.5%. The consensus estimate for third-quarter 2021 has also been revised 7.5% upward over the same time frame.

Impressive Earnings Surprise History

DuPont has outpaced the Zacks Consensus Estimate in each of the trailing four quarters. In this time frame, it has delivered an earnings surprise of 12.1%, on average.

Healthy Growth Prospects

The Zacks Consensus Estimate for earnings for 2021 for DuPont is currently pegged at $4.27, reflecting an expected year-over-year growth of 27.1%. Moreover, earnings are expected to register a 29.6% growth in the third quarter.

Growth Drivers in Place

DuPont is gaining from sustained strength in semiconductors and smartphone technologies and continued recovery in automotive, construction and industrial markets, which is driving its top line. The company, in its second-quarter call, raised its guidance for net sales and adjusted earnings per share for 2021 factoring in sustained momentum in its major end-markets.

Net sales for the year are now forecast to be between $16.45 billion and $16.55 billion, compared with $15.7 billion and $15.9 billion expected earlier. The company also expects adjusted earnings per share for 2021 in the band of $4.24-$4.30, up from the prior view of $3.60-$3.75.

DuPont remains focused on driving growth though innovation and new product development. Its innovation-driven investment is focused on several high-growth areas. It remains committed to drive returns from its R&D investment. It is also benefiting from cost synergy savings and productivity improvement actions. Its structural cost actions are contributing to its bottom line.

The company also remains focused on driving cash flow and shareholder value. It looks to boost cash flow through working capital productivity and earnings growth. The company returned $800 million to shareholders through share repurchases and dividends during the second quarter. It expects to return roughly $640 million in dividends this year.

DuPont de Nemours, Inc. Price and Consensus

DuPont de Nemours, Inc. price-consensus-chart | DuPont de Nemours, Inc. Quote

Stocks to Consider

Other top-ranked stocks worth considering in the basic materials space include Nucor Corporation NUE, Nutrien Ltd. NTR and Olin Corporation OLN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Nucor has a projected earnings growth rate of 534.4% for the current year. The company’s shares have surged around 106% in a year.

Nutrien has an expected earnings growth rate of 177.8% for the current year. The stock has also rallied around 69% over a year.

Olin has a projected earnings growth rate of 639.3% for the current year. The company’s shares have shot up around 241% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

DuPont de Nemours, Inc. (DD) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance