Here's Why You Should Add RLI Stock in Your Portfolio Now

RLI Corp.’s RLI top line is well-poised for growth, riding on a diversified product portfolio, focus on introducing products, sturdy business expansion, sustained rate increase, expanded distribution and operational strength.

Estimate Revision

The Zacks Consensus Estimate for 2023 and 2024 has moved 3% and 0.2% north, respectively, in the past 30 days. This should instill investors' confidence in the stock.

Earnings Surprise History

RLI has a decent earnings surprise history. It beat earnings estimates in each of the last four quarters, the average being 43.5%

Return on Equity (ROE)

RLI has been effectively improving its return on equity over the years. ROE in the trailing 12 months of 19.2% expanded 253 basis points year over year and was better than the industry’s average of 6.9%. This reflects the insurer’s efficiency in utilizing shareholders’ funds.

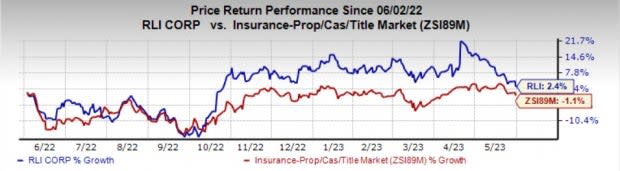

Zacks Rank & Price Performance

RLI currently sports a Zacks Rank #1 (Strong Buy).

In the past year, the stock has gained 2.4% against the industry’s decline of 1.1%. Solid segmental results and capital position are likely to help the stock continue the upside.

Image Source: Zacks Investment Research

Key Drivers

Premium, the main source of RLI’s revenues, is expected to rise, driven by strong performance in Property and Surety segments.

Product diversification across the Casualty, Property and Surety segments of RLI has fueled the insurer’s growth and financial success. The Casualty segment continues to gain from an expanded distribution base in personal umbrella and rate increases.

The commercial property business has been gaining from higher wind and earthquake exposure rates. Rate increases, improved retention and new opportunities in the inland marine space should benefit marine products.

The Surety segment continues to benefit from its compelling product portfolio, growth within existing accounts and writing of bonds with new customers. Building materials inflation and new accounts will aid commercial and contract surety businesses in the future. RLI boasts solid operating results and its financial position remained strong. Operating cash flows should gain from higher premium receipts.

A high-interest rate environment should continue benefiting the company’s net investment income metric in the future. It rose 51% year over year in the first quarter.

Underwriting income, a measure of profitability, improved 14.1% in the first quarter. The company will keep investing in customer relationships, technology and people to grow underwriting profits in the future.

The company has been paying dividends for 186 consecutive quarters and has a dividend yield of 0.8%, better than the industry’s average of 0.4%, making the stock an attractive pick for yield-seeking investors. RLI has $87.5 million of remaining capacity from the repurchase program.

The Zacks Consensus Estimate for RLI’s 2023 earnings is pegged at $4.88, indicating an increase of 4.1% on 15.2% higher revenues of $1.42 billion.

The insurer has been experiencing an increase in loss, settlement expenses, interest expenses on debt and policy acquisition costs. RLI must strive to control cost or grow revenues at a higher magnitude than that of expense increase, or else the margin may continue to erode, raising risks.

Other Stocks to Consider

Some other top-ranked stocks from the property and casualty insurance industry are Axis Capital Holdings Limited AXS, Conifer Holdings, Inc. CNFR and Kinsale Capital Group, Inc. KNSL. Each of these companies presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Axis Capital beat estimates in three of the last four quarters and missed once, the average being 6.5%. The Zacks Consensus Estimate for 2023 has moved 0.5% north in the past 60 days.

The Zacks Consensus Estimate for AXS’ 2023 and 2024 earnings per share (EPS) is pegged at $7.74 and $8.60, indicating a year-over-year increase of 33.2% and 11.1%, respectively. In the past year, AXS has lost 10.1%.

The Zacks Consensus Estimate for CNFR’s 2023 and 2024 EPS is pegged at $0.08 and $0.14, indicating a year-over-year increase of 106.6% and 75%, respectively. In the past year, CNFR has gained 0.7%.

Kinsale Capital has a solid track record of beating earnings estimates in each of the last four quarters, the average being 14.8%. In the past year, KNSL has gained 34.7%.

The Zacks Consensus Estimate for KNSL’s 2023 and 2024 EPS is pegged at $10.37 and $12.41, indicating a year-over-year increase of 33% and 19.7%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report

Conifer Holdings, Inc. (CNFR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance