Here's How Colgate (CL) Stock is Poised Ahead of Q1 Earnings

Colgate-Palmolive Company CL is expected to register top-line growth in its first-quarter 2024 numbers on Apr 26, before the opening bell. The Zacks Consensus Estimate for first-quarter revenues is pegged at $4.95 billion, indicating a rise of 3.8% from the year-ago quarter’s reported figure.

The consensus estimate for the company’s earnings is pegged at 82 cents per share, suggesting growth of 12.3% from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for earnings for the quarter has been stable in the past 30 days.

In the last reported quarter, the company's earnings beat the consensus estimate by 2.4%. It has delivered an earnings surprise of 4.2%, on average, in the trailing four quarters.

Key Aspects to Note

Colgate is anticipated to have benefited from solid consumer demand for personal care, hygiene and home care products. Colgate’s focus on innovation, premiumization and digital transformation and its brand strength are likely to have driven its performance in the to-be-reported quarter. The company’s top line is also likely to have benefited from its effective pricing actions and accelerated revenue growth-management plans. Solid momentum in the Hill's business is expected to have delivered sales growth in the quarter. Strength in Hill's Prescription Diet and Hill's Science Diet is likely to have aided the segment’s sales.

Colgate’s focus on the premiumization of its Oral Care portfolio through major innovations has been proving beneficial. The performance of its premium innovation products, including CO. by Colgate, Colgate Elixir toothpaste and Colgate enzyme whitening toothpaste, has been impressive. This is expected to have boosted organic sales growth for its Oral Care business in the to-be-reported quarter. Our estimate for the company’s organic sales growth is pegged at 4.3% for the first quarter. We anticipate Colgate’s adjusted gross margin to expand year over year by 150 basis points in the quarter to be reported.

The leading global consumer products company has been aggressively expanding the faster-growth channels while extending the geographic footprint of its brands. The company’s efforts to improve product availability through enhanced distribution across existing and new markets are likely to have driven its performance in the quarter under review.

However, higher raw material and packaging material costs have been a concern despite sales growth. CL has been witnessing a deleverage in SG&A expenses, which has been denting margins. Our model indicates about a 4.2% increase in adjusted SG&A expenses for the quarter under review on a year-over-year basis. Given the company’s substantial international operations, foreign currency translations are likely to have acted as deterrents in the to-be-reported quarter.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Colgate this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

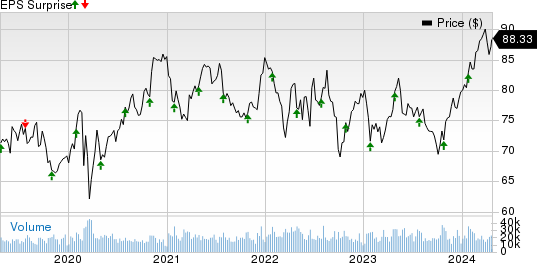

Colgate-Palmolive Company Price and EPS Surprise

Colgate-Palmolive Company price-eps-surprise | Colgate-Palmolive Company Quote

Colgate currently has an Earnings ESP of -0.02% and a Zacks Rank of 2.

Stocks With the Favorable Combination

Here are some companies, which according to model, have the right combination of elements to beat on earnings this reporting cycle.

Vital Farms VITL currently has an Earnings ESP of +5.75% and a Zacks Rank of 2. VITL is anticipated to register top and bottom-line growth when it reports first-quarter 2024 results. The Zacks Consensus Estimate for Vital Farms’ quarterly revenues is pegged at $137 million, indicating growth of 15% from the figure reported in the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Vital Farms’ earnings has moved up a couple of cents in the past 30 days to 22 cents per share. The consensus estimate suggests 37.5% growth from the year-ago quarter’s reported figure. VITL has delivered an earnings beat of 155.4%, on average, in the trailing four quarters.

Church & Dwight Co. CHD has an Earnings ESP of +2.37% and a Zacks Rank of 2, at present. CHD is likely to register top and bottom-line growth when it releases first-quarter 2024 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $1.49 billion, which suggests growth of 4.3% from the figure reported in the year-ago quarter.

The consensus estimate for Church & Dwight’s quarterly earnings has remained unchanged in the past 30 days at 86 cents per share, suggesting growth of 1.2% from the year-ago quarter’s reported number. CHD has delivered an earnings surprise of 9.7%, on average, in the trailing four quarters.

Monster Beverage MNST has an Earnings ESP of +0.44% and a Zacks Rank of 3, at present. MNST is likely to register top and bottom-line growth when it releases first-quarter 2024 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $1.93 billion, implying growth of 13.3% from that reported in the year-ago quarter.

The consensus estimate for Monster Beverage’s quarterly earnings has remained unchanged in the past 30 days at 44 cents per share, indicating growth of 15.8% from the year-ago quarter’s reported number. MNST has a trailing four-quarter average earnings surprise of 2.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance