Herc Holdings Inc (HRI) Surpasses Revenue Estimates in Q1 2024, Aligns with EPS Projections

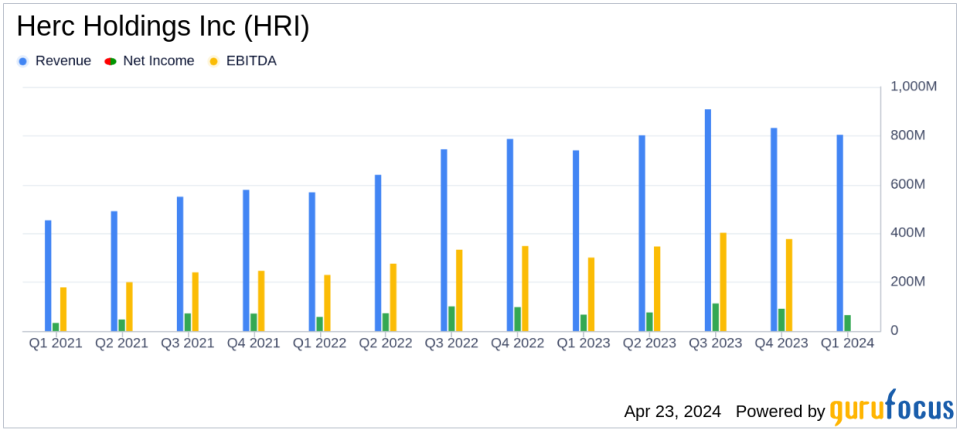

Revenue: $804M, up 9% from $740M in the previous year, surpassing estimates of $782.85M.

Net Income: $65M, down 3% from $67M in the prior-year period, exceeding estimates of $63.49M.

Earnings Per Share (EPS): Reported at $2.29 per diluted share, above the estimated $2.15.

Adjusted EBITDA: Increased by 10% to $339M, with the adjusted EBITDA margin growing to 42.2% from 41.6% year-over-year.

Rental Equipment Revenue: Grew by $65M due to a 5.1% increase in pricing and an 8.0% increase in volume, despite inflationary pressures.

Corporate Expansion: Added 15 new locations through mergers and acquisitions and greenfield openings.

Capital Expenditures: Net rental equipment capital expenditures were $120M, significantly reduced from $283M in the prior-year period.

Herc Holdings Inc (NYSE:HRI) released its 8-K filing on April 23, 2024, showcasing a strong start to the year with record first-quarter revenues and solid strategic expansions. The company reported a 9% increase in total revenues, reaching $804 million, surpassing the estimated $782.85 million. Earnings per share (EPS) stood at $2.29, closely aligning with the analyst projections of $2.15.

About Herc Holdings Inc.

Founded in 1965, Herc Holdings operates through its subsidiary, Herc Rentals Inc., as a full-line rental supplier with a significant presence across North America. The company, which was spun out of Hertz Global in 2016, is the third-largest equipment rental company in the region, holding a 4% market share. Herc Holdings serves a diverse range of sectors, including construction, industrial, and entertainment, offering a broad portfolio of rental equipment.

Quarterly Financial Performance

The increase in revenue was primarily driven by a $65 million rise in equipment rental revenue, reflecting a positive pricing adjustment of 5.1% and an 8.0% increase in volume. This growth was slightly offset by an unfavorable mix primarily due to inflation. Despite the revenue growth, net income saw a slight decline of 3%, totaling $65 million compared to $67 million in the prior-year period. This was attributed to a higher effective tax rate of 20%, up from 11% last year.

Strategic Expansions and Operational Efficiency

Herc Holdings has been actively expanding its geographical footprint and service offerings. During the quarter, the company added 15 new locations through mergers and acquisitions and greenfield openings. These strategic expansions are part of Herc Holdings broader goal to enhance customer experience and improve operational efficiency across its network.

Adjusted EBITDA and Margins

The company reported an Adjusted EBITDA of $339 million, a 10% increase from the previous year, with the Adjusted EBITDA margin also rising to 42.2%. This improvement reflects Herc Holdings' continued focus on leveraging operating expenses and optimizing revenue growth.

Capital Management and Future Outlook

Herc Holdings remains disciplined in its capital management, with net debt holding steady at $3.7 billion and a net leverage ratio of 2.5x. Looking forward, the company has reaffirmed its 2024 full-year guidance, projecting a 7-10% growth in equipment rental revenue and an Adjusted EBITDA of $1.55 billion to $1.60 billion.

Conclusion

Overall, Herc Holdings Inc. has demonstrated a robust start to 2024, marked by significant revenue growth and strategic network expansions. The company's alignment with EPS estimates and surpassing revenue forecasts reflect its strong market position and operational efficiency. With a clear strategy and solid financial footing, Herc Holdings is well-positioned to continue its growth trajectory and enhance shareholder value.

Explore the complete 8-K earnings release (here) from Herc Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance