Hedge fund manager explains why oil will be capped at $50

Hedge fund manager Anna Nikolayevsky, the founder of $170 million Axel Capital, says that oil prices capped at $50 and Wall Street just hasn’t realized it.

The crux of the argument is that technological innovation has transformed this established industry, she said in a presentation at the Capitalize For Kids Conference in Toronto last week.

Nikolayevsky pointed out that virtually all of the sophisticated players in the industry missed the oil price crash in 2015.

“This got us thinking that maybe there’s some hidden inefficiency at play that the market might be missing out,” she said.

She noted that current Wall Street analyst projections show that the consensus is that oil prices have hit bottom and that they’ll steadily go back up. Some analysts have a target of $70 and a few see oil going back to $80 by 2019. Most of these banks are using depletion analysis and require break-evens to determine future price.

One research note she quoted from in her presentation said, “The world cannot operate like this. We need higher oil.”

“‘Hope’ and ‘need’ are not strategies,” Nikolayevsky said.

“So rather than expecting a bottom at $50, like many on Wall Street do, we believe is $50 is the current seal. And absent a war-type of shock, that we are capped.”

To predict oil prices, most analysts focus on the supply side to determine the excess or deficit, she explained. Instead, they should look at the demand side.

“Instead, let’s take a look at where oil demand comes from. Over 50% of it is gasoline used in transportation. Oil prices should be extremely sensitive to any changes here,” she said.

In her presentation, she laid out these key changes:

1. Fuel efficiency:

Fuel efficiency of new cars has increased by 22%, she noted.

“That’s 22% less gasoline for cars to get to the same distance. While this is clearly great for the consumer, it’s negative for oil demand and gasoline.”

China is seen as the most important country because it’s assumed that as an emerging market it will be the largest contributor to future gasoline demand. However, because of pollution, China’s government is actively working to promote electric cars and is subsidizing both cars and charging stations across the country. Demand for oil has decelerated and it’s expected to decelerate further.

2. Sharing economies:

Uber Pool, Via, and Zipcar, etc. have changed the game in transportation.

“We think that sharing platforms such as these are going to permanently lower auto cycle peaks in mature economies and and will also lower the number of cars required in emerging markets as autonomous driving develops. Drivers won’t be necessary, which will further lower the costs and make sharing cheaper, which is also negative for gasoline,” she said.

3. Electric vehicles:

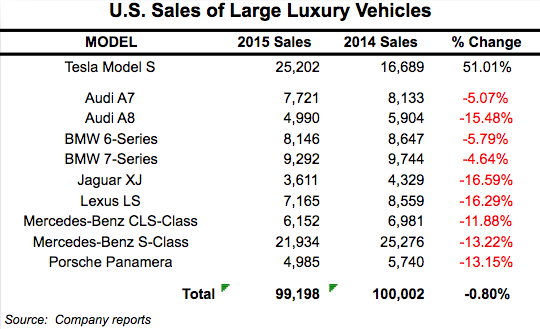

2016 was going great for US in the auto industry, but in February, Tesla (TSLA) showed a slide in its fourth quarter earnings presentation saying that its all-electric Model S captured the highest unit sales in

the large luxury market.

Tesla challenged the incumbents to respond with their own electrics. Now other car companies are introducing electric models.

“Bottom line here is there’s a lot of capital been committed. Electric vehicles are not a fad. This is a permanent industry shift. Ultimately, it does not matter which company wins or leads to profitability the fastest. They will still take share as a group.”

Nikolayevsky noted that oil producers are rational players.

“If the biggest asset your economy depends on is about to face a permanent demand shock, do you ever cut production? I think not.”

This is exactly why Russia’s, Iraq’s, and OPEC’s production is at an all-time high, she said.

Nikolayevsky believes that the consensus numbers for future oil prices are “materially off.” She thinks that we’re going through an “industry transforming demand shock” that’s both structural and secular.

Just a few years ago, the popular concept was “peak oil,” with the implication that every existing field has already been discovered and prices could only go up because the scarcity of the commodity, she added.

“Elon Musk’s goal was to dis-intermediate the auto industry. We think, however, that he impact is much broader,” she said, noting the structural and secular changes in the auto industry and electric vehicles.

“The concept of peak oil may be true, after all, but in terms of demand, not reserves, and this is a paradigm shift that will have a clearly have a substantial detrimental effect on future prices.”

—

Julia La Roche is a finance reporter at Yahoo Finance.

Read more:

Why Jim Chanos is thoroughly unimpressed with Tesla

Einhorn: Elon Musk is a promotional CEO who’s blinding his own investors

Yahoo Finance

Yahoo Finance