Health Catalyst Inc (HCAT) Q1 2024 Earnings: Modest Revenue Growth and Strategic Financial ...

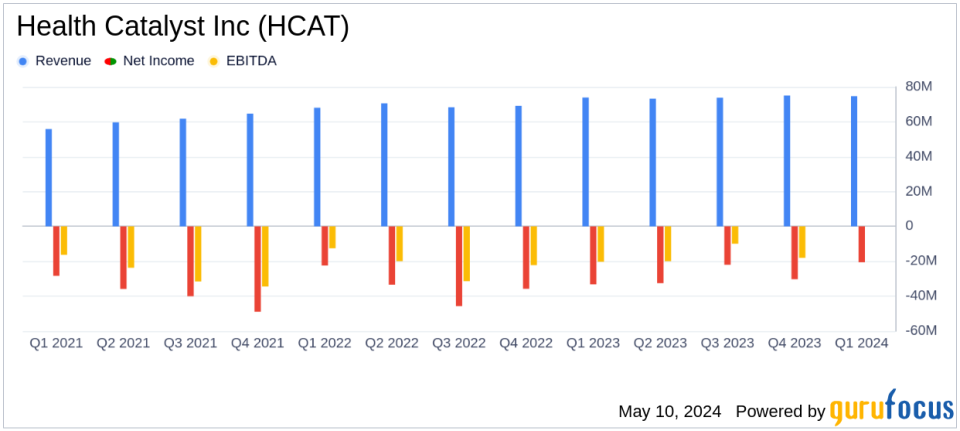

Revenue: Reported $74.7M, slightly below the estimate of $75.8M.

Net Loss: Improved to $(20.6M) from $(33.2M) year-over-year, indicating a 38% reduction in losses.

Gross Margin: Increased to 39% from 38% year-over-year, reflecting a 1% rise in gross profit to $29.3M.

Adjusted EBITDA: Totaled $3.4M, down from $4.2M in the previous year.

Future Guidance: Reiterated full-year revenue forecast between $304M and $312M and Adjusted EBITDA between $24M and $26M.

Operational Highlights: Maintained strong bookings metrics including dollar-based retention rate and net new DOS Subscription client additions.

On May 9, 2024, Health Catalyst Inc (NASDAQ:HCAT), a leader in healthcare data and analytics technology services, disclosed its financial results for the first quarter ending March 31, 2024, through an 8-K filing. The company reported a slight increase in revenue to $74.7 million from $73.9 million in the previous year, marking a 1% year-over-year growth. This performance slightly exceeded the analyst's revenue estimate of $74.8 million for the quarter.

Company Overview

Health Catalyst is at the forefront of providing data and analytics technology and services to healthcare organizations. With a focus on two main segments, Technology and Professional Services, Health Catalyst leverages cloud-based and subscription-based models to drive revenue, primarily through its Technology segment.

Financial Performance and Challenges

The company's financial results reflect a modest revenue growth, which is crucial in the competitive healthcare analytics sector. Despite this growth, Health Catalyst faced a significant net loss of $20.6 million during the quarter, although this was an improvement over the previous year's net loss of $33.2 million. The reduction in net loss by 38% year-over-year indicates effective cost management and operational adjustments.

Adjusted EBITDA stood at $3.4 million, a decrease from $4.2 million in the prior year, highlighting challenges in maintaining profitability margins amidst ongoing investments in technology and service enhancements. The gross margin saw a slight improvement from 38% to 39%, and adjusted gross margin decreased slightly from 52% to 51%.

Key Financial Metrics

The balance sheet shows a strong position with $201.4 million in cash and cash equivalents, up from $106.3 million at the end of the previous year. This increase is a positive indicator of liquidity and financial health. Total assets were reported at $695.1 million, with total liabilities at $337.9 million, resulting in a healthy equity position.

Strategic Outlook and Management Commentary

CEO Dan Burton expressed satisfaction with the quarter's results, emphasizing the alignment with the company's long-term profitability goals. Health Catalyst reiterated its full-year guidance for 2024, expecting total revenue between $304.0 million and $312.0 million and Adjusted EBITDA between $24.0 million and $26.0 million.

"For the first quarter of 2024, I am pleased by our strong financial results, including total revenue of $74.7 million and Adjusted EBITDA of $3.4 million, with these results beating the mid-point of our quarterly guidance on each metric," stated Dan Burton, CEO of Health Catalyst.

Investor and Analyst Perspectives

Investors and analysts might view the modest revenue growth positively, especially given the strategic management of expenses and operational efficiencies that helped reduce the net loss significantly. The strong cash position enhances the company's ability to invest in growth opportunities and may reassure investors about the company's resilience and strategic direction.

Overall, while Health Catalyst faces challenges in boosting profitability and managing operational costs, its strategic financial management and solid revenue growth trajectory provide a stable foundation for future growth. The company's commitment to leveraging data to inform healthcare decisions continues to position it as a key player in the healthcare analytics industry.

For detailed financial figures and future projections, interested parties are encouraged to review the full earnings report and listen to the earnings call available on the Health Catalyst investor relations website.

Explore the complete 8-K earnings release (here) from Health Catalyst Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance