HFE Letter Guide: 5 Steps to Apply for the HDB HFE Letter in Singapore (2024)

Need an HFE application guide? You’ve come to the right place.

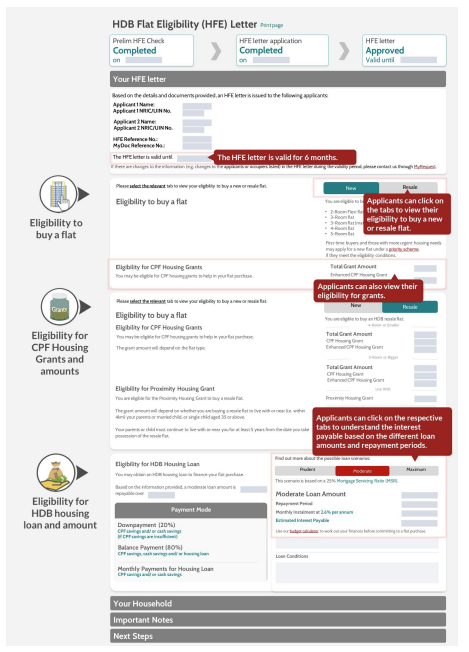

For those who don’t know what the HDB HFE letter is, it’s a document that informs you of your HDB flat eligibility, CPF housing grant eligibility, the amount you qualify for, and HDB loan eligibility and the amount you can loan. For second-timer HDB homebuyers, the HDB Flat Eligibility letter will also include your resale levy amount.

You need a valid HDB HFE letter if you want to apply for any BTO exercise or buy an HDB resale flat. In this article, we’ll guide you through how to obtain your HDB HFE letter and how to check your HFE application status.

Table of contents:

HDB HLE vs HDB HFE Letter: What’s the Difference?

Previously, the old HLE letter only allowed potential HDB homebuyers to check their HDB loan eligibility and amount. Your HDB flat eligibility and CPF Housing Grant eligibility occur at different stages of the home-buying journey.

Previously with HDB HLE Application (Before May 2023)

Type of flat | When to check for flat purchase eligibility | When to check for CPF Housing Grant eligibility | When to check for HDB home loan eligibility |

New HDB flat | At flat application | At flat booking | At HLE letter application (before booking the HDB flat) |

HDB resale flat |

|

| At HLE letter application (before obtaining an Option to Purchase (OTP)) |

All in all, the HFE letter application aims to provide a more holistic view of potential HDB flat buyers’ options beyond financing. Effectively, you’re combining the assessment for these three eligibility criteria into just one stage.

Dr Tan Tee Khoon, Country Manager – Singapore, PropertyGuru agrees, adding that these changes may benefit first-time homebuyers most.

“Especially for first-time homebuyers, the greatest hurdle is often obtaining all the necessary information at the outset to make informed, confident decisions. No buyer wishes to be encumbered by complex purchase processes, and certainly what HDB has done is the right step forward,” said Dr Tan.

HDB HFE Application: Who Needs to Apply for It?

If you applied for an HDB flat before 9 May 2023, you’ll be relegated to the ‘old’ HDB homebuying process. For example, if you’ve been shortlisted to book a flat, you’ll be invited to apply for an HLE letter instead of an HDB Flat Eligibility letter.

For everyone else, you will need to go through the HDB HFE application process.

If You’re Buying a New HDB Flat (BTO, SBF, OBF)

When applying for your new home from the October BTO 2023 launch onward, you will need your HDB Flat Eligibility letter to be ready to go

For those applying for other new HDB flats (BTO, SBF, OBF) after the May 2023 BTO launch, you will also need a valid HDB HFE letter

Pro tip: As mentioned, don’t leave the HDB HFE application to the last minute! The average processing time of 21 working days is expected to be longer during peak periods, especially right before and during the month of a BTO launch. In 2024, there will be three BTO launches: in February, June, and October.

So, take heed: apply for your HDB Flat Eligibility letter early for the upcoming February BTO 2024 launch!

If You’re Buying an HDB Resale Flat

You’ll need to have a valid HDB HFE letter before you receive your Option to Purchase (OTP) and submit your HDB resale flat application.

HFE Application: How Do I Apply?

1. Log in to the HDB Flat Portal

Use your Singpass to log in to the HDB flat portal.

2. Retrieve Your Personal Information from Myinfo

This includes your household income and ownership of private property.

3. Input Information to Access Your Eligibility

This step is also known as the HDB HFE preliminary check. At this step, HDB will give you a general assessment of what type of HDB flat, CPF Housing Grant, and HDB home loan you’re eligible for, as well as the corresponding grant and loan amounts.

This will be helpful if you wish to proceed with buying an HDB flat (i.e. formally apply for an HDB Flat Eligibility letter) or reconsider your purchase and budget.

4. Upload Supporting Documents to Apply for Your HDB Flat Eligibility Letter

If you’re happy with the outcome of your preliminary HFE check, it’s time to apply for the HDB Flat Eligibility letter. Here, you’ll be prompted to submit additional supporting documents to confirm your HFE letter application.

The next step is to wait for the result of your HFE application status.

5. Log in to the HDB Flat Portal to retrieve your HDB Flat Eligibility Letter

HDB will send you an SMS once the outcome of your HFE application status is out. If our HFE application status is successful, know that your approved HDB Flat Eligibility letter is valid for nine months. Just like that, congrats, you are one step closer to buying an HDB flat!

To retrieve your HDB Flat Eligibility letter, simply log back into the HDB Portal. From the portal, you can also check the outcome of your HFE application status.

HDB HFE Application: What Happens After I Apply?

Financing Your HDB Flat with an HDB Loan

Similar to the HLE letter, your HDB Flat Eligibility letter will comprise an assessment of your HDB loan eligibility and the loan amount you can borrow. Upon receiving a successful HFE application status, you will be informed if you can apply for an HDB loan.

If you’re eligible for an HDB loan, you can apply directly through the HDB Flat Portal.

Financing Your HDB Flat with a Bank Loan

If you intend to finance your HDB flat using a bank loan or a loan from a financial institution (FI), pay attention.

You can now request an In-Principle Approval (IPA) and Letter of Offer (LO) from participating FIs via the HDB Flat portal. Additionally, you can review potential loan options from participating FIs:

DBS

Hong Leong Finance

Maybank

OCBC

Sing Investments & Finance

UOB

For those who intend to finance your HDB flat with a loan from an FI, Paul Wee, Vice President – PropertyGuru Finance cautions that it may be difficult to assess which is the ‘best’ loan package to sign up for via the HDB Portal.

“Potential HDB homebuyers who apply for IPAs with the participating FIs through the portal are likely to lose out on critical, objective advice to help them choose the best home loans for them – especially if each participating FIs touts their packages as the best.”

“Additionally, the new HDB Portal will likely result in varying implications for different people. For instance, potential homebuyers with unique circumstances, such as those with variable and secondary income, or who receive dividends, may not be able to receive the most comprehensive assessment of their various HDB flat eligibilities.”

If you’re unsure which bank loan you should go for, you can always reach out to our friendly PropertyGuru Finance Mortgage Experts. From finding the most competitive mortgage deals on the market to simplifying the home financing process, they can provide you with tailored advice – all at no cost!

Yahoo Finance

Yahoo Finance