Harley-Davidson (HOG) Q1 Earnings Beat Estimates, Rise Y/Y

Harley-Davidson, Inc. HOG reported first-quarter 2023 adjusted earnings of $2.04 per share, beating the Zacks Consensus Estimate of $1.42. Higher-than-anticipated revenues from the motorcycles & related products and Financial Services segments resulted in the outperformance. The bottom line also shot up 41% from the $1.45 per share reported in the year-ago quarter.

The motorcycle manufacturer generated consolidated revenues (including motorcycle sales and financial services revenues) of $1,789 million, up 20% from the prior-year quarter.

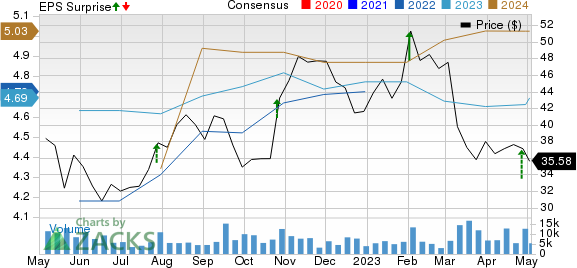

Harley-Davidson, Inc. Price, Consensus and EPS Surprise

Harley-Davidson, Inc. price-consensus-eps-surprise-chart | Harley-Davidson, Inc. Quote

Segmental Highlights

Harley-Davidson Motor Company: Total revenues from the motorcycle and related products segment, which constitute the bulk of the firm’s overall revenues, increased 21% on a year-over-year basis and came in at $1,558 million. The figure also outpaced the consensus mark of $1,365 million. The operating income for the segment increased to $336 million from $219 million in the corresponding quarter of 2022. The reported amount also surpassed the Zacks Consensus Estimate of $223 million.

In the quarter under review, revenues from the sale of motorcycles came in at $1,302 million, rising 23% year over year and crossing the consensus mark of $1,090 million. The company’s global shipments came in at 62,200 motorcycles, up 14%.

During the reported quarter, Harley-Davidson retailed 39,425 motorcycle units globally, down 12.4% year over year. Its retail motorcycle units sold in North America declined 16.6% to 26,021. Meanwhile, sales in Latin America decreased 25.1% and in Asia Pacific and EMEA (Europe, Middle East and Africa) sales increased 2.7% and decreased 5.9%, respectively.

Revenues for parts & accessories were up 1% from a year ago to $168 million and missed the consensus mark of $177 million. Revenues from apparel rose 39% compared with the prior-year quarter to $71 million and outpaced the consensus mark of $63 million.

Harley-Davidson Financial Services: Revenues for Harley-Davidson Financial Services totaled $223 million, up 16% year over year and crossed the consensus mark of $198 million. Operating income declined 32% to $58 million and missed the consensus mark of $63 million.

LiveWire: During the reported quarter, the total shipment for LiveWire was 63 units, down 35% compared with Q1, 2022. Revenue declined by 25% to $8 million and the operating loss widened from $16 million to $25 million.

Financial Position

In the fourth quarter, selling, general and administrative expenses from the HDMC unit increased 17.2% to $221.3 million from $188.8 million in the year-ago quarter.

The firm generated $47 million in cash from operating activities. The company paid dividends of 16.50 cents per share in the reported quarter.

Harley-Davidson had cash and cash equivalents of $1.56 billion as of Mar 31, 2023, up from $1.43 billion as of Dec 31, 2022. In the same period, the long-term debt increased to $5,275 million from $4,457 million recorded on Dec 31, 2022.

2023 Guidance

For 2023, the company expects revenues from the motorcycles segment to grow in the band of 4%-7%. The operating income margin expectation for the motorcycles segment is in the range of 14.1% to 14.6%. HOG expects its operating income for Financial Services to decline by 20-25%. For the LiveWire segment, the motorcycle wholesale units are expected to be in the range of 750-2,000 and the operating loss for the segment is anticipated to be in the range of $115-$125 million. Capital expenditure projection for the full year is estimated to be in the range of $225-$250 million.

Zacks Rank & Key Picks

HOG currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

A few top-ranked players in the auto space are Geely Automobile Holdings Limited GELYY, BYD Company Limited BYDDY and Mercedes-Benz Group AG MBGAF, all of which sport a Zacks Rank #1.

Geely is engaged in automobile manufacturing and related areas. The Zacks Consensus Estimates for GELYY’s 2023 sales and earnings imply year-over-year growth of around 57.5% and 7.4%, respectively.

BYD is engaged in the research, development, manufacture and distribution of automobiles, secondary rechargeable batteries and mobile phone components. The Zacks Consensus Estimate for BYDDY’s 2023 sales implies year-over-year growth of around 209.6%.

Mercedes-Benz develops, manufactures and sells passenger cars, including premium and luxury vehicles. The Zacks Consensus Estimate for MBGAF’s 2023 sales implies year-over-year growth of 6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Harley-Davidson, Inc. (HOG) : Free Stock Analysis Report

Geely Automobile Holdings Ltd. (GELYY) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report

Mercedes-Benz Group AG (MBGAF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance