Is Halcyon Agri Corporation Limited (SGX:5VJ) A Financially Sound Company?

Investors are always looking for growth in small-cap stocks like Halcyon Agri Corporation Limited (SGX:5VJ), with a market cap of S$861.31M. However, an important fact which most ignore is: how financially healthy is the business? Assessing first and foremost the financial health is crucial, as mismanagement of capital can lead to bankruptcies, which occur at a higher rate for small-caps. I believe these basic checks tell most of the story you need to know. Though, given that I have not delve into the company-specifics, I’d encourage you to dig deeper yourself into 5VJ here.

Does 5VJ generate enough cash through operations?

5VJ’s debt levels have fallen from US$706.11M to US$611.09M over the last 12 months , which is made up of current and long term debt. With this reduction in debt, the current cash and short-term investment levels stands at US$173.08M , ready to deploy into the business. Moving onto cash from operations, its trivial cash flows from operations make the cash-to-debt ratio less useful to us, though these low levels of cash means that operational efficiency is worth a look. As the purpose of this article is a high-level overview, I won’t be looking at this today, but you can assess some of 5VJ’s operating efficiency ratios such as ROA here.

Can 5VJ pay its short-term liabilities?

At the current liabilities level of US$344.90M liabilities, it seems that the business has been able to meet these commitments with a current assets level of US$804.82M, leading to a 2.33x current account ratio. For Commercial Services companies, this ratio is within a sensible range since there is a bit of a cash buffer without leaving too much capital in a low-return environment.

Does 5VJ face the risk of succumbing to its debt-load?

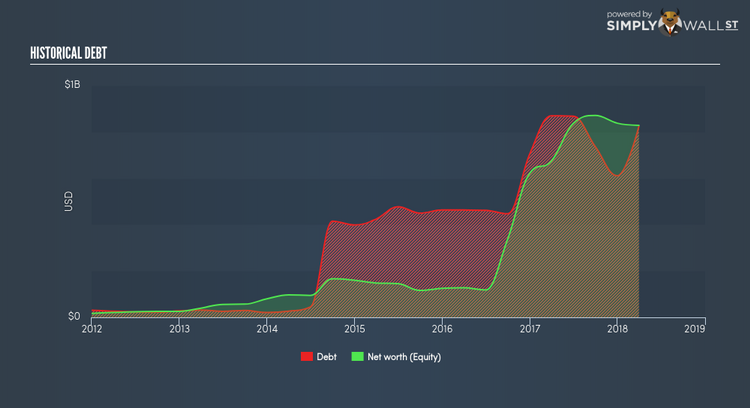

5VJ is a relatively highly levered company with a debt-to-equity of 99.45%. This is not uncommon for a small-cap company given that debt tends to be lower-cost and at times, more accessible. We can test if 5VJ’s debt levels are sustainable by measuring interest payments against earnings of a company. Ideally, earnings before interest and tax (EBIT) should cover net interest by at least three times. For 5VJ, the ratio of 0.97x suggests that interest is not strongly covered, which means that lenders may be more reluctant to lend out more funding as 5VJ’s low interest coverage already puts the company at higher risk of default.

Next Steps:

5VJ’s cash flow coverage indicates it could improve its operating efficiency in order to meet demand for debt repayments should unforeseen events arise. Though, the company exhibits proper management of current assets and upcoming liabilities. I admit this is a fairly basic analysis for 5VJ’s financial health. Other important fundamentals need to be considered alongside. I recommend you continue to research Halcyon Agri to get a more holistic view of the stock by looking at:

Historical Performance: What has 5VJ’s returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance