Get the Guru View: Appreciating property

Singapore’s property market seems bright.

Sellers often tout capital appreciation as a key selling point for properties. Yet, what truly counts as good capital appreciation, and how can we calculate it? We give to you our Guru View.

By Chang Hui Chew

Over the past quarter, a number of private and executive condominium (EC) projects have launched, and we have visited most, if not all of these new launches for our project reviews. In each showflat, we typically hear property agents try to convince prospective buyers of the capital appreciation potential of each unit by mentioning historical appreciation or government plans for the area.

“Capital appreciation” is a phrase often thrown by agents at buyers in a bid to convince them that a property is a good buy and the lure of value in the future, so that buyers will part with a good amount of their funds right now.

In this edition of the Guru View, we explain a little about what the term means, and more importantly, how do we judge what is good capital appreciation.

How do we define capital appreciation?

In general, capital appreciation simply means the increase in value of an asset over time.

For real estate, we typically look at simple annual appreciation, which is the difference between the selling price and buying price over the number of years held; and compound annual growth rate (CAGR), which also looks at annual returns, but smoothens out the peaks and valleys of the growth curve to a steadier rate.

To illustrate, let’s look at the Urban Redevelopment Authority’s (URA) Property Price Index (refer to Figure 1). In general, for private properties bought in Q1 2007 and sold in Q4 2016, with a holding period of about 10 years, we are looking at a simple annual appreciation of 4.0 percent, or a CAGR of 3.4 percent.

What is interesting to note is that even if a property owner were to buy at a peak and sell at a trough, there would still be a return on investment. The steady performance of Singapore’s real estate market is one of the reasons why it continues to be viewed as a safe haven by funds as well as institutional and foreign investors.

Beating the market

When considering a property purchase, aside from market timing, another factor is the potential to appreciate higher than the market’s rate.

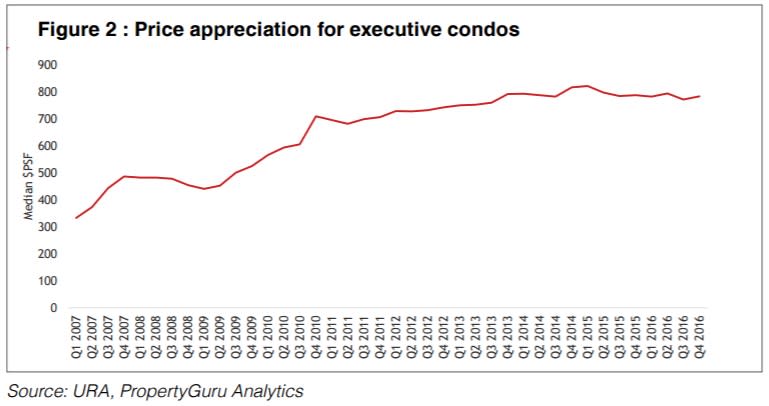

Most market watchers would suggest that a safe bet for capital appreciation is the EC market. Figure 2 demonstrates the 10-year median price movement for this property class. Over a 10-year period, ECs observed an annual appreciation in median prices of 13.5 percent, and a CAGR of 8.9 percent.

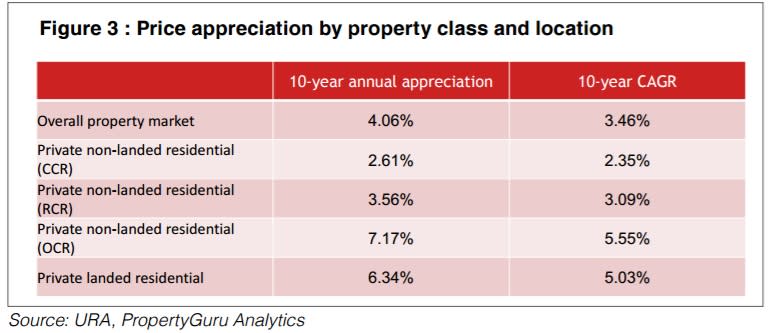

Figure 3 summarises the price appreciation for the private property market over the past ten years.

Non-landed private properties in the Outside Central Region (OCR) have seen the highest price appreciation over the past ten years, driven both by HDB upgraders and foreign investors looking outside the city centre.

Meanwhile, landed properties have also held up well over the past decade with a 10-year CAGR – more than 150 basis points above the overall property market’s. This is not surprising given the tight supply in landed property, generally strong holding power among landed property owners, and its position as an aspirational property class.

Look out for the future

While there are certain property classes that might see higher overall appreciation, value is inextricably linked to the location.

In Singapore, it’s almost a cliché, but the best way to judge if a location’s property will see strong capital appreciation in the future, one needs to follow the government’s activities. Singapore’s government regularly publishes their Master Plan and it gives both the real estate industry and home buyers an idea of where attention and resources will be placed in the medium to long term, to shape an area.

In the most recent Master Plan, published in 2014, the state made special mention of Holland Village, Bidadari and Woodlands Regional Centre. We have also seen a release of both commercial and residential land sites, public housing launches and development of transport links in these areas.

Buyers should also pay attention to plans for public transport links as well. Traditionally, properties around MRT stations have seen better capital appreciation in the long term, and in the short term, are easier to tenant with better rental yields. MRT stations also see a number of amenities pop up around them, from convenience stores to suburban retails malls, which provide a host of conveniences to those living nearby.

Buyers do need to take note of a few things, however. Infrastructure development is a process that takes years, if not decades, and buyers do need to ensure that their time frame to exit the investment accounts for that. For those looking for a shorter holding period, they might need to look at other avenues to park their capital.

One of the key reasons for buyers with an eye for capital appreciation to adopt a longer-term view is because most sellers, be it real estate developers or private sellers, have “future-priced” the property in question, setting higher sums to account for future value. Buyers would need to wait for prices to first catch up before they can resell for higher in the future.

A word of caution

As always, when it comes to buying property based on future potential, caveat emptor applies.

A number of years ago, before the government announced their plans for the Thomson-East Coast Line, there was an expectation that a new MRT station would be built in the Siglap area. After all, market watchers speculated the state was taking back the four blocks of public housing in the area and it would be an ideal site for a new MRT station. A few new projects in the area were sold based on this potential.

During that time, with the property market on the rise, it was common to hear optimistic predictions of strong rental pick up and good capital appreciation once the MRT station was announced and then subsequently when it was completed. However, when the final locations for the MRT stations were announced some distance away, these buyers saw their expectations dashed. While the properties did still appreciate over time, it was not as much as was initially expected.

Buying properties, like any other investment, does not come with any guarantees. While the prospect of money in the future is always tempting, it might be important to remember an adage as well – “A bird in hand is worth two in the bush”.

This article was first published in the print version PropertyGuru News & Views. Download PDFs of full print issues or read more stories now! | |||

Yahoo Finance

Yahoo Finance