Guidewire (GWRE) Incurs Loss in Q1, Revenues Top Estimates

Guidewire Software GWRE reported first-quarter fiscal 2022 non-GAAP loss of 21 cents per share, beating the Zacks Consensus Estimate by 12.5%. The company had reported earnings of 17 cents per share in the year-ago quarter.

Guidewire reported revenues of $165.9 million, which beat the Zacks Consensus Estimate by 0.74% but declined 2.3% year over year.

Cloud bookings were more than 90% of deal activity for the first time in the company’s history. Guidewire signed five InsuranceSuite cloud deals and witnessed another six successful cloud customer deployments in the reported quarter.

Quarter in Detail

Subscription and support revenues (47.6% of total revenues) surged 36.3% from the year-ago quarter to $79 million due to higher subscription revenues, which jumped 53% to $57.1 million.

License revenues (24.2% of total revenues) declined 38.5% year over year to $40.2 million while Services revenues (28.2% of total revenues) climbed 0.5% year over year to $46.8 million.

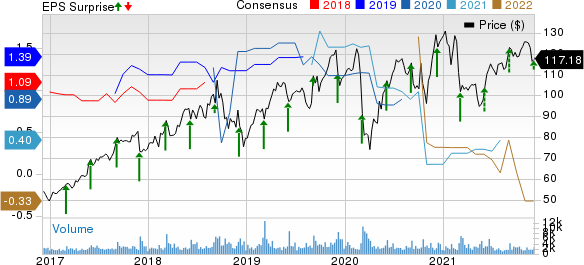

Guidewire Software, Inc. Price, Consensus and EPS Surprise

Guidewire Software, Inc. price-consensus-eps-surprise-chart | Guidewire Software, Inc. Quote

Annual recurring revenues (ARR) were $594 million as of Oct 31, 2021, compared with $582 million as of Jul 31, 2021.

Non-GAAP gross margin contracted 950 basis points (bps) on a year-over-year basis to 44.5%. Subscription and support gross margin was 43%, down from 48% reported in the year-ago quarter, primarily due to large investments Guidewire made to support its current and future cloud customers. Higher cloud infrastructure costs also hurt gross margin.

Total operating expenses increased 16% year over year to $128.1 million, driven by higher cloud infrastructure costs and commission expenses.

Non-GAAP operating loss was $28.7 million against operating income of $2.8 million reported in the year-ago quarter.

Balance Sheet

As of Oct 31, 2021, cash and cash equivalents and short-term investments came in at $1.1 billion compared with $1.3 billion as of Jul 31, 2021.

Guidewire used $107 million in cash from operations and $43.8 million for the acquisition of HazardHub in the reported quarter.

In the quarter under review, Guidewire repurchased 0.2 million shares worth $26.3 million.

Guidance

For second-quarter fiscal 2022, revenues are expected in the range of $195-$199 million. ARR is expected between $613 million and $616 million.

Non-GAAP operating loss is projected in the range of $11-$15 million.

For fiscal 2022, the company expects total revenues between $780 million and $790 million. ARR is expected between $659 million and $669 million.

Non-GAAP operating loss for fiscal 2022 is projected in the range of $48-$58 million.

For fiscal 2022, cash flow from operations is projected in the range of $10-$20 million.

Zacks Rank & Stocks to Consider

Guidewire currently has a Zacks Rank #3 (Hold).

Guidewire shares are down 9%, underperforming the Zacks Business-Software Services industry’s growth of 20.4% and Computer & Technology sector’s return of 21.6% year to date.

Some of the better-ranked stocks in the Computer & Technology sector are Nova Measuring Instruments NVMI, Advanced Micro Devices AMD and Pinterest PINS

Currently, Nova Measuring sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. Long-term earnings growth rate stands at 32.2%.

Nova Measuring shares have returned 83.3% year to date compared with the Zacks Electronics-Semiconductors industry’s growth of 34.6% and the Computer & Technology sector’s return of 21.7%.

Long-term earnings growth rate for AMD, a Zacks Rank #2 (Buy) stock, is currently pegged at 46.2%.

AMD shares have returned 64.3% year to date, outperforming the Electronics-Semiconductors industry’s growth of 34.6% and the Computer & Technology sector’s return of 21.7%.

Pinterest, currently carrying a Zacks Rank #2 (Buy) has a long-term earnings growth rate of 52.7%.

PINS shares are down 43%, underperforming the Zacks Internet Software industry’s decline of 22.2% and the Computer & Technology sector’s return of 21.7% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Guidewire Software, Inc. (GWRE) : Free Stock Analysis Report

Nova Ltd. (NVMI) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance