GSK Announces FDA Acceptance of New Meningococcal Jab BLA

GSK plc GSK announced that the FDA has accepted its biologics license application (BLA) seeking approval of its 5-in-1 meningococcal ABCWY vaccine candidate, MenABCWY. The FDA has granted a standard review to the BLA and is expected to give its decision on Feb 14, 2025.

The MenABCWY vaccine candidate combines the antigenic components of GSK’s two popular licensed meningococcal vaccines, Bexsero (MenB) and Menveo (MenACWY). The MenABCWY combination targets the five serogroups of the bacteria Neisseria meningitides (A, B, C, W, and Y), which is primarily responsible for most invasive meningococcal disease cases globally.

Per GSK, a potential approval of this 5-in-1 vaccine candidate could provide the broadest meningococcal serogroup coverage and lead to a simplified immunization schedule. The 5-in-1 meningitis vaccine candidate has the potential to reduce the number of injections compared to current FDA-approved meningitis vaccines, as it has been designed to protect against all five vaccine-preventable serogroups with one combined product.

The BLA was based on data from a pivotal phase III study. The study met all its primary endpoints, including the non-inferiority of the vaccine candidate for all five Neisseria meningitides serogroups compared to Bexsero and Menveo in terms of an immune response.

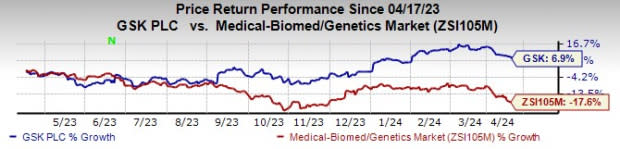

GSK’s stock has risen 6.9% in the past year against a decline of 17.6% for the industry.

Image Source: Zacks Investment Research

GSK boasts a broad vaccine portfolio that targets infectious diseases like meningitis, shingles, flu, polio and many more. GSK has more than 20 marketed vaccines in its portfolio. The company achieved strong vaccine growth of 25% at CER in 2023, driven by strong sales for its shingles vaccine, Shingrix and meningitis portfolio and exceptional contribution from the new respiratory syncytial virus (RSV) vaccine, Arexvy.

The company expects continued strong sales of Shingrix in 2024, primarily driven by outside U.S. markets. The vaccine is now approved in 39 countries. Arexvy sales are expected to be strong in 2024, driven by further penetration in the U.S. market as well as early adoption from international launches. Over time, GSK expects Arexvy to generate more than £3 billion in annual sales.

GSK is also focusing on accelerating the vaccines pipeline, particularly the expanded use of the RSV vaccine, pentavalent vaccine and MenABCWY to drive long-term growth. It has a leading suite of vaccine platform technologies, including next-generation mRNA, multiple antigens presenting systems, as well as adjuvant systems.

Zacks Rank & Stocks to Consider

GSK currently has a Zacks Rank #3 (Hold).

GSK PLC Sponsored ADR Price and Consensus

GSK PLC Sponsored ADR price-consensus-chart | GSK PLC Sponsored ADR Quote

Some better-ranked stocks in the healthcare sector are ANI Pharmaceuticals (ANIP), Entera Bio (ENTX) and ADMA Biologics (ADMA), sporting a Zacks Rank #1 (Strong Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, 2024 estimates for ANI Pharmaceuticals have improved from $4.06 per share to $4.43 per share. For 2025, earnings estimates have improved from $4.80 per share to $5.04 per share in the past 60 days. In the past year, shares of ANIP have risen 69.4%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters, delivering a four-quarter average earnings surprise of 109.06 %.

In the past 60 days, the consensus estimate for Entera Bio’s 2024 loss has narrowed from 75 cents per share to 25 cents per share. In the past year, shares of ENTX have risen 168.5%.

ENTX beat estimates in three of the trailing four quarters and missed the mark once, delivering an average earnings surprise of 10.66%.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share have improved from 22 cents to 30 cents. Estimates for 2025 have increased from 32 cents to 50 cents. In the past year, shares of ADMA Biologics have risen 84.5%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same once. ADMA delivered a four-quarter average earnings surprise of 85.0%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Entera Bio Ltd. (ENTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance