The Great Rotation – is it finally here in 2016?

In this week’s #FeatureFriday, we take a look at the aftermath of what the ‘Trump Effect’ brings to the market, and whether the ‘Great Rotation’ is finally happening?

What Is The Great Rotation?

The ‘Great Rotation’, or the rotation phenomenon, is where there is a massive shift of money out of bonds and into stocks. This term was first coined by the Bank of America back in 2011.

Since 2011, there had been a couple of false starts, leading to the failed materialisation of predictions that were previously made, until possibly now.

To many, the open question as to whether the great rotation will come true heavily depends on the extent to which investors flee bonds in favor of equities.

However, when it was first introduced by Merrill Lynch, that prediction didn’t come true, as the 10-year yield bond managed to stay below 3 percent.

However, with the recent US Presidential election results released and the people of America having decided that Mr. Donald Trump is to be their next president, investors from all around the world are asking, ‘Is This It?’

By ‘it’, they are not hinting at America’s political future, but the turbulent and unstable market that has been set off as a result of the Presidential election.

The wide discussion surrounding the ‘great rotation’ and the massive outflow of money from bonds to stocks have had analysts and investors wondering is this is going to be long term or just a flash in the pan.

Trump Presidency

Source: Call Levels

One of the prominent reasons behind the dramatic skyrocket in the stock market was the result of the US presidential election, where the stock market had bet on Trump to increase infrastructure spending, while cutting taxes and government regulations.

This also signals a decisive shift in the belief of abandoning the largely exhausted ineffective monetary policy seen by the market. Donald Trump had repeatedly stated the use of a stimulatory fiscal policy, hinting at an increase in government spending, mostly in the infrastructure sectors.

Why This Might Be The Great Rotation?

Source: Call Levels

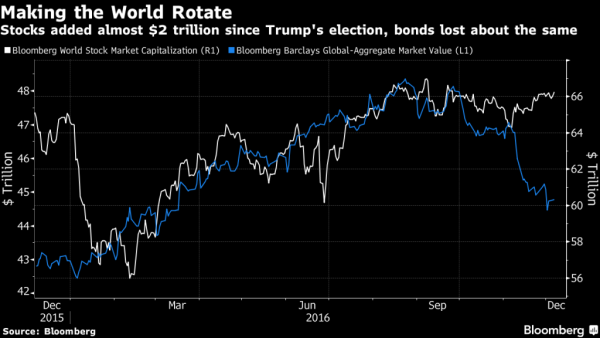

Since Donald Trump was elected as the next president of the United States on November 8th 2016, close to $2 trillion had been erased in value of global bonds, initiating a round of growth and inflation views, coinciding with his promise of introducing inflationary fiscal policies.

As opposed to the bond markets, the US stock market had seen record highs ever since Trump was elected.

The stock market has seen the biggest equity inflows in two years at $28 billion, according to Bank of America Merrill Lynch, with the biggest bond outflows in 3 and ½ years at $18 billion.

This historical data backs up the prediction, as it was the widest weekly disparity between stock and bond flows ever.

In addition, the shift in favor of using fiscal policies as opposed to traditional monetary policies for the first time since the financial crisis in 2008 highlights yet another rare phenomenon that supports the theory of the great rotation.

The increase in government spending and tax cuts would imply higher borrowing volume by the U.S. government, as well as putting an upward pressure on inflation, proving the long view of low yielding bonds to be something of the past, ending a three-decade bond bull run and propelling the stock market to record highs.

Why This Might Not Be True

While the unprecedented statistics increase the traction of the great rotation, analysts provided admonition that this notion has had several false starts since the term was first coined.

In addition, what worries investors and analysts is also the uncertainty of Trump and how he plans to deliver on his promises.

This bodes with the possible negative impacts brought about by the Trump Effect. With the worldwide events leading to the trend of anti-globalization in 2016, such as Brexit and the latest referendum held in Italy, Trump represents the biggest arrow towards this movement, leading many investors pondering about how anti-globalization could restrict trade and affect corporate profits.

‘It has been a tough two weeks for bonds, but it has not been as intense as the rout in 2013 following the Fed’s announcement that it was ending its third round of quantitative easing.” as described by CIBC World Markets Chief Economist Avery Shenfeld.

Ten-year treasury yields touched 3%, on two separate occasions during the 2013 rout; and in comparison, the bond rout that started ever since Trump was elected had the yield hovering at 2.3% from 1.6% from just two months ago, according to Financial Post.

Therefore, many believe, including Societe Generale currency strategist Kit Juckes, that the current yield at 2.3% is still not sufficient to signify a definitive materialization of the great rotation, as he believes that the end of the bond bull market isn’t going to come to an end unless the US 10-year yields break 3.25 percent.

“While I very doubt we have seen the low in yields, we’ve probably seen the low for this economic cycle.”, said Jukes.

Whether the end of the 30-year bond bull market will come true in the near future, leading to the great rotation is still largely uncertain, but nonetheless provides a meaningful economic outlook between the correlations of the equity and the bond market in the coming years.

Visit Call Levels website at https://www.call-levels.com/.

(By Call Levels)

Related Articles

- The aftermath of the Brexit effect on banks in the UK

- How Trump as president-elect will affect Singapore’s economy

- Mumbai’s economy (soon) as big as Malaysia’s (now)? India’s growth in context.

Yahoo Finance

Yahoo Finance