Great Industrial Dividend Stocks For Every Portfolio

Industrial names generally suffer from deep cyclicality which can affect companies operating in areas ranging from machinery to aerospace to construction. Hence, considering economic volatility is of paramount importance when thinking about an industrials company’s profitability. Cash flow availability also drives dividend payout, so in times of growth, these companies could provide hefty dividend income for your portfolio. If you’re a long term investor, these high-dividend industrials stocks can boost your monthly portfolio income.

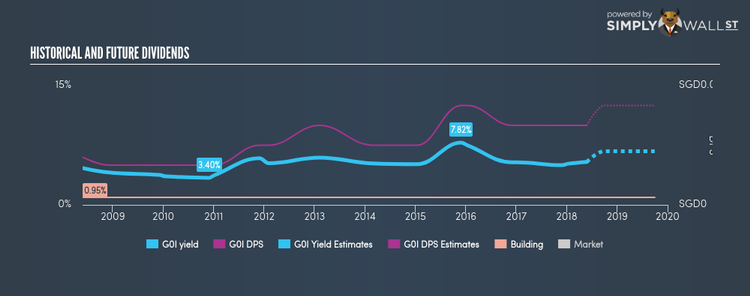

Nam Lee Pressed Metal Industries Limited (SGX:G0I)

G0I has a juicy dividend yield of 5.41% and distributes 23.37% of its earnings to shareholders as dividends . While there’s been some level of instability in the yield, G0I has overall increased DPS over a 10 year period from S$0.012 to S$0.02. Dig deeper into Nam Lee Pressed Metal Industries here.

OKP Holdings Limited (SGX:5CF)

5CF has an alluring dividend yield of 6.06% and their payout ratio stands at 20.55% . While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. The company has a lower PE ratio than the SG Construction industry, which interested investors would be happy to see. The company’s PE is currently 9.7 while the industry is sitting higher at 12.4. Continue research on OKP Holdings here.

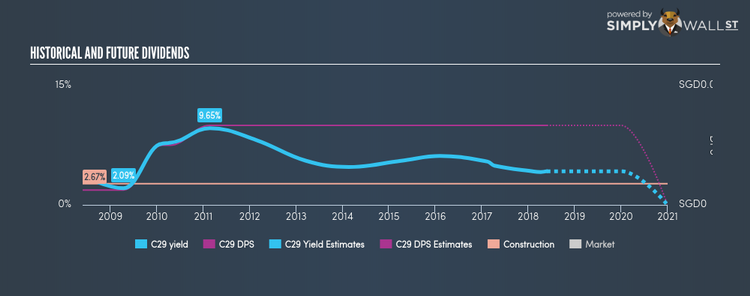

Chip Eng Seng Corporation Ltd (SGX:C29)

C29 has a large dividend yield of 4.23% and pays 75.47% of it’s earnings as dividends . C29 has increased its dividend from S$0.0075 to S$0.04 over the past 10 years. Much to the delight of shareholders, the company has not missed a payment during this time. If analysts are correct, Chip Eng Seng has some strong future growth on the horizon with an expected increase in EPS of 94.14% over the next three years. More on Chip Eng Seng here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance