Goldman Sachs is buying a startup that is out to ‘revolutionize the retirement industry’

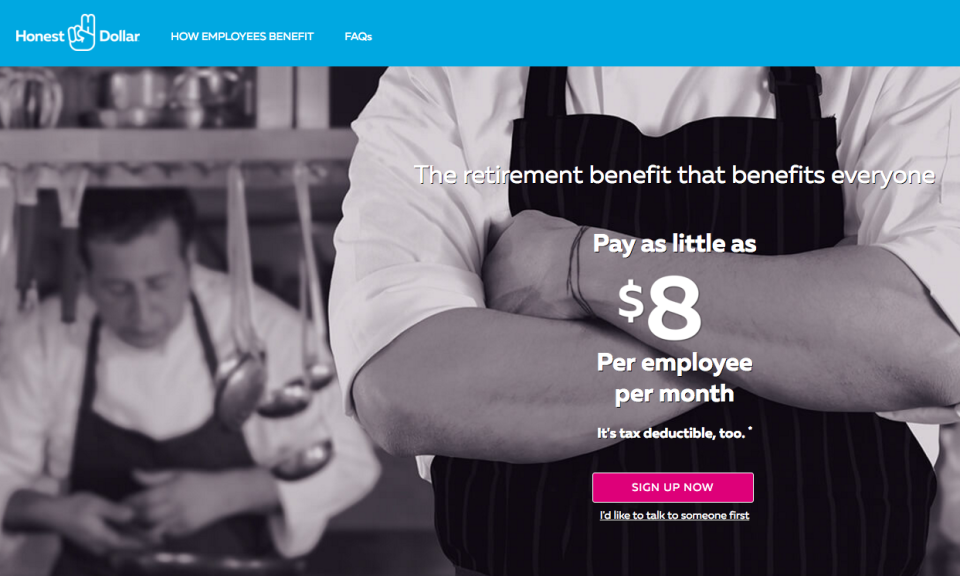

Honest Dollar

Goldman Sachs has struck a deal to buy Honest Dollar, an Austin, Texas-based startup which serves small businesses looking to set up retirement saving programs for staff.

There are approximately 45 million Americans who do not have access to employer-sponsored retirement, according to the Goldman Sachs statement announcing the deal.

Honest Dollar, which is web and mobile-based, tries to take the hassle out of small businesses ― including startups ― setting these retirements plans up.

It claims it takes employers 90 seconds to sign up, and it charges employers as little as $8 per employee per month to set up a retirement savings account. Once employees are set up, they’re asked a series of questions and have one of six portfolios recommended to them. These are all made up of four different Vanguard exchange-traded funds.

“Honest Dollar has created a simple solution to a complex retirement savings problem,” Timothy J. O’Neill and Eric S. Lane, co-heads of IMD at Goldman Sachs, said in a statement. “Together, we have the potential to help millions of people achieve their investing goals.”

Honest Dollar won the 2015 ReleaseIt at SXSW competition, and previously raised funds from Expansive Ventures and Formation 8. It was cofounded by William Hurley, cofounder of technology studio Chaotic Moon and a former Master Inventor at IBM, and Henry Yoshida. Yoshida later left in 2015.

“We set out with a singular focus: to revolutionize the retirement industry and reach individuals who historically have been underserved,” said Hurley in the statement.

Honest Dollar will remain in Austin on completion of the transaction. Terms were not disclosed.

For Goldman, the deal marks its latest foray into financial technology.

Goldman Sachs CEO Lloyd Blankfein has often referred to his firm as a “tech company,” and the firm has put a focus on hiring for its own tech team, hosting hackathons and giving away some of its trading technology to clients using open-source software.

NOW WATCH: Paul Krugman gave us his top 3 investment tips

The post Goldman Sachs is buying a startup that is out to ‘revolutionize the retirement industry’ appeared first on Business Insider.

Yahoo Finance

Yahoo Finance