Gold Price Forecast – Still Expecting $1700 In March

Our cycle work maintains a bullish advance into March that should propel gold to approximately $1700 before the next meaningful correction.

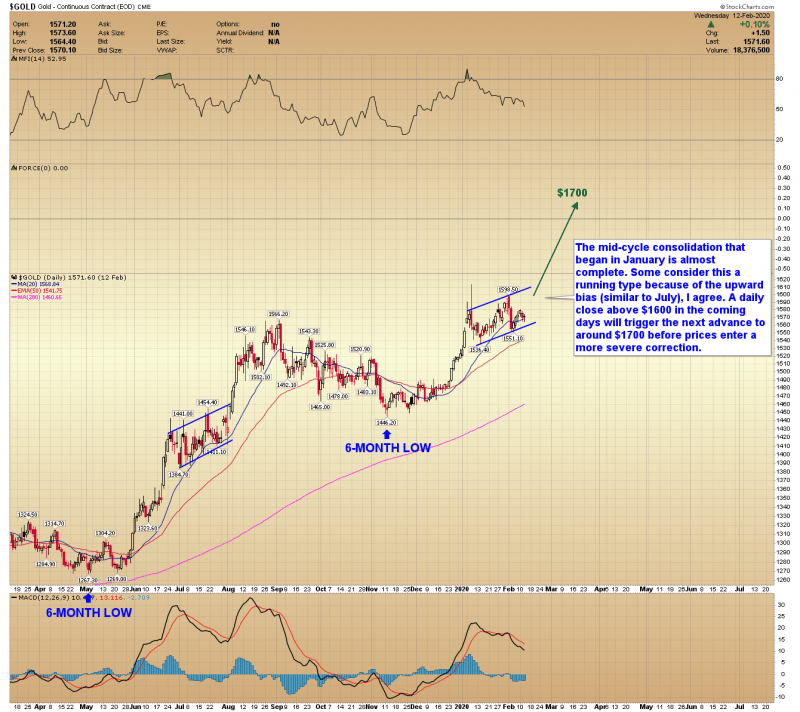

Consolidation Nearly Complete

The mid-cycle consolidation that began in January is almost complete. Some consider this a running type because of the upward bias (similar to July), I agree. A daily close above $1600 in the coming days will trigger the next advance to around $1700 before prices enter a more severe correction.

Potential Triggers

Typically, these consolidations end with a bang resulting in a $20.00+ up day in gold. Potential triggers for such an event are Friday’s retail sales, a spike in the coronavirus over the weekend, or next week’s FOMC minutes.

AG Thorson is a registered CMT and expert in technical analysis. He believes we are in the final stages of a global debt super-cycle. For more information, please visit https://goldpredict.com/

This article was originally posted on FX Empire

More From FXEMPIRE:

GBP/USD Price Forecast – British Pound Breaks Above Significant Level

Gold Price Prediction – Prices Rebound on Increase in Coronavirus Cases

Crude Oil Price Update – Strengthens Over $51.95, Weakens Under $50.99

USD/JPY Price Forecast – US Dollar Pulls Back From Major Level Again

S&P 500 Price Forecast – Stock Market Continues To Show Resiliency

Yahoo Finance

Yahoo Finance