GoDaddy Inc. (GDDY) Q1 2024 Earnings: Surpasses Revenue and Net Income Expectations

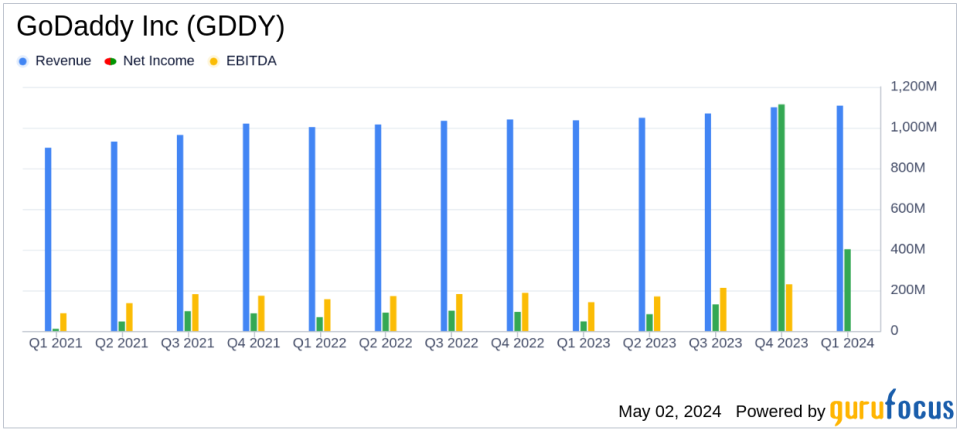

Total Revenue: Reached $1.1 billion, up 7% year-over-year, surpassing estimates of $1.096 billion.

Net Income: Soared to $401.5 million, a 747% increase year-over-year, significantly exceeding estimates of $135.03 million.

EPS: Reported at $2.76 diluted, vastly surpassing the estimated $0.96.

Free Cash Flow: Increased by 26% year-over-year to $327.4 million.

NEBITDA: Grew 25% year-over-year to $313.0 million, with a margin of 28%, exceeding the first quarter guidance of 27%.

Applications and Commerce Revenue: Grew 13% year-over-year to $383.1 million.

Share Repurchases: Repurchased 2.8 million shares for $345.6 million, reducing fully diluted shares by approximately 22% since the inception of the current buyback program.

GoDaddy Inc. (NYSE:GDDY) released its 8-K filing on May 2, 2024, reporting a robust first quarter with significant year-over-year increases in revenue and net income, surpassing analyst expectations. The company, a global leader in domain registration and online services, continues to demonstrate strong financial health and strategic market positioning.

Company Overview

GoDaddy Inc. is renowned for providing a suite of services designed to empower entrepreneurs, including domain registration, website hosting, and business productivity tools. Following its acquisition of the payment platform Poynt in 2021, GoDaddy has expanded into omnicommerce solutions, enhancing its service offerings to include both online and offline payment systems.

Financial Performance

For Q1 2024, GoDaddy reported total revenue of $1.1 billion, reflecting a 7% increase from the previous year and surpassing the estimated $1.096 billion. This growth was driven by a 13% increase in Applications and Commerce (A&C) revenue, which totaled $383.1 million. The Core Platform segment also saw a rise, contributing $725.4 million, up 4% year-over-year.

Net income showed a remarkable surge to $401.5 million, dramatically up from $47.4 million in Q1 2023, which includes a substantial non-routine, non-cash tax benefit. This performance significantly exceeded the analyst's net income expectation of $135.03 million. The net income margin stood at an impressive 36%, underscoring GoDaddy's enhanced profitability.

Operational Highlights and Strategic Initiatives

The quarter witnessed a 9% increase in total bookings, indicating robust demand for GoDaddy's offerings. The launch of GoDaddy Airo, an innovative customer experience solution, marks a significant milestone in the company's strategy to enhance user engagement and satisfaction. This initiative is part of GoDaddy's broader effort to streamline its operations and focus on high-margin opportunities.

Financial Health and Future Outlook

GoDaddy's balance sheet remains solid with $664 million in cash and cash equivalents and a net debt position of $3.2 billion. Looking forward, the company has raised its full-year 2024 revenue forecast to between $4.50 billion and $4.56 billion, reflecting confidence in its operational strategies and market conditions.

Management Commentary

"We are off to a great start in 2024, and we are excited to build on this momentum as we execute on our mission of empowering entrepreneurs everywhere and making opportunity more inclusive for all," said GoDaddy CEO Aman Bhutani.

"Our strong first quarter results underscore our commitment to sustainable growth and disciplined capital allocation," added CFO Mark McCaffrey.

Conclusion

GoDaddy's Q1 2024 results not only demonstrate its ability to exceed financial expectations but also highlight the effectiveness of its strategic initiatives and operational efficiency. With a positive outlook for the year and ongoing innovations, GoDaddy is well-positioned to maintain its leadership in the domain and online services market, continuing to deliver value to its customers and shareholders alike.

Explore the complete 8-K earnings release (here) from GoDaddy Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance