GM, Disney, and JOLTS — What you need to know in markets on Tuesday

After last week’s data deluge, this week will be quieter on the data side but earnings will still keep investors busy.

On Tuesday, two of the week’s biggest headliners will cross the tape as General Motors (GM) will report earnings before the market open and Disney (DIS) releasing results after the bell.

On the economic data front, we’ll get the December job openings and labor turnover survey, or JOLTS report, out on Tuesday morning. Economists are expecting the report, which is one of Federal Reserve Chair Janet Yellen’s favorite indicators, to show there were about 5.59 million jobs open in the December.

SLOOS

The Federal Reserve’s quarterly Senior Loan Officer Opinion Survey, or SLOOS report, was released on Monday, and the findings, in general, ran somewhat counter to the economic narrative we’ve seen emerge since the election.

“The latest SLOOS showed tightening lending standards and weakening demand across several types of loans,” wrote JPMorgan economist Daniel Silver.

“The data can be choppy and the latest figures were not especially bad, but the SLOOS data send a more negative signal about activity than many other recent business surveys that have been almost universally upbeat over the past few months.” (Emphasis added.)

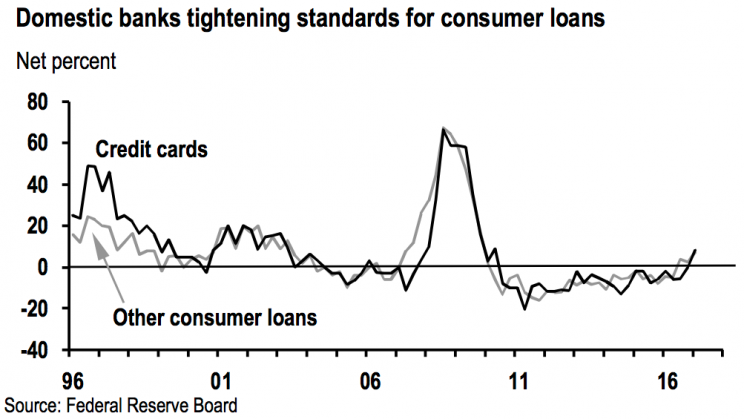

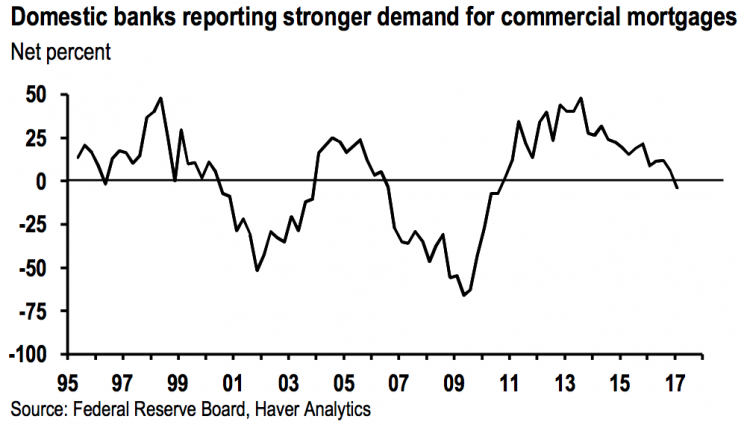

Of note in the report were both credit card lending and commercial real estate.

The SLOOS report indicated that banks tightening lending standards for credit card lending for the first time since 2010 while demand weakened for all three main categories of consumer loans — credit cards, auto loans, and others.

Commercial real estate demand, meanwhile, declined for the first time since 2010 and banks continued to tighten lending standards, though Silver noted not as several as in recent quarters.

Since the election, consumer and business surveys have notably improved, and this surge in “soft data” readings has now caught the market’s attention as we seek follow-through to the “hard data” — which includes things like the jobs report, industrial production, and durable goods orders.

In a note to clients on Monday, Goldman Sachs strategist Charles Himmelberg said that data pointing to more optimism around economic growth is probably peaking.

And while incoming hard data has been solid, if perhaps not as strong as the exuberant sentiment readings might suggest, the SLOOS data is a reminder that we are, if nothing else, at the beginning of a tightening cycle.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance