Gilead Sciences Inc (GILD) Q1 2024 Earnings: Misses Analyst EPS Estimates Amid Significant ...

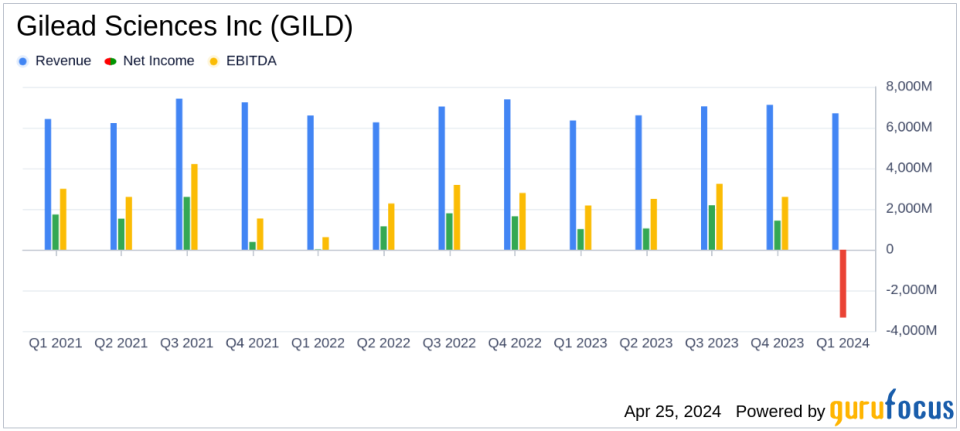

Total Revenue: Reached $6.7 billion in Q1 2024, a 5% increase year-over-year, exceeding estimates of $6.338 billion.

Net Loss: Reported a significant net loss due to a $3.9 billion acquired IPR&D charge, with diluted EPS at -$3.34, falling below the estimated EPS of -$1.51.

Product Sales: Grew by 5% to $6.6 billion, with HIV, Oncology, and Liver Disease as key drivers.

Operating Cash Flow: Generated $2.2 billion in the first quarter, supporting robust operational activities despite financial losses.

Dividends and Share Repurchases: Paid dividends of $990 million and repurchased $400 million of common stock, reaffirming commitment to shareholder returns.

Research & Development Expenses: Increased to $1.5 billion in Q1 2024 from $1.4 billion in the same period in 2023, reflecting ongoing investment in innovation.

Effective Tax Rate: Reduced significantly to 7.0% in Q1 2024 from 24.3% in Q1 2023, influenced by non-deductible acquired IPR&D charges.

Gilead Sciences Inc (NASDAQ:GILD) released its 8-K filing on April 25, 2024, revealing a challenging first quarter with significant financial impacts due to acquisition-related expenses. The biopharmaceutical company, known for its innovative therapies for life-threatening infectious diseases, reported a diluted earnings per share (EPS) of $(3.34), a stark contrast to the previous year's $0.80 EPS and missing analyst estimates of $(1.51) EPS for the quarter.

Financial Highlights and Challenges

Total revenue for Q1 2024 increased by 5% year-over-year to $6.7 billion, driven by strong sales in the HIV, Oncology, and Liver Disease segments. Despite this growth, Gilead faced significant financial burdens due to a $3.9 billion acquired in-process research and development (IPR&D) charge from its recent acquisition of CymaBay Therapeutics. This charge had a substantial $(3.14) impact per diluted share. Additionally, a $2.4 billion pre-tax IPR&D impairment charge related to assets acquired from Immunomedics in 2020 further strained earnings, contributing to a $(1.46) per share impact.

Operational and Sales Performance

Gilead's product sales, excluding Veklury, rose by 6% to $6.1 billion. Notably, Biktarvy sales increased by 10% to $2.9 billion, buoyed by robust demand across the United States, Europe, and other international markets. However, Veklury sales saw a decline of 3%, reflecting lower COVID-19 related hospitalizations. The Oncology portfolio also showed impressive growth, with an 18% increase year-over-year, totaling $789 million.

Strategic Acquisitions and Research Advancements

The acquisition of CymaBay is poised to add potentially transformative therapies for liver diseases to Gilead's portfolio, with a regulatory decision on seladelpar expected in August 2024. Gilead also highlighted progress in its HIV treatment pipeline, including promising new data on long-acting regimens.

Financial Position and Outlook

As of March 31, 2024, Gilead reported $4.7 billion in cash, cash equivalents, and marketable debt securities, a decrease from $8.4 billion at the end of 2023. The company generated $2.2 billion in operating cash flow during the quarter and returned significant capital to shareholders through $990 million in dividends and $400 million in stock repurchases.

For the full year 2024, Gilead has adjusted its diluted EPS guidance to between $0.10 and $0.50, down from the previous range of $5.15 to $5.55, reflecting the financial impact of its recent acquisitions and charges. The non-GAAP diluted EPS forecast has also been revised to between $3.45 and $3.85, from the earlier projection of $6.85 to $7.25.

Conclusion

While Gilead Sciences Inc (NASDAQ:GILD) demonstrates strong revenue growth and strategic expansion through acquisitions, the substantial financial impacts from these activities have posed significant challenges to its earnings performance in the first quarter of 2024. Investors and stakeholders will likely keep a close watch on how these investments in R&D and acquisitions translate into long-term value.

For more detailed insights and ongoing updates, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Gilead Sciences Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance