GBPUSD Attempts 3rd Bullish Breakout

DailyFX.com -

Talking Points

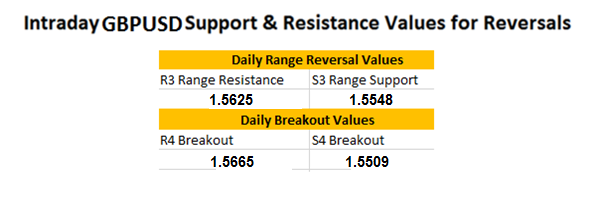

Today’s GBPUSD range measures 78 points

R4 Breakouts begin over 1.5665

R3 resistance is found at 1.5626

GBPUSD 30Minute Chart

(Created using Trading View Charts)

Looking for more FX Reversals? Sign up for my email list here: SIGN UP HERE

The GBPUSD is attempting to breakout higher this morning, and close the week on newly created highs. The pair has gained momentum after the Fed declined to raise rates in yesterday’s FOM rate decision. Price action is currently trading above today’s 78 pip trading range, which starts at the R3 Camarilla pivot seen below at a price of 1.5626. The next value of resistance for the pair stands at the R4 pivot at a price of 1.5665. A move beyond this value would mark the 3rd bullish breakout over the last three trading sessions. If a breakout does occur, traders can begin targeting a 1x extension of today’s range towards a price of 1.5743.

In the event that prices fail to breakout to a new high, traders will look for prices to drop back inside of the previously mentioned range. In this scenario, prices must first drop below the R3 pivot before potentially challenging values of support. It should be noted that range support is found at 1.5548. A decline below this point, to the S4 pivot at 1.5509, would be considered significant. A bearish reversal to this value would bring the pair back at Pre-FOMC event prices, and open the GPBUSD up to further price declines.

Camarilla pivots can be helpful for evaluating support and resistance for day trading. To learn more about pivots, and how to identify intraday price reversals, continue your education with DailyFX HERE.

Once you are ready to get started, register for a FREE Forex demo with FXCM. This way you can practiceyour day trading techniques while watching Forex pairs in real time.

Previous Market Setups

EURGBP Continues to Trade in Range

EURUSD Attempts Second Breakout

---Written by Walker England, Trading Instructor

To Receive Walkers’ analysis directly via email, pleaseSIGN UP HERE

To contact Walker, email wengland@fxcm.com.

Contact and Follow Walker on Twitter @WEnglandFX.

Video Lessons || Free Forex Training

Trading Using Fibonacci (13:08)

Reading the RSI, Relative Strength Index (13:57)

Money Management Principles (31:44)

Trade Like a Professional Workshop (1:44:14)

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance