There is a ‘game changer’ technology on Wall Street and people keep confusing it with bitcoin

Autonomous Research

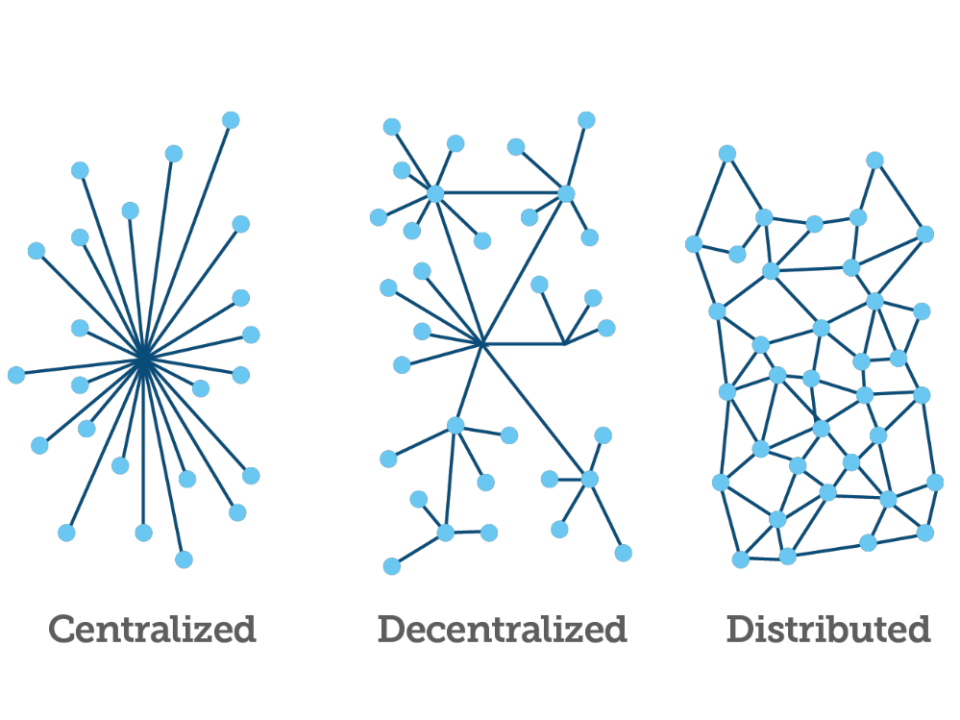

Blockchains are made up of distributed ledgers.

Wall Street banks are buzzing about blockchain.

Goldman Sachs says the technology “has the potential to redefine transactions” and can change “everything.”

JPMorgan last month announced it was launching a trial project with the blockchain startup led by its former executive, Blythe Masters. Her company, Digital Asset Holdings, has secured funding from Goldman, Citi, ICAP, and a boatload of other financial firms.

If you’re wondering what a blockchain actually is, or how its works, you’re not alone. Autonomous Research, which calls the technology a “game changer,” has released a report to answer all of your blockchain questions.

The important thing to understand is that it has nothing to do with bitcoin — at least for Wall Street’s purposes. Blockchain is the technology behind bitcoin, but it has many other uses too.

Wall Street wants to use blockchains to simplify the way it processes transactions.

That may not sound very exciting, but if it works, it could eliminate back office jobs and costs. So it’s worth paying attention to — especially if you’re one of the thousands of people who work in bank back offices.

Here’s how it works.

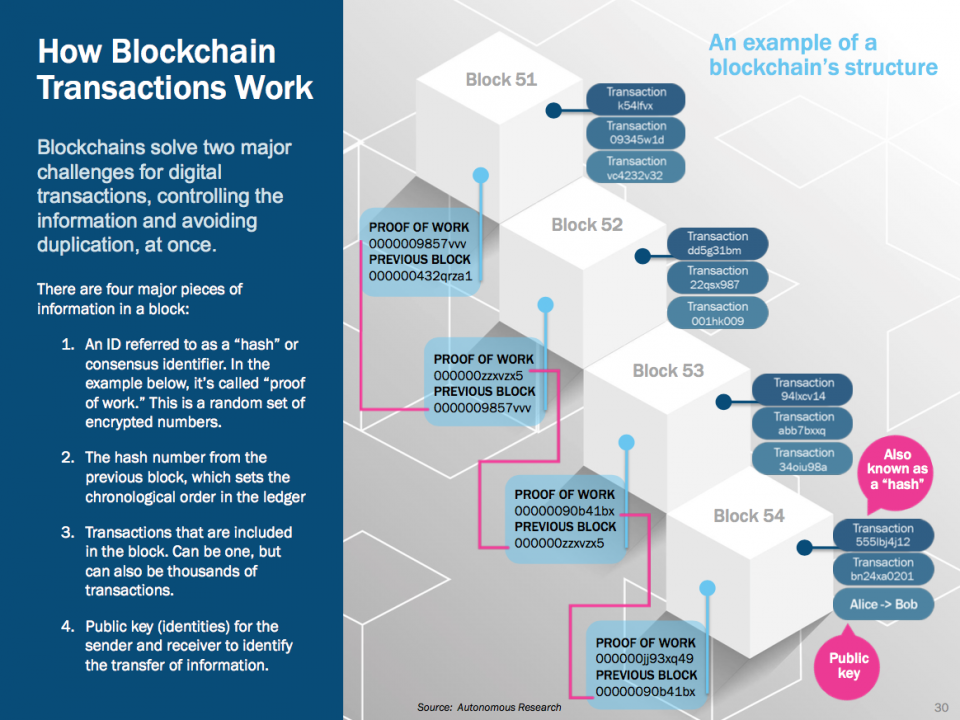

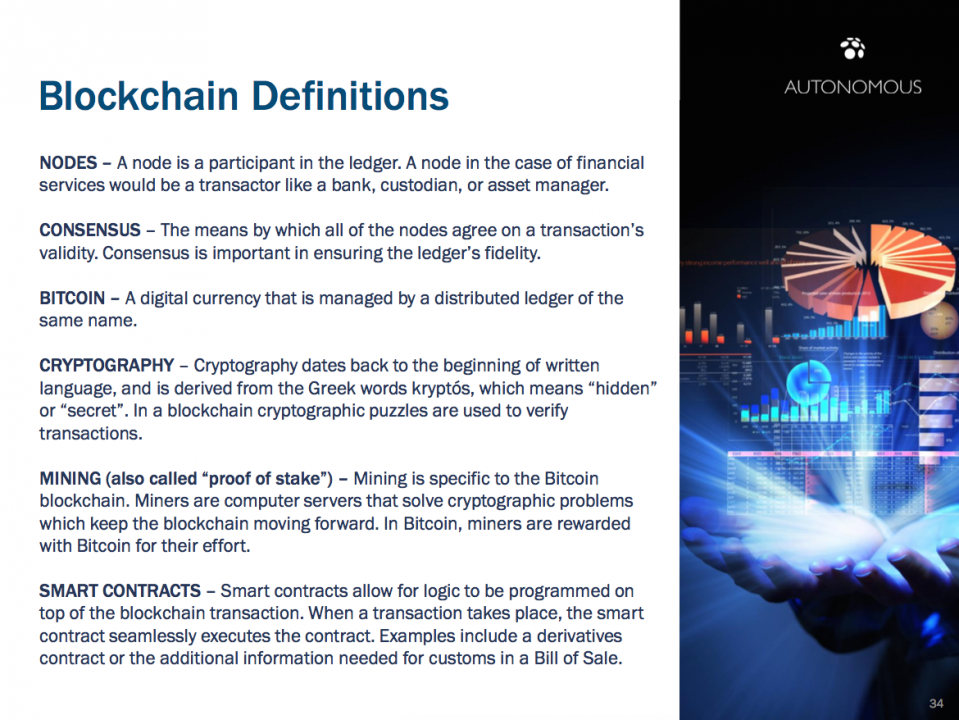

Blockchains are ledgers (like Excel spreadsheets), but they accept inputs from lots of different parties. The ledger can only be changed when there is a consensus among the group. That makes them more secure, and it means there’s no need for a central authority to approve transactions.

Blockchains control information and avoid duplication.

There’s no need for a centralized authority to validate transactions when multiple banks, asset managers, or custodians can agree and validate them instead.

When blockchain transactions take place, smart contracts automatically execute themselves.

What does it really mean for Wall Street? It could eliminate back office costs — and jobs.

And it could create a huge amount of value for the top Wall Street banks. That’s why they’re so interested in the technology.

Here are some helpful definitions.

The post There is a ‘game changer’ technology on Wall Street and people keep confusing it with bitcoin appeared first on Business Insider.

Yahoo Finance

Yahoo Finance