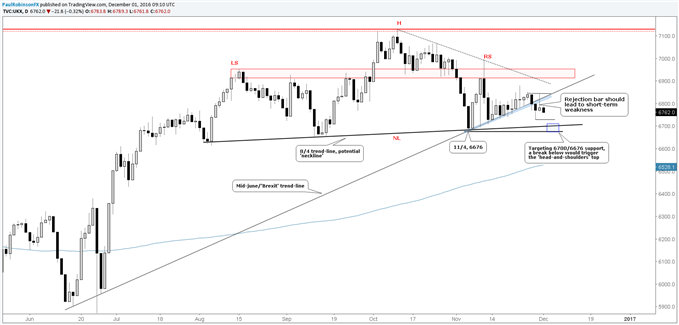

FTSE 100: Rejection at Resistance Points to Weakness Ahead

DailyFX.com -

What’s inside:

The FTSE 100 closes below criticial trend-line for a second day in a row

Yesterday’s rejection upon attempt to reclaim support bolsters bearish case

Looking for follow-through towards 6700/6776, with bigger picture implications on a break

On Tuesday, when we last discussed the FTSE 100 it was slipping below the critical June trend-line it’s been tight-roping for the past couple of weeks. It ended the session closing under, but wasn’t the most convincing break as a late-day rebound helped pare more than half of its losses. However, what was more convincing from a bearish standpoint was the attempt yesterday to recapture the trend-line and subsequent rejection in afternoon trade. Yesterday’s price action helped further cement the importance of the trend-line we’ve been watching so closely. But instead of it acting as support it now acts as a reference of resistance.

Rejection bars often times, within the proper context, lead to follow through not long after the event takes place. If this is to be the case, then the FTSE should not overtake the Wednesday high of 6845 and ultimately not close above the trend-line. If it does, then a neutral at the least, possibly bullish stance will be warranted.

With continuation to the downside in mind, we will look to the Tuesday low at 6729 as minor support, with the 8/4 trend-line/neckline as our next signficant level of support. At this time the line runs through roughly 6700. Below 6700, the 11/4 low at 6676 comes into play. A clean closing break below 6700/6676 would be considered a signficant event as the developing 'head-and-shoulders' pattern dating back to August would trigger. We will delve further into this should it become relevant.

FTSE 100: Daily

Created with Tradingview

See our Trading Guides for educational resources and forecasts. For a list of live events conducted daily to not only help educate but provide trading ideas, please see our webinar calendar.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance