FTI Consulting (FCN) Rides on Low Debt, Investor-Backing Moves

FTI Consulting, Inc. FCN currently banks on its strong balance sheet and measures to boost its shareholder value.

FCN delivered impressive first-quarter 2022 results, with both earnings and revenues beating the Zacks Consensus Estimate. Adjusted earnings per share (excluding 6 cents from non-recurring items) of $1.66 surpassed the Zacks Consensus Estimate by 24.8% but decreased 12.2% on a year-over-year basis. Total revenues of $723.6 million beat the consensus mark by 3% and rose 5.4% on a year-over-year basis.

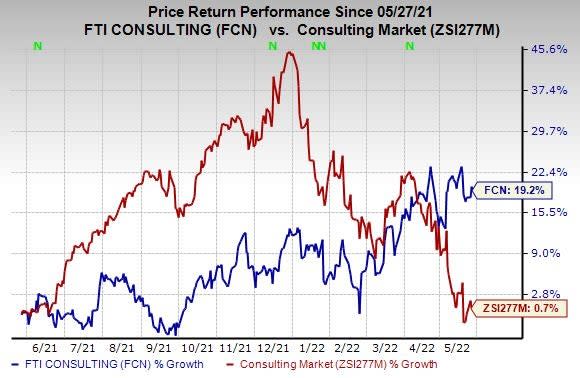

The stock has rallied 19.2% in the past year compared with the 0.7% rise of the industry it belongs to.

Image Source: Zacks Investment Research

How is FTI Consulting Faring?

We are impressed by FTI Consulting's endeavors to reward its shareholders though share buybacks. In 2021, 2020 and 2019, FCN had repurchased shares worth $46.1 million, $353.4 million and $105.9 million, respectively. These initiatives not only instill investors’ confidence in the stock but also positively impact its earnings per share.

FTI Consulting's current ratio (a measure of liquidity) stood at 2.40 at the end of first-quarter 2022, higher than 1.91 recorded at the end of fourth-quarter 2021 and the prior-year quarter’s 2.32. The gradually increasing current ratio bodes well for FTI Consulting. Moreover, a current ratio of more than 1.5 is usually considered good for a company. This may imply that the risk of default is less.

We believe that FTI Consulting’s international operations help expand its geographic footprint and contribute to its top-line growth. In 2021, FCN earned almost 38% of its revenues from its international businesses. The industrial and geographical diversification of its customer base (throughout the United States and internationally) helps mitigate the risk of incurring material losses.

However, escalating investments in people are likely to increase the costs incurred by FCN and dent its bottom-line growth in the initial stage.

FTI Consulting currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Stocks to Consider

Investors interested in the broader Business Services sector may also check out some other stocks worth considering like Avis Budget Group, Inc. CAR, Cross Country Healthcare CCRN and FactSet Research Systems Inc. FDS.

Avis Budget sports a Zacks Rank #1 at present. CAR has a long-term earnings growth expectation of 19.4%.

Avis Budget delivered a trailing four-quarter earnings surprise of 102%, on average.

Cross Country Healthcare sports a Zacks Rank of 1. CCRN has a long-term earnings growth expectation of 6.9%.

Cross Country Healthcare delivered a trailing four-quarter earnings surprise of 29.2%, on average.

FactSet’ carries a Zacks Rank of 2, currently. FDS has a long-term earnings growth expectation of 10%.

FactSet pulled off a trailing four-quarter earnings surprise (three beats and one miss) of 6.1%, on average. FDS continues to benefit from high client retention, solid revenue growth and a competitive pricing strategy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

FactSet Research Systems Inc. (FDS) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance