Frequency (FREQ) Up 77% on Merger Deal With Korro Bio

Shares of Frequency Therapeutics FREQ surged 77.48% on Friday, after management announced that the company entered into a definitive agreement with RNA editing company, Korro Bio, to merge in an all-stock transaction.

Per the terms of the agreement, pre-merger FREQ shareholders will own approximately 8% of the combined entity while the remaining 92% stake will be owned by pre-merger Korro Bio shareholders. Prior to the merger, Korro Bio has secured commitments from a syndicate of investors for a planned concurrent $117 million financing.

In addition, pre-merger FREQ shareholders will also be eligible to receive a contingent value right for each outstanding share, provided that the company has not monetized its remyelination program for Multiple Sclerosis (MS) prior to the closing of the merger.

This combined entity will focus on advancing Korro Bio’s portfolio of RNA editing programs, which is developed using the latter’s RNA editing proprietary platform. Korro Bio’s platform enables a breadth of indications with an initial focus on six potential programs all of which are wholly owned. The lead program is a disease modifying therapy for alpha-1 antitrypsin deficiency for which a regulatory filing is expected in the second half of 2024.

Post-merger, the newly formed entity will operate under Korro Bio and will apply to trade on the NASDAQ under the ticker symbol KRRO. The combined company will be headquartered in Cambridge, MA and led by the existing management team of Korro Bio. The combined entity is expected to have cash balance of around $170 million, which is expected to provide cash runway into 2026.

The board of directors of both Frequency Therapeutics and Korro Bio have given their approval to thistransaction. The merger, which is subject to customary closing conditions and clearance from the regulatory authorities, is expected to be completed by fourth-quarter 2023.

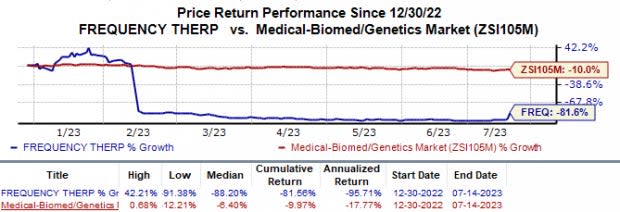

Year to date, shares of FREQ have plunged 81.6% compared with the industry’s 10.0% decline.

Image Source: Zacks Investment Research

Currently, Frequency does not have any pipeline candidate in clinical development. In February, the company suffered a major setback when it decided to discontinue the development of FX-322 as a potential treatment for sensorineural hearing loss. The decision was based on data from a mid-stage study which failed to achieve its primary efficacy endpoint of improving speech perception. Alongside the results, the company also announced restructuring activities and decision to reduce its headcount by around 55% in order to curb cash burn.

The most advanced candidate in FREQ’s pipeline is its remyelination program for treating MS, which is expected to enter clinical development next year. With the new entity’s focus on developing Korro Bio’s RNA editing programs, FREQ will no longer continue developing the remyelination program and is currently exploring strategic alternatives for the same.

Frequency Therapeutics, Inc. Price

Frequency Therapeutics, Inc. price | Frequency Therapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Frequency Therapeutics currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Alkermes ALKS, IDEAYA Biosciences IDYA and Ligand Pharmaceuticals LGND, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Alkermes’ 2023 earnings have increased from 20 cents to $1.02 in the past 60 days. The earnings estimates for 2024 have also increased from $1.73 to $2.08 in the past 60 days. Shares of ALKS have risen 16.5% in the year-to-date period.

Earnings of Alkermes beat estimates in three of the last four quarters and met the mark on the one occasion, the average surprise being 90.83%. In the last reported quarter, ALKS delivered an earnings surprise of 133.33%.

Estimates for IDEAYA Biosciences’ 2023 earnings have narrowed from $2.05 to $2.02 in the past 60 days. During the same period, the loss per share estimates for 2024 has improved from $2.66 to $2.64. So far this year, shares of IDYA have gained 24.8%.

Earnings of IDEAYA Biosciences beat estimates in each of the last four quarters, the average surprise being 30.59%. In the last reported quarter, IDYA delivered a positive earnings surprise of 3.59%.

In the past 60 days, the estimate for Ligand’s 2023 earnings per share has increased from $4.79 to $5.25. During the same period, the earnings per share estimate for 2024 has increased from $4.58 to $4.69. So far this year, shares of LGND have risen 1.6%.

Ligand beat earnings estimates in two of the last four quarters and missed the mark on the other two occasions. On average, the company’s earnings witnessed an earnings surprise of 21.50%.In the last reported quarter, LGND delivered an earnings surprise of 121.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

IDEAYA Biosciences, Inc. (IDYA) : Free Stock Analysis Report

Frequency Therapeutics, Inc. (FREQ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance