Franklin's (BEN) April AUM Declines 2.5% on Weaker Markets

Franklin Resources, Inc. BEN reported its preliminary assets under management (AUM) of $1.60 trillion as of Apr 30, 2024. This reflected a decrease of 2.5% from the prior month’s level.

The decline in AUM balance was primarily due to the impact of negative markets and long-term net outflows, including $5.9 billion related to the $25 billion AUM received from the Great-West Lifeco acquistion.

BEN recorded equity assets of $564.4 billion, which declined 4.8% from the previous month. Further, fixed income AUM of $559.6 billion at the end of April 2024 decreased 2.1% from the previous month. Multi-asset AUM and alternative assets were $162.6 billion and $255 billion, respectively, which decreased marginally from March 2024.

However, the cash management balance was $62.2 billion, up nearly 1% from the prior month’s level.

The month of April was a challenging period for Franklin, largely due to weaker markets and long-term net outflows. Nonetheless, increased cash management, along with BEN’s efforts to grow inorganically, supported its financials.

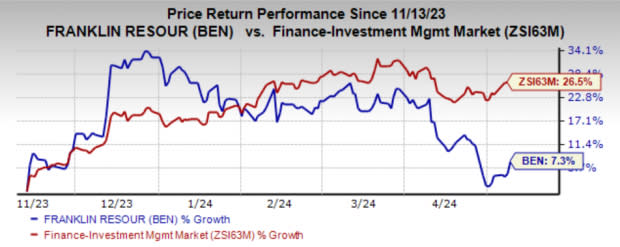

Over the past six months, shares of BEN have gained 7.3% compared with the industry’s 26.5% growth.

Image Source: Zacks Investment Research

Currently, BEN carries a Zacks Rank # 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

Virtus Investment Partners, Inc. VRTS recorded a sequential decline of nearly 5.2% in its preliminary AUM balance for April 2024. The company reported a month-end AUM of $170.06 billion, down from the Mar 31, 2024 level of $179.31 billion.

VRTS offered services to $2.6 billion of other fee-earning assets. This was excluded from the above-mentioned AUM balance.

Victory Capital Holdings, Inc. VCTR reported AUM of $163.6 billion for April 2024. This reflected a 4% decline from $170.3 billion as of Mar 31, 2024.

By asset class, VCTR’s U.S. Mid Cap Equity AUM declined 5.8% from the March level to $31.02. The U.S. Small Cap Equity AUM of $15.18 billion decreased 6.8%. The Global/Non-U.S. Equity AUM declined 2.2% to $17.8 billion. The U.S. Large Cap Equity AUM dropped 5.5% to $13.13 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

Virtus Investment Partners, Inc. (VRTS) : Free Stock Analysis Report

Victory Capital Holdings, Inc. (VCTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance