Frankie & Benny's owner to take knife to dividend

Brutal restaurant trading conditions could lead to a cut in shareholder payouts at the owner of Frankie & Benny’s as it braces for another steep fall in profits.

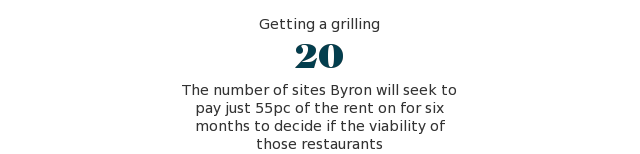

It has been a torrid few months for the restaurant chains after a flurry of profit warnings, while rescue bids have been launched at burger chain Byron and Jamie Oliver’s Italian.

Analysts are predicting Restaurant Group, which owns Frankie & Benny’s and Mexican eatery Chiquito, is likely to add to the bad news with end of year trading figures this week.

Expectations are that it will cut its dividend to 15.2p a share for 2017, down from 17.4p the prior year, as analysts predict a 30pc drop in profits to £54m. One analyst said “whichever way you cut it they are in real trouble”.

Restaurant Group has suffered two years of falling like-for-like sales and has continued to discount its food heavily in a bid to attract customers. “With the pressures on the sector one might ask should they be paying a dividend,” the analyst said. “You have got to think it should be trimmed as a minimum.”

Russ Mould, from investment company AJ Bell, said the amount of money the company had to cover its dividend was “lower than you would like”.

“If they hold the dividend flat that would be a positive surprise,” he said. Mr Mould noted the pressures in the sector from rising wages and food price inflation but said one positive aspect about Restaurant Group was its low levels of debt.

The downbeat predictions about the company come as data this week from industry monitor Coffer Peach revealed like-for-like sales at restaurants over the six-week Christmas period were down 1pc compared with a small rise of 0.6pc at pubs.

Drink sales were also more healthy, the data showed, suggesting those pub businesses skewed towards drink, such as Fuller, Smith & Turner, Revolution Bars and JD Wetherspoon, are likely to produce more upbeat trading statements next week than rivals that concentrate on serving food, such as Greene King and Mitchells and Butlers.

Restaurant Group declined to comment on Friday night.

Yahoo Finance

Yahoo Finance