Fortuna Silver (FSM) Q4 Earnings Miss, Revenues Rise Y/Y

Fortuna Silver Mines Inc. FSM reported fourth-quarter 2023 adjusted earnings per share of 7 cents, which missed the Zacks Consensus Estimate of 8 cents. The bottom line marked a solid 250% improvement year over year. Results were aided by higher gold sales volume and improved gold prices.

Including the impact of impairment charges and other non-recurring items, Fortuna Silver reported a loss of 30 cents per share in the fourth quarter. The company had reported a loss of 52 cents per share in the fourth quarter of 2022.

Fortuna Silver’s revenues surged 61% year over year to $265 million in the quarter under review on higher gold sales volumes and prices.

The improvement in gold sales volume was mainly attributed to the contribution of Séguéla in its second full quarter of production and increased sales at Yaramoko from higher processed head grade. This was partially offset by lower sales at San Jose. Realized gold price was $1,990 per ounce in the fourth quarter of 2023 compared with $1,737 per ounce in the year-ago quarter.

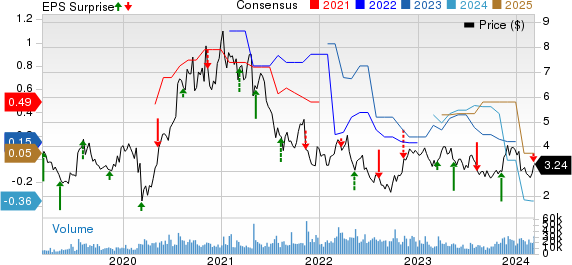

Fortuna Silver Mines Inc. Price, Consensus and EPS Surprise

Fortuna Silver Mines Inc. price-consensus-eps-surprise-chart | Fortuna Silver Mines Inc. Quote

All-In Sustaining Cost (AISC) per gold equivalent ounce was $1,509 in the fourth quarter of 2023 compared with $1,579 recorded in the year-ago quarter. AISC per ounce of gold sold was $1,557 for the Lindero mine and $1,720 for the Yaramoko mine. AISC per gold ounce sold was $737 for the Séguéla mine. 2023 AISC per silver equivalent ounce of payable silver sold was $21.98 and $22.34 for the San Jose mine and Caylloma mine, respectively.

FSM reported a mine-operating profit of $51.8 million in the quarter under review, reflecting year-over-year growth of 99%. The company reported an operating loss of $77.4 million compared with a loss of $173.1 million in the year-ago quarter.

The loss included the impact of an impairment charge of $90.6 million related to the anticipated closure of the San Jose Mine in late 2024. It also included a write-down of materials inventory of $10.1 million at the San Jose, Yaramoko and Lindero Mines, and a write-down of low-grade ore stockpiles of $5.4 million at the Lindero Mine. FSM also recorded a $6.4 million severance provision associated with the scheduled closure of the San Jose Mine and a write-down of $5.9 million related to greenfield exploration projects in Mexico and Argentina

Adjusted EBITDA rose 116% year over year to $120 million in the fourth quarter of 2023. The adjusted EBITDA margin was 45.3% compared with 33.9% in the -year-ago quarter.

Financial Position

Fortuna Silver ended 2023 with around $128 million of cash and cash equivalents compared with $81 million held at the end of 2022. Net liquidity as of Dec 31, 2023, was $213 million. Net cash flow from operating activities was $297 million in 2023 compared with $194 million in 2022.

Production Details

In the quarter under review, Fortuna Silver’s gold equivalent production improved 6% year over year to a record 136,154 ounces. Gold equivalent production was 452,389 ounces in 2023, up 13% year over year.

The company produced 107,376 ounces of gold in the fourth quarter and 326,638 ounces in 2023, both at record levels for the respective period. Silver production was reported at 1,354,003 ounces for the fourth quarter and 5,883,691 ounces for 2023.

2023 Results

Fortuna Silver reported adjusted earnings per share of 22 cents, which missed the Zacks Consensus Estimate of 23 cents. Earnings improved 57% year over year.

Including one-time items, Fortuna Silver reported a loss of 17 cents per share in 2023 (including the impact of impairment charges and other non-recurring items) compared with a loss of 44 cents per share in 2022.

Fortuna Silver’s revenues grew 24% year over year to $842 million in 2023.

Price Performance

Shares of Fortuna Silver have gained 2.8% in a year against the industry’s 2.9% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Fortuna Silver currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Ecolab Inc. ECL and Alpha Metallurgical Resources, Inc. AMR. Each of these companies currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $3.96 per share. The consensus estimate for 2024 earnings has moved 11% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 27% in a year.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.39 per share, indicating an increase of 22.7% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.7%. ECL shares have gained 38.8% in a year.

Alpha Metallurgical Resources has an average trailing four-quarter earnings surprise of 9.6%. The Zacks Consensus Estimate for AMR’s 2024 earnings is pegged at $43.05 per share. Earnings estimates have moved 48% north in the past 60 days. AMR shares have rallied 106% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Fortuna Silver Mines Inc. (FSM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance