Fortive (FTV) Q1 Earnings Beat Estimates, Revenues Rise Y/Y

Fortive Corporation FTV reported first-quarter 2024 adjusted earnings per share (EPS) of 83 cents, which topped the Zacks Consensus Estimate by 5.1%. The bottom line increased 11% year over year.

Revenues rose 4% year over year to $1.52 billion. However, it missed the Zacks Consensus Estimate by 0.1%. Core revenues also moved up 3% year over year, gaining from acceleration in the Intelligent Operating Solutions and Healthcare segments.

The year-over-year improvement in the top line was driven by continued momentum in the Fortive Business System.

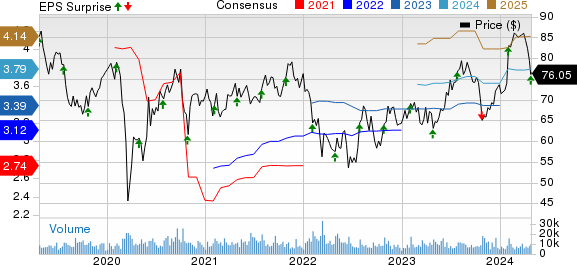

Fortive Corporation Price, Consensus and EPS Surprise

Fortive Corporation price-consensus-eps-surprise-chart | Fortive Corporation Quote

On Mar 14, 2024, the company completed a transaction to sell land and certain office buildings in its Precision Technologies segment for $90 million. The company received $20 million in cash proceeds and a $70 million promissory note secured by a letter of credit, with principal due in August and November 2024.

The company also provided guidance for 2024. Management now projects adjusted net EPS between $3.77 and $3.86 compared with the previous guidance of $3.73 and $3.85. The Zacks Consensus Estimate is pegged at $3.78.

Revenues are now anticipated to be between $6.350 billion and $6.425 billion compared with the previous guidance of $6.425 billion and $6.525 billion, indicating 4.5-6% growth from the year-ago levels. The Zacks Consensus Estimate is pegged at $6.49 billion.

Core revenue growth is anticipated to be between 2% and 4%. Free cash flow is forecasted to be $1.385 billion.

Adjusted operating profit is envisioned in the range of $1.720-$1.770 billion, suggesting 9-13% growth from the prior-year levels.

For second-quarter 2024, adjusted net EPS is estimated to be in the range of 90-93 cents. Revenues are envisioned in the $1.550-$1.575 billion band. The Zacks Consensus Estimate for second-quarter EPS and revenues is pegged at 94 cents and $1.63 billion, respectively.

Free cash flow is forecasted to be $270 million. Adjusted operating profit is expected to be in the range of $410-$420 million, indicating 3-6% growth from the year-earlier levels.

The stock was down 5.7% on Apr 24 and closed the session at $76.05. In the past year, shares of FTV have gained 21.1% of their value compared with the sub-industry’s growth of 18.1%.

Image Source: Zacks Investment Research

Top Line in Detail

Fortive operates under the following three organized segments.

Intelligent Operating Solutions: The segment generated revenues of $666 million (contributing 43.7% to total revenues), up 5% on a year-over-year basis.

Precision Technologies: Segmental revenues totaled $559 million (36.7%), up 3% year over year.

Advanced Healthcare Solutions: This segment registered revenues of $300 million (19.6%), up 4% year over year.

Operating Details

In the quarter under review, adjusted gross margin reached 59.5%, which expanded 110 basis points (bps) year over year.

Adjusted operating margin was 25.1%, extending 110 bps on a year-over-year basis.

Segment-wise, adjusted operating margins of Intelligent Operating Solutions and Precision Technologies were 31.9% and 24.4%, rising 160 bps and 80 bps, respectively, year over year.

Advanced Healthcare Solutions’ adjusted operating margin of 24.2% improved 200 bps.

Balance Sheet & Cash Flow

As of Mar 29, 2024, cash and cash equivalents were $704.6 million compared with $1,888.8 million as of Dec 31, 2023.

As of Mar 29, 2024, accounts receivables were $962.6 million compared with $960.8 million as of Dec 31, 2023.

FTV generated an operating cash flow of $256.7 million for the first quarter compared with $174.4 million in the year-ago quarter. Non-GAAP free cash flow was $230.3 million compared with $149.6 million in the prior-year quarter.

Zacks Rank and Other Key Picks

Currently, Fortive has a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the broader technology space are Badger Meter BMI, Pinterest PINS and Arista Networks ANET. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Badger Meter’s 2024 EPS has increased 9.9% in the past 60 days to $3.89. BMI’s long-term earnings growth rate is 12.3%.

Badger Meter’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, delivering an average surprise of 12.7%. BMI shares have risen 35.8% in the past year.

The Zacks Consensus Estimate for PINS’s 2024 EPS has increased 0.7% in the past 60 days to $1.34. PINS’s long-term earnings growth rate is 20.1%.

Pinterest’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, delivering an average earnings surprise of 37.4%. Shares of PINS have gained 13% in the past year.

The Zacks Consensus Estimate for ANET’s 2024 EPS has increased 0.4% in the past 60 days to $7.49. ANET’s long-term earnings growth rate is 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, delivering an average earnings surprise of 13.3%. Shares of ANET have gained 62.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Fortive Corporation (FTV) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance