Forex: US Dollar Consolidates After GDP, Fed - NFPs Tomorrow

ASIA/EUROPE FOREX NEWS WRAP

The majors have consolidated overnight as global investors continue to weigh three very significant US-driven event risks between yesterday and tomorrow: the 4Q’12 GDP reading; the FOMC’s cryptic policy statement; and the January Nonfarm Payrolls release. Accordingly, with equity markets in Europe sliding and US futures pointing lower, the Japanese Yen and the US Dollar have emerged as two top performers.

The GDP figure yesterday was not nearly as bad as the headline of -0.1% (annualized) appeared. Defense spending, the most bloated government subsidized industry in the US, dropped by -22% in the 4Q’12, while the aggregate combination of the trade deficit and weak inventory figures (as a result of Hurricane Sandy) weighed on the headline figure by -2.7%. In other words, consumption and investments – together accounting for approximately 80% of the headline figure, were significantly stronger at +2.6%. The underlying components were promising as well: incomes have risen as inflation has remained tame (thus implying increased purchasing power for US consumers); and the savings rate increased to +4.7% from +3.6%. With the payroll tax hike at the start of the year, consumption figures could be weaker – but the economy is indeed picking back up.

With respect to the Fed and NFPs, they’re nearly one in the same – after all, the Fed has said it will stimulate the economy until the Unemployment Rate falls to 6.5%, on a sustainable basis (accompanied by increased participation rates). But with the labor market improving – the six month average of jobs gain is +159.67K, the highest rate since May, at +175.83K – and the US consumer strengthening, there has been little reason for the Fed to alter its path. In fact, it deemed the slowdown in growth the past few months as “transitory” – they too are anticipating a stronger economy. A strong NFP figure tomorrow could stoke further gains in the US Dollar as Treasury yields rise; a weak figure at this point isn’t priced it.

Taking a look at European credit, peripheral yields have increased slightly, perhaps hurting the Euro today. The Italian 2-year note yield has decreased to 1.627% (-2.0-bps) while the Spanish 2-year note yield has increased to 2.565% (+5.8-bps). Similarly, the Italian 10-year note yield has increased to 4.324% (+1.7-bps) while the Spanish 10-year note yield has increased to 5.227% (+3.3-bps); higher yields imply yields prices.

RELATIVE PERFORMANCE (versus USD): 11:50 GMT

NZD: +0.17%

JPY: +0.05%

AUD: -0.02%

CHF:-0.09%

GBP:-0.11%

CAD:-0.12%

EUR:-0.14%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.06% (-0.09% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

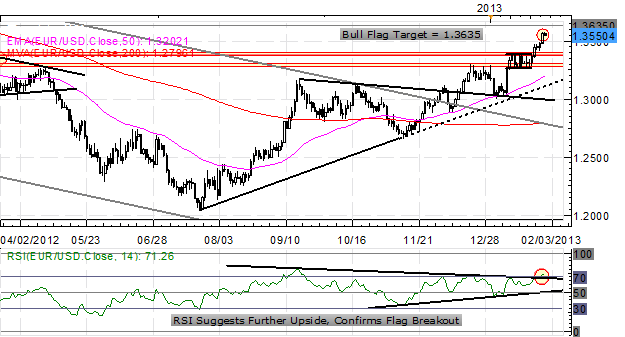

EURUSD: No change: “The Bull Flag breakout has begun after cracking 1.3485, “with a final measured move pointing towards 1.3635.” Support comes in at 1.3470/3500, 1.3380/85 (mid-March swing high, Bull Flag resistance), and 1.3280/3310. Resistance is 1.3545/50 (price is here now), and 1.3635.”

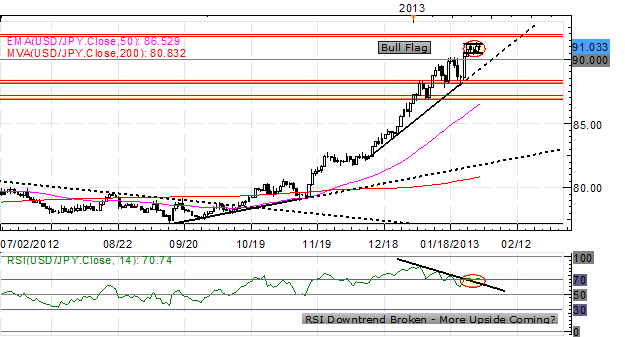

USDJPY: No change: “The USDJPY rally is back on the up and up, with price breaking above 91.00 (perhaps a Bull Flag on the hourly chart had developed, hindsight being 20/20). I maintain: “The focus remains on buying dips, and generally speaking, selling Yen strength (EURJPY, USDJPY preferred for gains; CADJPY, GBPJPY preferred for loses).” Resistance comes in at 92.00/05 (weekly R1), 93.15/20 (weekly R2), and 93.45/50 (monthly R3). Support comes in at 91.00 and 90.00/10 (weekly pivot, monthly R2).”

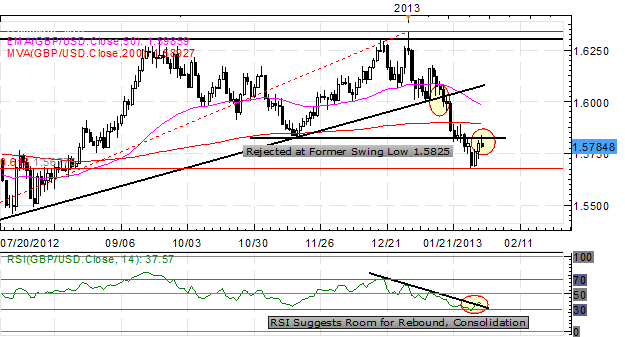

GBPUSD: No change: “The pair has rallied off of the 61.8% Fibonacci retracement from the June low to January high, but I maintain: as long as the daily RSI downtrend holds, it is possible for a move lower.” This may break today, signaling an end to the bearish bias for the near-term, and wouldn’t rule out a rally back towards the 50-EMA and significant psychological resistance at 1.5990/6000. Support is 1.5700 and 1.5675/80.”

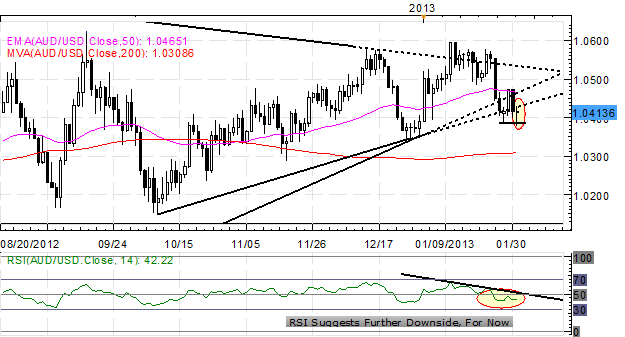

AUDUSD:No change: “The pair continues to range although it has showed signs of cracking, with both the ascending trendline off of the June low and the October low having been breached, as well as the ascending TL off of the June low and the December low. Accordingly, a weekly close below 1.0460 could signal a deeper retracement towards 1.0350/400, before a greater breakdown towards parity. Support comes in at 1.03800/400 (weekly low), 1.0340/50 (December low), and 1.0140/50 (October low). Resistance is 1.0460/70 (ascending TL off of the June and December lows, 50-EMA) and 1.0500/15.” Note: the Morning Star candlestick cluster isn’t seeing any follow through today, as the daily RSI downtrend has persisted.

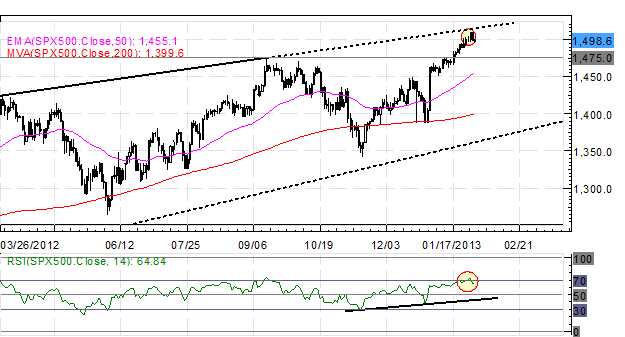

S&P 500: Tuesday I said: “as indicated on the charts the past weeks, noting “nearing the top 1505/1512” – the top was 1504.6. If this breaks, 1520 is in sight.” Indeed, the irrational exuberance has continued, bringing topline Bearish Rising Wedge resistance in focus at 1512/15; the December 2007 highs of 1520/24 could be reached on an overshoot. Bottom line: I’m expecting a crash in the S&P 500 unless volumes accelerate rapidly, given the disconnect from reality.

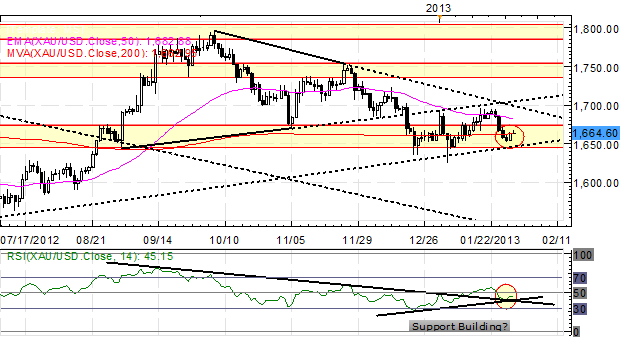

GOLD: The past few weeks I’ve maintained: "When considering the move off of the September highs, a measured A-B=C-D (as expressed on the Daily) suggests that a bottom could be in place at [1630/40].” The rebound has ensued, with the alternative safe haven rallying up to 1690 today. A daily close above 1700 points towards 1722/25 and 1755. Support is 1663 (200-EMA) and 1640/45.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance