Forex Trading: NZD/JPY Year End Plunge is Possible

Rather than present several compelling setups across non-USD crosses, I am presenting the MOST compelling idea into year end. A NZDJPY short idea was touched on this morning. After noticing that daily RSI had registered 85 yesterday, I scanned NZDJPY history for similar readings and found none! The AUDJPY registered an 85 reading in early December 2006. The similarities between the AUDJPY in December 2006 and the NZDJPY now are striking. Both advances channel perfectly. Even the swings within the channel are nearly identical.

EidoSearch is a powerful recognition tool that ‘objectifies’ what I am seeing. An idea based on heuristics but backed by science is an idea worth implementing.

New Zealand Dollar / Japanese Yen

Daily Bars

Prepared by Jamie Saettele, CMT

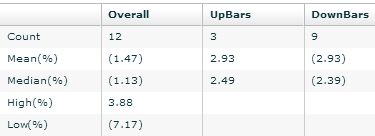

EidoSearch – 10 Day Backtest

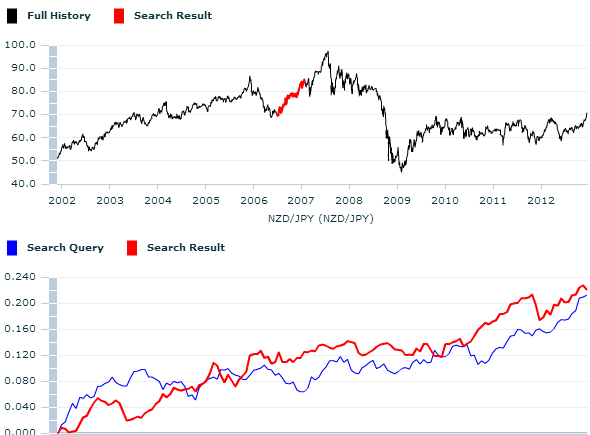

A search for patterns that match the series of closes from 05/31/12 to 12/16/12 returns 12 matches with a score of 75 or better. 10 days later, the NZDJPY had declined 9 times by an average of (2.93%) and declined advanced 3 times by an average of 2.93%. The largest decline after 10 days was (7.17%) and the largest advance after 10 days was 3.88%.

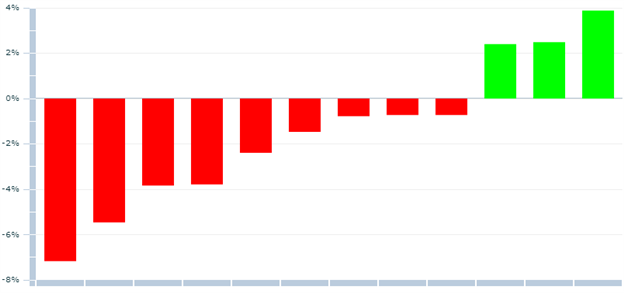

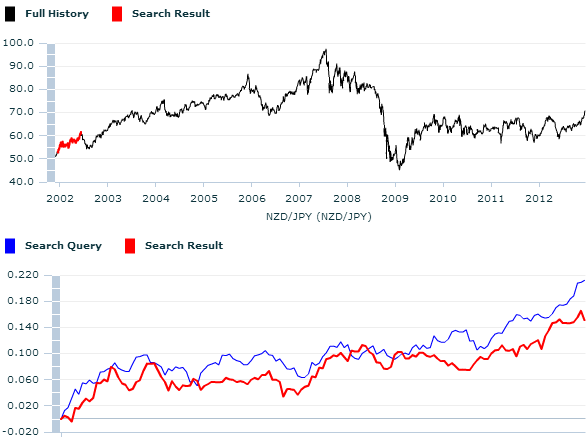

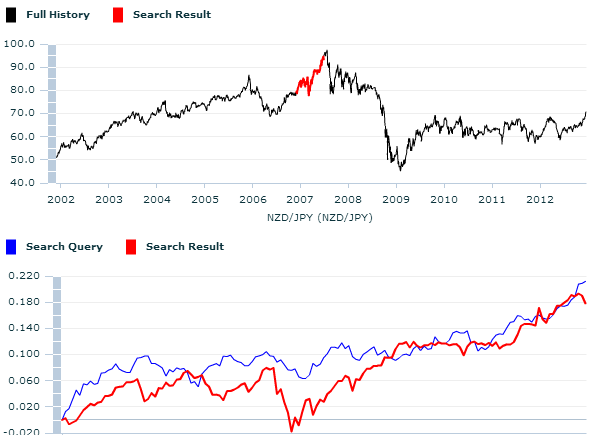

The 3 time series that closest match our search query are 12/16/01 to 6/12/02, 11/30/06 to 06/26/07, and 07/02/06-1/23/07. Each time series’ position in history is highlighted in red on the historical chart along with a comparison to the current time series.

12/16/01 to 6/12/02

11/30/06 to 06/26/07

07/02/06-1/23/07

Summary and How I am Trading It

The essence of true technical analysis is its objectivity. This bearish NZDJPY call is not based on a subjective interpretation of news or outside events. Rather, a pattern in price and time has been identified that typically leads to a sharp downturn.

The weight of evidence is bearish NZDJPY at the current level for probably at least the next few weeks. That doesn’t mean that the envisioned scenario has to play out. Trading is a probabilistic endeavor, not a certain one. The gap higher on Sunday and negative Monday close is enough for me to be short now with a stop above Sunday night’s high. A more conservative trader might wait for a drop beneath the latest pivot low at 7013. The tradeoff is reward/risk versus accuracy. Trading through the Sunday night high wouldn’t negate the bearish evidence but a new setup would be required in order to re-enter the short side. If the NZDJPY begins to decline, then interim supports are 6960/80, 6860/90, and 6800. Ultimately, the objective is much lower given the outcomes of similar patterns. A soft target is 6500.

--- Written by Jamie Saettele, CMT, Senior Technical Strategist for DailyFX.com

To contact Jamie e-mail jsaettele@dailyfx.com. Follow me on Twitter for real time updates @JamieSaettele

Subscribe to Jamie Saettele's distribution list in order to receive actionable FX trading strategy delivered to your inbox.

Jamie is the author of Sentiment in the Forex Market.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance