Forex Strategy: US Dollar Offers Trend Trading Opportunities

Article Summary: A pronounced US Dollar rally did not produce a material shift in forex volatility expectations, and our overall trading biases continue to favor lower-volatility range trading and trend trading strategies across major FX pairs.

DailyFX PLUS System Trading Signals –Sharp US Dollar (ticker: USDOLLAR) rallies have failed to produce similar shifts in FX volatility, and the US Dollar may be short-lived without a stronger shift in sentiment.

Last week we wrote that our US Dollar forecast remained cautiously bearish as extremely low forex market volatility made the safe-haven currency unattractive. A surprising late-week sell-off in the US S&P 500 nonetheless sparked an important USD turnaround and left it near critical price resistance. In fact our technical strategy team forecasts that the Euro should be sold against the US Dollar on any signs of strength.

Yet we will need to see a larger bounce in forex volatility expectations to have full faith in this Greenback reversal. Indeed, it seems as though the USD downtrend remains very much intact against high-yielders such as the Australian and New Zealand Dollars.

The mixture of low volatility and surprising US Dollar strength makes setting our trading strategy bias difficult. That said, trend-based trading systems such as “Tidal Shift”/Momentum2 on our forex trading signals have done well in key US Dollar and Japanese Yen pairs. In others, low volatility leaves range trading as our preferred trading technique.

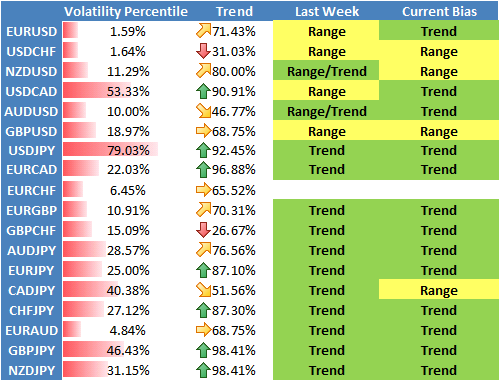

DailyFX Individual Currency Pair Conditions and Trading Strategy Bias

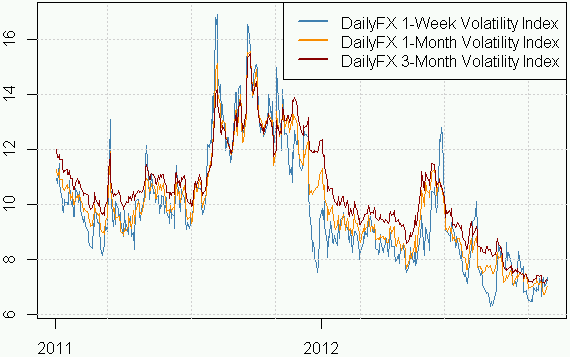

Market Conditions:Sharp early-month moves in the Euro/US Dollar and other USD pairs did not coincide with a similarly pronounced shift in volatility expectations. In fact, our FX Options-based DailyFX Volatility Indices remain near their lowest levels since the onset of the financial crisis in 2007.

DailyFX Volatility Indices from 2011-2012

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up to David’s e-mail distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

Meet the DailyFX team in Las Vegas at the annual FXCM Traders Expo, November 2-4, 2012 at the Rio All Suite Hotel & Casino. For additional information regarding the schedule, workshops and accommodations, visit the FXCM Trading Expo website.

Definitions

Volatility Percentile – The higher the number, the more likely we are to see strong movements in price. This number tells us where current implied volatility levels stand in relation to the past 90 days of trading. We have found that implied volatilities tend to remain very high or very low for extended periods of time. As such, it is helpful to know where the current implied volatility level stands in relation to its medium-term range.

Trend – This indicator measures trend intensity by telling us where price stands in relation to its 90 trading-day range. A very low number tells us that price is currently at or near 90-day lows, while a higher number tells us that we are near the highs. A value at or near 50 percent tells us that we are at the middle of the currency pair’s 90-day range.

Range High – 90-day closing high.

Range Low – 90-day closing low.

Last – Current market price.

Bias – Based on the above criteria, we assign the more likely profitable strategy for any given currency pair. A highly volatile currency pair (Volatility Percentile very high) suggests that we should look to use Breakout strategies. More moderate volatility levels and strong Trend values make Momentum trades more attractive, while the lowest Vol Percentile and Trend indicator figures make Range Trading the more attractive strategy.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES IS MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION.

OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS. Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice. The FXCM group will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance contained in the trading signals, or in any accompanying chart analyses.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance