Forex Strategy: EUR/USD and Yen Crosses Mislead Measure of Risk Trends

What are our favorite measures of standard risk appetite trends? The S&P 500 is perhaps the most recognizable as both the target of regular investors’ capital and distinct benefactor of the Federal Reserve’s generous stimulus effort. It so happens that Index is at five year highs. Then there is EURUSD as a benchmark currency pairing of one of the most fundamentally troubled (euro) and highly regarded safe haven (dollar) currencies. That measure is at a 15 month high after having overtaken 1.3500 and then 1.3600 in short order. And, then there is the general carry trade basket for the currency market. On that front, we have we have the yen crosses scaling multi-year highs across the board.

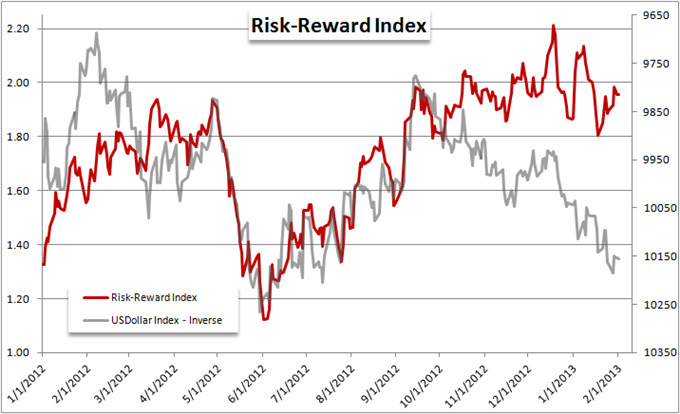

For all intents and purposes, it seems like our standard bearers for risk are soaring. Investor confidence would thereby reflect unabashed optimism and an appetite for higher return wherever it can be found. However, conviction really isn’t that impressive. Instead, our trusty measures are ‘broken’. For the equities market, EURUSD and USDJPY; we are seeing not the outright influence of risk appetite but rather the side effects of changing stimulus regimes. The Fed is engaged in an $85 billion-per-month stimulus effort, which keeps the buffer for global investors from encroaching risks. The euro is advancing as the ECB actually shrinks its balance sheet and lifts market rates. And, the yen is depreciating rapidly (mistaken as a carry trade build up) due to threats of massive, $145 billion-per-month injects that are set to start in 2014.

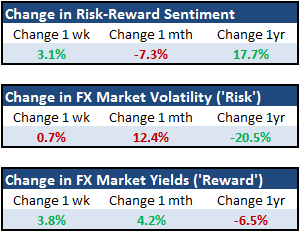

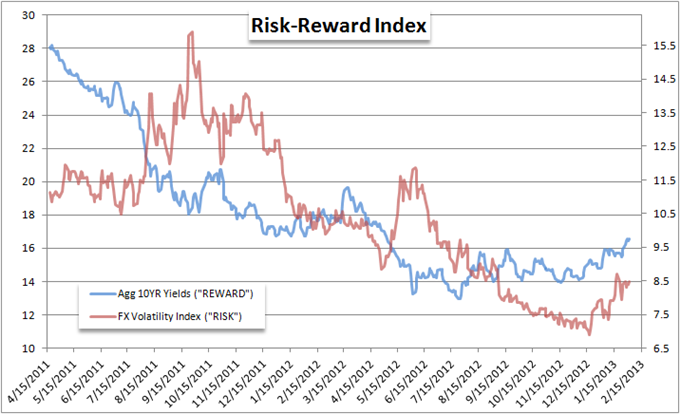

All of these factors are distracting from the underlying elements of risk and reward – the level of return to be made in the market against the degree of risk we take in pursuit of that yield. We have certainly seen a positive development in the elements of risk trends with volatility measures dropping quickly and medium to long-term yields starting to firm. However, the balance for investment to draw the fabled ‘sidelined money’ is far from encouraging. And, in recent weeks, we have seen serious cracks start to form in the foundation of our risk run…

Read the Introduction to Risk Trends and the Risk-Reward Indicator Here.

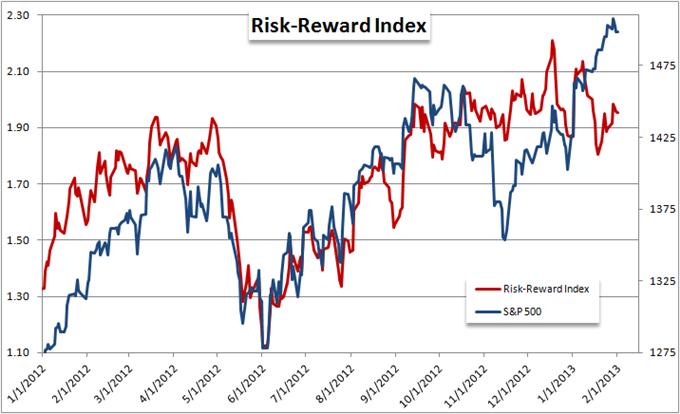

Most immediate in our measure of investor sentiment, we can take note of the deteriorating trend of the Risk-Reward Index above. Since the peak in mid-December, conditions have steadily declined despite all of the above mentioned improvements in market benchmarks. Most notable was the short-lived swell that followed the Fiscal Cliff resolution – one of the last, great financial threats on the immediate horizon.

The disconnect has long existed and the imbalance grew with time as the ‘improvement’ in market conditions has been one-sided. Instead of finding a healthy combination of both greater levels of return and more stable markets, we have only seen the latter. With incredible rounds of stimulus, the central banks and governments of the world absorbed risk from the system. The effort would also inject cheap funds for further investment, yet that reinvestment never took traction. Evolving from banks hoarding capital, we are now also starting to see revenue growth shrink (and dividends along with it).

In the meantime, there isn’t much further for ‘risk’ to fall. Having bottomed out at five year lows recently, we have recently started to see the FX Volatility Index (FX VIX) pick up for the past month. Just this past week, we have seen the more closely watched CBOE VIX (equities-based) climb as well. Central banks have pulled out the unlimited programs and at the extreme of their capabilities. So, what happens if another financial shock hits? And, would they attempt to escalate their efforts if there were just a correction in the markets that didn’t threaten a systemic risk to global growth or financing?

Risk–Reward Index vs Market Standards

Looking at the charts below, we can see the clear different in performance between the S&P 500 and the Risk-Reward Index. Such deviation is far more dramatic when we compare performance back to the beginning of 2009 when stimulus really began; but there was considerable momentum behind what that intervention could accomplish. Pushing prices on market benchmarks to multi-year highs with extremely low participation (both in liquidity and volume) speaks to a stretched market.

Now, we look to the rising Volatility Indexes and to the measures of risk appetite that are at the very extremes of the investable frontier. Far more sensitive to changing tides in sentiment, we have seen both of the major junk bond funds SPDR High Yield Bond ETF and iShares High Yield Corporate Bond Fund take sharp spills over just the past few days. Junk bonds are exceptionally risky assets with higher levels of return, and the market’s have flooded in trying to reap competitive yield in a market that is starving for it. An unwinding here first is a first blush sign.

If this early risk aversion effort is to catch traction, a commitment is needed. A serious catalyst could spark the move – but there are fewer splashy, big-ticket items out there like a Greece exit from the Eurozone or impending fiscal crisis in the United States. However, when the market commits, it is the building momentum behind fear that matters most – not the initial spark.

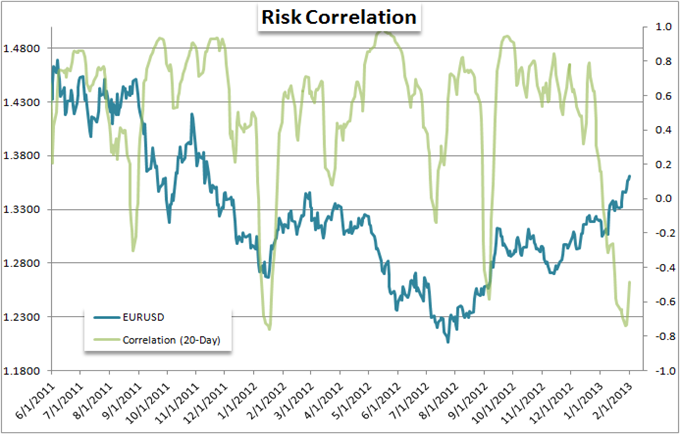

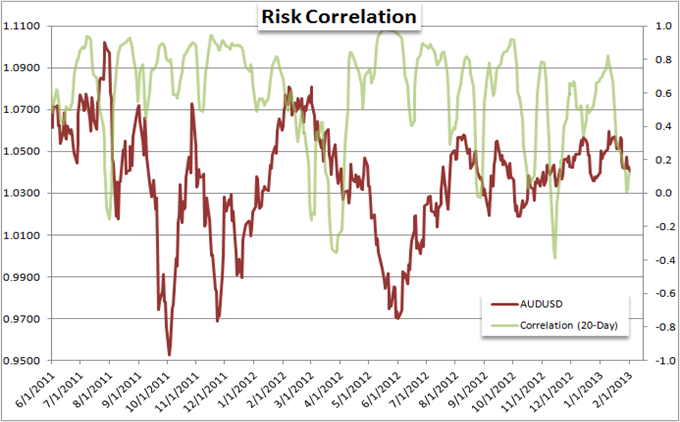

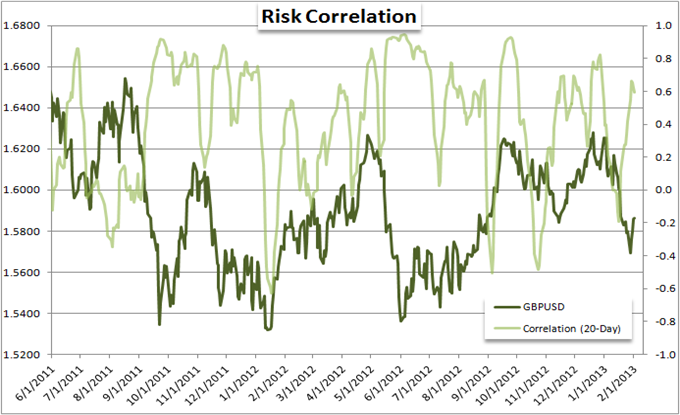

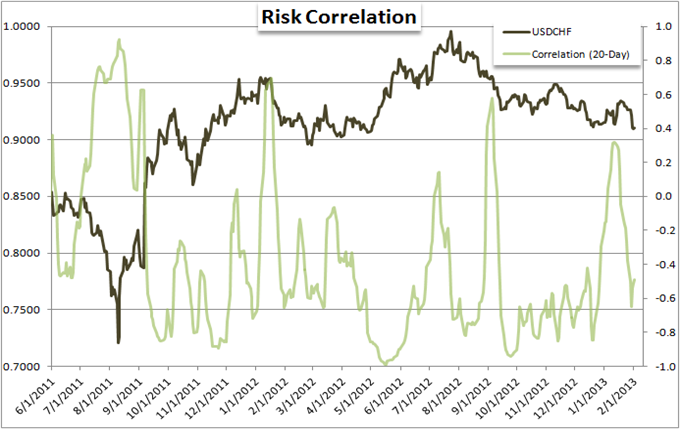

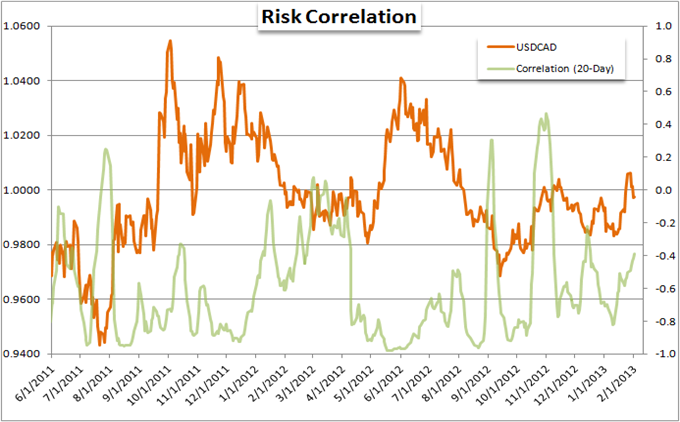

Majors Correlation to Risk Trends (How Influential is Risk Appetite)

Below, are charts that show the price action for the majors against the correlation that the pair runs against the Risk-Reward Index. The closer to 1.0 the correlation, the pair will move in lock step with risk appetite (optimism rises and so does the currency pair). On the other hand, the closer a reading is to -1.0 means the closer the pair moves in exactly the opposite direction but at the same pace as risk trends.

This is valuable information for fundamental traders. If you recognize a currency pair is highly correlated (positively: close to 1.0, or negatively: close to -1.0), we know that we should be watching factors that change sentiment to offer us guidance on that particular pair. Alternatively, the closer to 0.0 the reading, we know that there is less influence from risk trends and we can trade independent of that bigger theme.

--- Written by: John Kicklighter, Chief Strategist for DailyFX.com

To contact John, email jkicklighter@dailyfx.com. Follow me on twitter at http://www.twitter.com/JohnKicklighter

Sign up for John’s email distribution list, here.

Additional Content:Money Management Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance