Forex Strategy: Is the EUR/USD and Yen Cross Rally a Risk Trend Move?

Looking across the markets today, the EURUSD rallied to close at its highest level in nine months, the yen crosses have revived their incredible climb higher and the S&P 500 has ended Thursday at a level last seen almost exactly five years ago. What fundamental element can unite these diverse assets and markets? Investor sentiment. If the appetite for higher return decisively overwhelms the risk of volatility and adverse market movement, market participants will abandon their safe havens (dollar, yen, Treasuries) and seek out high return assets (Euro, carry currencies, equities) regardless of what market they happen to be in. A strong correlation between these otherwise very different markets can be one of the best measures of underlying sentiment that can be assessed. Yet fear and greed often come in fits and starts. Is this week’s swell a sign of a lasting trend in confidence or a brief tryst facilitated by bombastic headlines?

From the headlines this past week, the yen crosses (a serious measure of FX risk trends via carry trade interests) were back on pace and soaring to multi-year highs after the Japanese government announced its endorsement of 10.3 trillion yen in fresh stimulus. Asian currencies and capital markets were throttled higher after China announced a surprising surge in its December trade report. European markets were bolstered by a strong government debt auctions by bailout countries and the ECB’s relative upgrade in tone for growth forecasts. And, in the US, the dubious Fiscal Cliff resolution offered up a comfortable buffer until the debt ceiling must be faced.

Looking back over these developments, there is certainly enough sway to support regional rallies. However, as fuel for a lasting change in sentiment that projects strong trends of growth, higher rates and greater participation in the capital markets (the open interest in benchmark S&P 500 futures is still at 15 year lows); these developments don’t speak to a structural change. The risk climb can continue, but it will remain exceptionally fragile and particularly prone to scheduled event risk heading forward (4Q US earnings, Chinese 4Q GDP, focus on the Eurozone crisis, etc). If these headlines don’t maintain their support for optimism, the markets may experience whiplash on the reversal.

Read the Introduction to Risk Trends and the Risk-Reward Indicator Here.

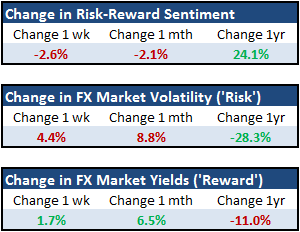

Looking at the Risk-Reward Index since the start of the new trading year, there has certainly been a substantive rally. The source of the move is as unmistakable as the market response itself. The temporary (and technically late) solution offered up for the United States’ burdensome ‘Fiscal Cliff’ translated into an aggressive drop in volatility (moreso for the equity market’s VIX than the FX VIX) and government bond yields surged as investors felt they could move out of the security of the painfully low-returns of the bulwarks.

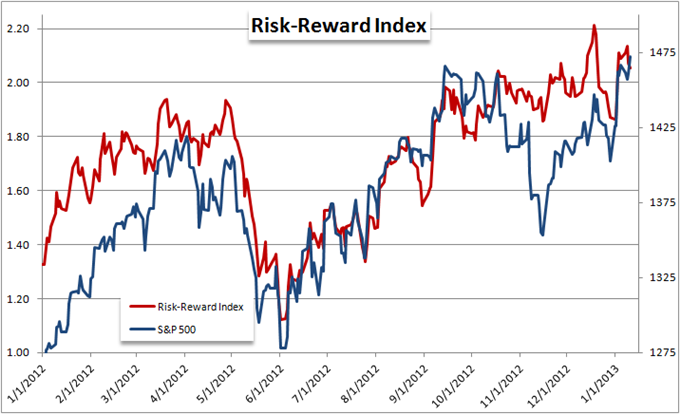

A rally after such an imminent crisis was averted was to be expected. Yet, the next stage requires far greater commitment than a mere ‘relief rally’. Investors now must commit to stronger growth and rising returns through the foreseeable future – so that market benchmarks like the S&P 500 already at a five-year high can extend their rallies. That is a significant jump in expectations and not one that is well founded in what the backdrop reflects. In fact, looking at the two primary components of the Risk-Reward index (below), we find that rates of return are still extremely low on a historical basis – even if they have picked up to the top of a four-month range. Furthermore, a climb in speculative positioning that typically follows the withdrawal of safe haven exposure (represented by a drop in the Volatility Index) is already fully exhausted with assumptions of risk at half decade lows.

As we move forward, the underdeveloped climb in speculative markets will require either a seismic shift in fundamentals to support long-term investment appeal or a steady stream of positive outcomes from major event risk. Given the issues that are still so prevalent in the global markets, we will almost certainly rely on the latter scenarios. And that is a precarious situation indeed. Of particular interest over the next week are the Chinese 4Q GDP reading to signal the beginning of growth season, the IMF’s review of Greece’s progress and the increased flow of 4Q US Corporate earnings reports.

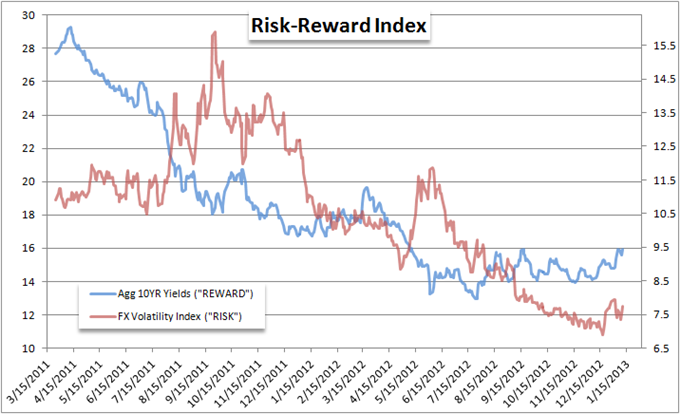

Risk–Reward Index vs Market Standards

Technical levels are made to be breached – even if the market does eventually reverse course soon after seemingly negating the otherwise sound ‘line in the sand’. That is what we have to remember with the S&P 500. The benchmark equity index Thursday climbed to secure its highest close in almost exactly five-years – progress that many may associate to a removal of underlying fundamentals and market conditions. It is worth comparing the equity index’s bearing to that of the Risk-Reward Index. The stock benchmark marked a significant deviation back in October and November, tipping into a bear phase that was not confirmed by the sentiment measure. The gap has closed, but the S&P 500 continues to make bullish progress where the Risk-Reward Index has actually retreated somewhat.

From the FX market, we see that the preferred reserve US Dollar has diverged from its pure safe haven track. In the graph below, the dollar (inverted, so that it matches standard risk appetite trends) has extended its three-month departure from the Risk-Reward Index’s recovery. This could prove a similar situation as to what we experienced with the S&P 500 over the final quarter of 2012 – where the dollar will reconcile to basic sentiment trends. However, the question is whether the Index will hold steady and draw the dollar lower to meet some level of fundamental ‘balance’; or risk appetite trends shift materially in the coming weeks and months to either meet or accelerate currency.

These markets are certainly extended and investors are facing numerous uncertainties moving forward, but there is a chance that certain milestones along the way can provide periodic boosters to keep the semblance of a true bull trend in capital and financial markets.

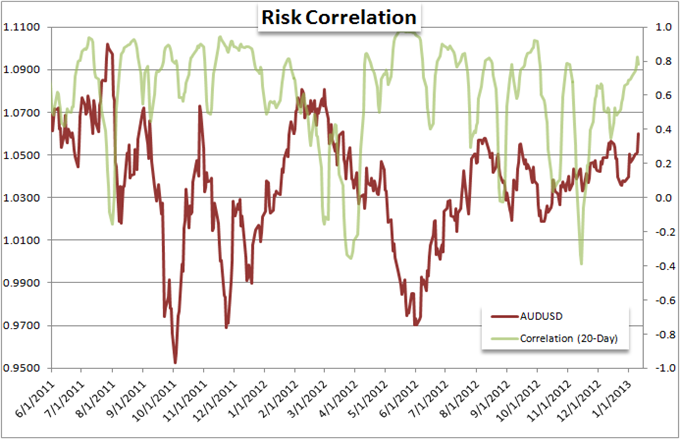

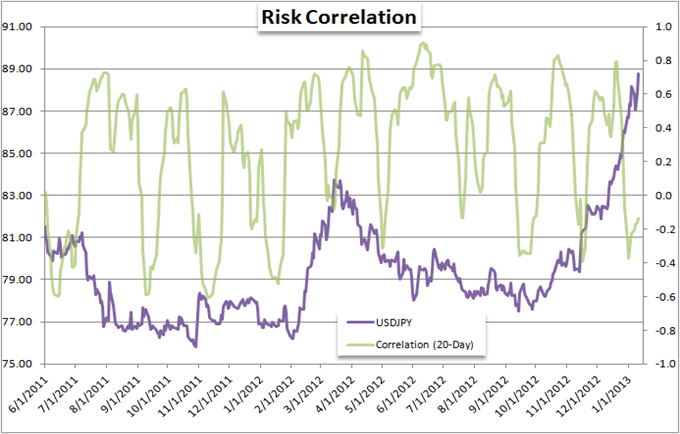

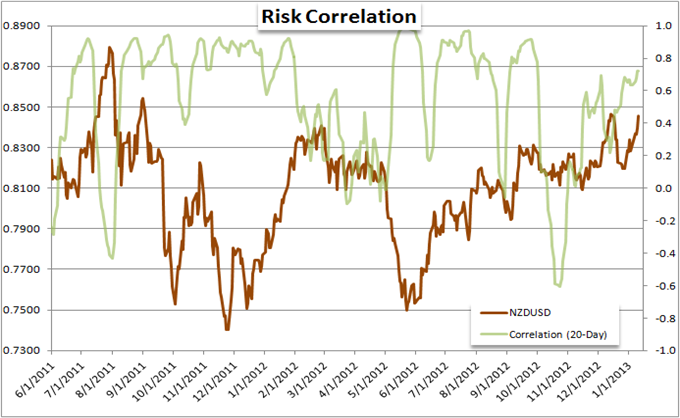

Majors Correlation to Risk Trends (How Influential is Risk Appetite)

Below, are charts that show the price action for the majors against the correlation that the pair runs against the Risk-Reward Index. The closer to 1.0 the correlation, the pair will move in lock step with risk appetite (optimism rises and so does the currency pair). On the other hand, the closer a reading is to -1.0 means the closer the pair moves in exactly the opposite direction but at the same pace as risk trends.

This is valuable information for fundamental traders. If you recognize a currency pair is highly correlated (positively: close to 1.0, or negatively: close to -1.0), we know that we should be watching factors that change sentiment to offer us guidance on that particular pair. Alternatively, the closer to 0.0 the reading, we know that there is less influence from risk trends and we can trade independent of that bigger theme.

--- Written by: John Kicklighter, Chief Strategist for DailyFX.com

To contact John, email jkicklighter@dailyfx.com. Follow me on twitter at http://www.twitter.com/JohnKicklighter

Sign up for John’s email distribution list, here.

Additional Content:Money Management Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance