Forex News: EUR/USD Dips after Advance Retail Sales, Initial Jobless Claims

THE TAKEAWAY: USD Advance Retail Sales (NOV) > +0.3% versus +0.5% expected, from -0.3% (m/m) > USD Producer Price Index (NOV) > +1.5% versus +1.8% expected, from +2.3% (y/y) > USD Producer Price Index ex Food & Energy (NOV) > +2.2% as expected, from +2.1% (y/y) > USD Initial Jobless Claims (DEC 8) > 343K versus 369K expected, from 372K (revised from 370K) > EURUSD NEUTRAL

The major US data dump at 08:30 EST / 13:30 GMT produced volatility but not much clarity, as some prints beat while others disappointed, while the Federal Reserve, the European Central Bank, and the Bank of Canada announced an extension of the currency swaps set to expire in February by another year. Of the data released, the most significant report was the November Advance Retail Sales figure, which disappointed.

Perhaps the best gauge of consumption for US consumers, Advance Retail Sales increased by +0.3% month-over-month in November, negating the -0.3% m/m seen in October. Nevertheless, the reading came in slightly below expectations, with consensus forecasts calling for a +0.5% m/m gain, according to Bloomberg News. Mainly, this can be attributed to the beginning of the holiday sales period: purchases of clothing and electronics surged, while automobile sales had a modest rebound. Bottom line: the US consumer is curbing back spending amid an uncertain tax horizon, which could hurt the 4Q’12 GDP figure.

Also released at 08:30 EST / 13:30 GMT was the Initial Jobless Claims report for the period of December 8, which beat expectations, coming in at 343K from 372K, well-below the consensus forecast of 369K. After claims surged by nearly 25% (from 361K to 451K) in the weeks after Hurricane Sandy, the labor market looks stronger, having recouped all of the losses and then some: Initial Jobless Claims have fallen by -5.0% since the first week of November. Considering that the Fed is now tethering its monetary policy to the labor market, today’s data bodes well for the December Nonfarm Payrolls report, due out in three weeks.

On a side note: the extension of the currency swap line does not appear to be significant. These swaps were established on November 30, 2011, and were set to expire in February 2013; now they will expire in February 2014. Typically, the announcement of new swaps portends to a weaker US Dollar; instead, the extension shouldn’t have a material impact on price action today.

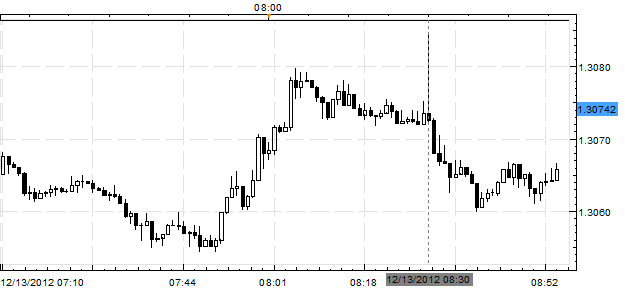

EUR/USD 1-minute Chart: December 13, 2012

Charts Created using Marketscope – Prepared by Christopher Vecchio

Following the data releases as well as the swaps announcement, the EURUSD dropped from 1.3074 to 1.3060, before basing and rebounding back towards its prerelease level within thirty minutes. Similar price action was observed across the board, with the AUDUSD, GBPUSD, and NZDUSD all falling briefly before rebounding back to unchanged to their prerelease levels.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance