Forex: More QE Does Little Damage to US Dollar, Yen Remains Weak

ASIA/EUROPE FOREX NEWS WRAP

High beta currencies and risk-correlated assets saw a solid uptick yesterday, as the Federal Reserve offered up its latest iteration of quantitative easing. The new program, dubbed as a QE3 expansion, will see a continuation of $40 billion per month in agency MBS purchases, as well as $45 billion per month in outright US Treasury purchases. Essentially, QE3+ is just a combination of the QE1 extension and QE2, based on the composition of asset buys.

What has thrown a wrench in the typical ‘if the Fed eases, the market squeezes’ trade has been the implementation of the “Evans Rule,” which is essentially the Fed’s own stop loss. Named after Chicago Fed President Charles Evans (an ultra dovish FOMC member), the Evans Rule stipulates that the stimuli will remain in place until the Unemployment Rate hits 6.5%, unless the rate of yearly inflation (as measured by the various gauges of inflation) increases to over +2.5%; in both cases, the Fed’s plans would be reevaluated.

Accordingly, the US Dollar hasn’t seen much of a continuation lower, and in fact, by midway through the European session, the world’s reserve currency had turned higher. While this is surprising in the sense that the Fed has doubled its stimulus with little impact on the US Dollar, the bigger surprise is that it hasn’t generated any buying interest in the Japanese Yen as an alternative safe haven, an occurrence noted each time the Fed has begun QE. So why hasn’t the Yen rallied; it is the worst performing currency today. On Sunday, Japan goes to the polls to elect a new prime minister, and with Shinzo Abe leading in polls, it is very likely that the next government uses a heavy hand to manipulate the Bank of Japan to ease further.

Taking a look at European credit, bond yields are slightly lower, offering little support for the Euro. The Italian 2-year note yield has decreased to 2.024% (-0.5-bps) while the Spanish 2-year note yield has decreased to 2.815% (-0.9-bps). Similarly, the Italian 10-year note yield has decreased to 4.616% (-1.2-bps) while the Spanish 10-year note yield has increased to 5.343% (+1.4-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:47 GMT

NZD: +0.11%

CAD: +0.07%

CHF: -0.08%

AUD:-0.10%

GBP:-0.16%

EUR:-0.18%

JPY:-0.20%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.11% (-0.11% past 5-days)

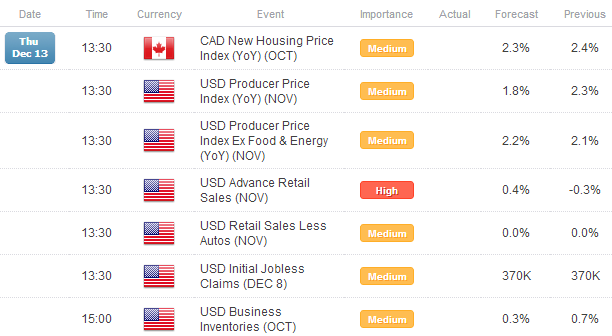

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: The same descending trendline off of the September and October highs which served as resistance last week (in combination with the monthly R1) has once again held this week (in combination with the weekly R1). Accordingly, with the Fed ultimately disappointing, consolidation is possible the rest of the week. Resistance remains 1.3075/90 and 1.3145/75. Support is 1.3010/30, 1.2875/90 and 1.2800/20 (late-September/early-October swing low).

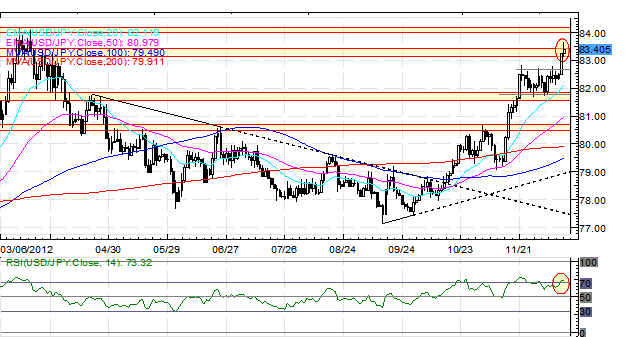

USDJPY: The Bull Flag on the daily has broken to the upside, with validation occurring above 82.90; the USDJPY is now on its way towards the mid-March highs above 84.00. With the Fed out of the way, the Yen’s fundamentals could help lift this pair higher. Support comes in at 82.90/83.00, 81.75, and 81.15.Resistance is 83.30/55 (breaking now) and 84.00/20 (March high).

GBPUSD: The GBPUSD traded into a reactionary top following the Fed, at the November high at 1.6170/80 and has since traded lower. Accordingly, my levels remain the same. Resistance comes in at 1.6170/80 and 1.6300/10 (post-QE3 announcement high in mid-September). Support is 1.6040/45 (20-EMA), 1.5955/65 (100-DMA), and 1.5865/70 (200-DMA).

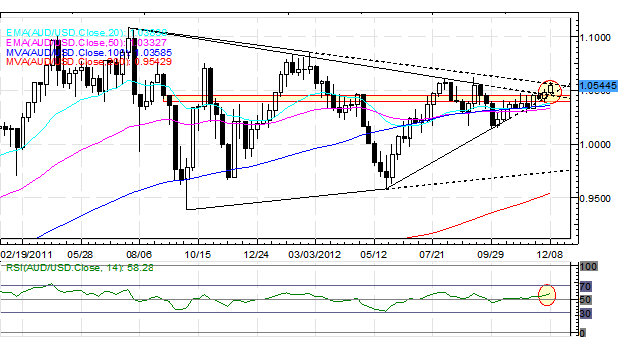

AUDUSD:The AUDUSD couldn’t break descending trendline resistance off of the July 2011 and February 2012 highs, which comes in at 1.0550/55 today, but that doesn’t mean the uptrend is over just yet. With price holding just below the monthly R2 at 1.0570 and thelong-term Symmetrical Triangle starting to break to the upside, consolidation may be ahead the next few sessions. Support is at 1.0500/15, 1.0460, and 1.0235/80. Resistance is 1.0555/75 and 1.0605/25 (August and September highs). Note: this is a weekly chart to highlight how close the AUDUSD to a potential breakout.

S&P 500: The S&P 500 has set a new December high, breaking above the early-November highs but failing in the key 1435/40 zone. Accordingly, the pair is back at1425, the 61.8% Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension. Support comes in at 1425 (holding now), 1400, 1388 (200-DMA) and 1345/50 (November low). A move higher through 1435/40 points to 1450 and 1470/75.

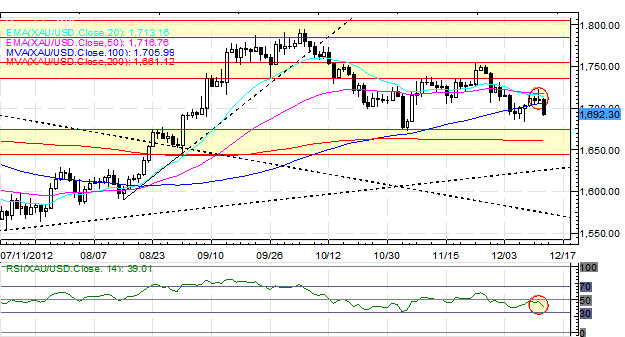

GOLD: Gold has fallen back a bit as the US Dollar has rebounded in the face of another QE package. Now that Gold is back below 1700, I expect buying interest to resume; though it should be noted that December is historically a bad month for precious metals. I will continue to look to get long as low as 1675. Resistance is 1735, 1755/58 and 1785/1805. Support is 1700, 1670/75 (November low), and 1660/65 (200-DMA).

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance