Forex: Monday, a Microcosm of 2013: Euro Leads as Sterling and Yen Tumble

ASIA/EUROPE FOREX NEWS WRAP

With light news flow over the weekend, the market has been afforded time to ‘reset’ and return to trends that persisted throughout January. Mainly, this has amounted to strength in equity markets on lower volumes, a slight upward drift in government bond yields, and of course, further jostling in FX markets. Today is thus best described as a microcosm of 2013: the Euro leads, the US Dollar (denoted by the Dow Jones FXCM Dollar Index (Ticker: USDOLLAR)) continues to push higher, while the British Pound and the Japanese Yen lead to the downside.

With respect to the British Pound: after the world’s oldest currency saw strength after incoming Bank of England Governor Mark Carney’s testimony on Thursday, reality seems to have overtaken perception, as reports have circulated that the BoE is close to lowering its growth forecasts for the British economy once more. Mr. Carney suggested that the BoE wouldn’t stray from its contemporary inflation targeting policy, and with inflation stubbornly high, this led speculators to believe that no further expansionary monetary policy would be levied.

However, the economic situation in the United Kingdom is dire. Although the labor market picture is getting brighter, stagflation essentially remains: weak growth, high inflation, and a high rate of unemployment. With austerity continuing for at least another year and inflation running high, consumption is likely to remain tepid at best, meaning that the BoE will have to do more to offset the current fiscal drag. If Mr. Carney is indeed planning to maintain the BoE’s current policies (rather than adopt a nominal GDP target), then more QE from the BoE should be expected, which historically has increased demand for Gilts, lowering yields and thus the appeal for the British Pound.

Taking a look at European credit, peripheral yields have crept higher throughout the morning, holding the Euro back from further gains. The Italian 2-year note yield has increased to 1.654% (+0.2-bps) while the Spanish 2-year note yield has increased to 2.712% (+2.0-bps). Likewise, the Italian 10-year note yield has increased to 4.574% (+2.9-bps) while the Spanish 10-year note yield has increased to 5.393% (+5.6-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 11:20 GMT

EUR: +0.12%

CHF: -0.14%

NZD: -0.43%

AUD:-0.46%

CAD:-0.46%

GBP:-0.65%

JPY:-0.74%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.45% (+1.03 % past 5-days)

ECONOMIC CALENDAR

There are no key events on the economic docket for the US session today.

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: Price has steadied below 1.3400, entering the Bull Flag range set in mid-January, from 1.3280 to 1.3390. On lower-term timeframes, a Bear Flag may have formed, with the measured move pointing to 1.3280/300. A break lower can’t be ruled out, but as long as the ascending trendline off of the mid-December and early-January lows holds at 1.3215/35, any setbacks are seen as near-term corrections.

USDJPY: No change: “Further bullish price action as US Treasury yields strengthen and speculation over BoJ policy arises again.” Resistance comes in at 93.40/45 (monthly R1), 93.85 (weekly R1) and 94.00/10. Support comes in at 92.90/95 (weekly pivot), and 91.75/95 (weekly S1).

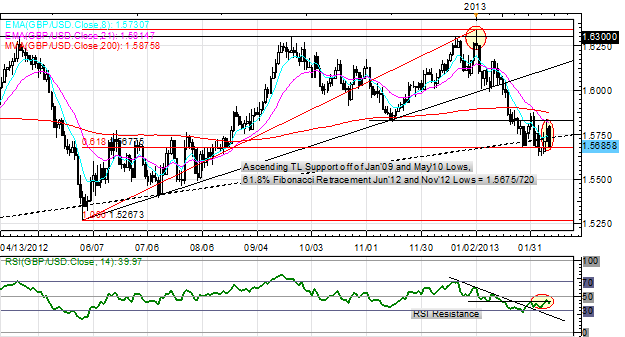

GBPUSD: No change: “The pair is holding at the 61.8% Fibonacci retracement from the June low to January high, vindicating the “cover on dips, sell rallies” perspective. I continue to look to sell rallies in the pair as significant RSI divergence exists. A hold below 1.5675 eyes a move towards 1.5500, and ultimately, 1.5265/70, the June low. Resistance comes in at 1.5825 and 1.5885/90. Support is 1.5675 and 1.5580 (monthly S1).”

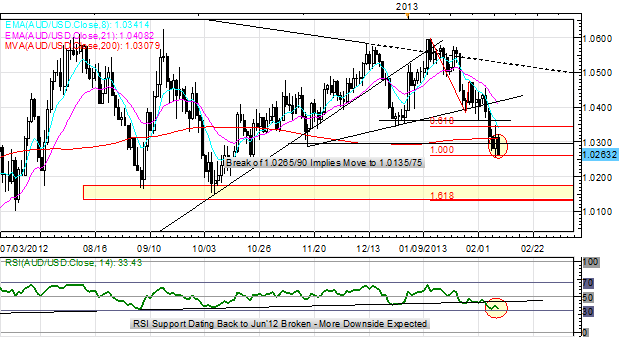

AUDUSD:The bounce from the 1.0265/90 area may have completed, with the rally halted at the 200-DMA at 1.0305/10. The pair is sitting at the 100% extension at 1.0265 now, and a break implies a deeper setback towards 1.0135/75, early-September and –October swing lows, as well as the 161.8% extension.

S&P 500: Tuesday I said: “as indicated on the charts the past weeks, noting “nearing the top 1505/1512” – the top was 1504.6. If this breaks, 1520 is in sight.” Indeed, the irrational exuberance has continued, bringing topline Bearish Rising Wedge resistance in focus at 1520; the December 2007 highs of 1520/24 could be reached on an overshoot. The 100% Fibonacci extension on the fiscal cliff rally and flag comes in at 1530. Bottom line: I’m expecting a significant setback (-10%) in the S&P 500 unless volumes accelerate rapidly, given the disconnect from reality.

GOLD: The past few weeks I’ve maintained: "When considering the move off of the September highs, a measured A-B=C-D (as expressed on the Daily) suggests that a bottom could be in place at [1630/40].” The rebound has ensued, with the alternative safe haven rallying up to 1690 today. A daily close above 1700 points towards 1722/25 and 1755. Support is 1663 (breaking now) (200-EMA) and 1640/45.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance