Forex: Japanese Yen Tanks on Unlimited Easing Concerns; Euro Leads

ASIA/EUROPE FOREX NEWS WRAP

The risk-aversion especially prevalent in US bond and equity markets recently, with the US Dollar continuing its strength following the Federal Reserve’s QE3 announcement in mid-September, was thrown off its footing earlier today following pronounced weakness in the Japanese Yen. Typically, the Yen, as a low yielding and very liquid currency, is only deemed appealing by investors when investors are seeking safety from volatility or looking to find an alternative safe haven instead of the US Dollar.

But today’s dramatic drop in the Japanese Yen has nothing to do with a rebound in risk-appetite, or new prospects for a stronger US Dollar. Instead, the surprise call for elections in December by current Japanese Prime Minister Yoshihiko Noda on Wednesday, coupled with calls for unlimited easing by the Bank of Japan from opposition leader, and most likely the next leader of Japan, have dropped the Yen to its lowest value against the US Dollar since late-April.

Thus, with the Japanese Yen looking unsuitable as a safe haven in the short-term, the US Dollar looks poised to see additional flows during risk-averse scenarios. Today might not be the best representation of true risk-aversion, considering that the Canadian and New Zealand Dollars have been top performers alongside the Euro, while the Australian Dollar and the Japanese Yen are leading to the downside. Nevertheless, how the market handles the US Dollar with respect to the highly distorted Yen will be an indicator of the BoJ’s credibility over the coming weeks.

Taking a look at credit, peripheral bond yields are mostly lower, allowing the Euro to appreciate. The Italian 2-year note yield has decreased to 2.259% (-2.0-bps) while the Spanish 2-year note yield has increased to 3.194 % (+1.9-bps). Likewise, the Italian 10-year note yield has decreased to 4.913% (-3.4-bps) while the Spanish 10-year note yield has decreased to 5.884% (-1.9-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:50 GMT

CAD: +0.24%

EUR:+0.24%

NZD:+0.21%

CHF:+0.19%

GBP: +0.05%

AUD:-0.37%

JPY: -1.11%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.24% (+0.85% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: After a daily Hammer on Tuesday, the EURUSD has regained 1.2750, mid-June swing highs and the early-September “pause” the EURUSD experienced. Support comes in there, 1.2630/45 (100-DMA), and 1.2400/35. Resistance is 1.2790 (last Friday’s high), 1.2820/30 (mid-October swing low, 200-DMA), 1.2880/1.2900, and 1.3015/20 (late-October high).

USDJPY: The USDJPY has moved to the top of trend resistance near 81.15 and has broken above our key 80.50/70 level, leaving the mid-April swing high at 81.75/80 as the next major resistance level. Support comes in at 80.50/70 (former November high) and 79.10/30.

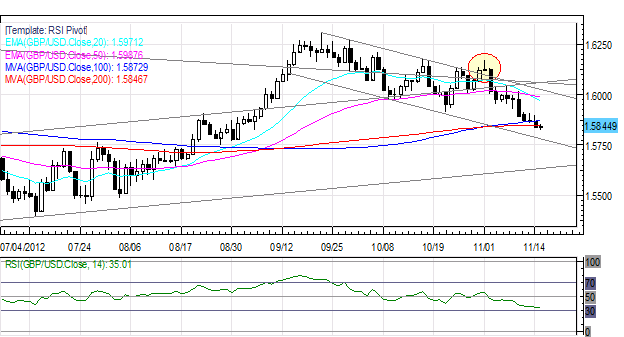

GBPUSD: No change from last Tuesday: “While the GBPUSD appeared to be moving to breakout of its recent downtrend, an Inverted Hammer on November 1 has biased the pair to the downside. For now, we are neutral if not looking lower.” Resistance comes in at 1.5910/15 (October low), 1.5970/90 (20-EMA, 50-EMA) and 1.6170/80 (late-October highs). Support (breaking now) is 1.5845/50 (200-DMA) and 1.5800/05.

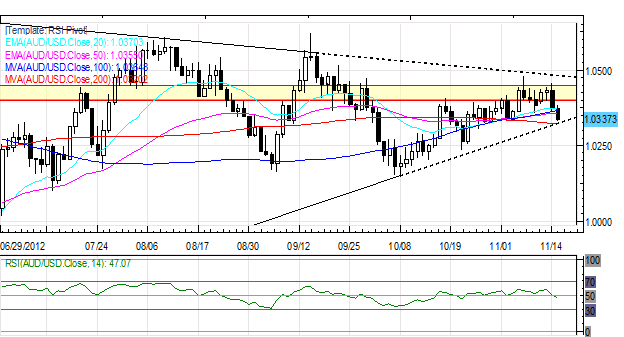

AUDUSD: The AUDUSD has failed in the 1.0405/50 zone once more, leading to a sharp decline the past two days to trendline support off of the June 1 and October 23 lows at 1.0315/25. Support is close by at 1.0315/25 (200-DMA) and 1.0235/80. Resistance is at 1.0355/70 (20-EMA, 50-EMA), 1.0405/50 (former swing highs and lows, October high) and 1.0500/15.

S&P 500: No change, although the S&P 500 is very close to crucial support: “Now the pullback is looking deeper: the ascending channel off of the October 4, 2011 and June 4, 2012 lows is breaking. Targets near 1355 are in focus now that price is below 1395.” Support comes in at 1350/65 (monthly S2, ascending channel support off of November 2011 and June 2012 lows). Resistance comes in at 1383 (200-DMA) and1400/15 (20-EMA, 50-EMA, 100-EMA). If there’s no rebound by the end of this week, a technical bounce could be seen given oversold conditions, but only viewed within the context of a corrective rebound before a bigger sell-off.

GOLD: Gold has consolidated just below its November highs, though considering that the US Dollar is at its strongest level in over two months, Gold is holding up well. As such, I still expect the 1700 area to be defended vigorously, and look to get long as low as 1675. Resistance is 1735, 1755/58 and 1785/1805. Support is 1700, 1675/80 (100-DMA, November low), and 1660/65 (200-DMA).

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance