Forex: Japanese Yen Rebounds Swiftly - Volatility Likely Until BoJ

ASIA/EUROPE FOREX NEWS WRAP

Risk appetite is dampened this morning as the Japanese Yen and the US Dollar have rebounded across the board, amid a warning from Fitch Ratings that another debt ceiling debacle would have a “material” impact on the United States’ top credit rating. The Yen is the top performer, boosted by comments from Japan’s economy minister, who suggested that too weak of a Yen would hurt imports as well as consumers’ purchasing power.

With respect to the Yen, Japanese Prime Minister Shinzo Abe has stepped up his rhetoric for the Bank of Japan to implement a +2.0% yearly inflation target, meaning that speculation about potential policy changes will continue to run high until the January 22 policy meeting. As the meeting approaches, however, it is worth pointing out that the Japanese Yen is simply a very oversold currency. In fact, according to the CTFC’s COT report, net non-commercial futures positioning is at its shortest level since July 2007; the short trade is very crowded and a significant unwind would undoubtedly provoke a sharp move.

A look at the weekly chart shows that the USDJPY hasn’t posted a negative period since the first week of November. In fact, last week’s RSI was above 80 – the last time that happened was in December 2005, which produced a pullback of >500-pips. Accordingly: seeing the Japanese Yen bottom (xxxJPY pairs top) after the BoJ would not be surprising; the conditions are ripe for a significant turnaround, just not yet. I’m very wary of the Yen bottom occurring before the official measures being announced.

Taking a look at European credit, slight strength in peripheral yields have done little to support the Euro. The Italian 2-year note yield has decreased to 1.363% (-3.3-bps) while the Spanish 2-year note yield has decreased to 2.400% (-5.7-bps). Likewise, the Italian 10-year note yield has decreased to 4.143% (-4.0-bps) while the Spanish 10-year note yield has decreased to 4.947% (-5.2-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 12:00 GMT

JPY: -0.02%

CAD: -0.03%

EUR: -0.10%

CHF:-0.27%

AUD:-0.29%

GBP:-0.32%

NZD:-0.67%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.15% (-0.17% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

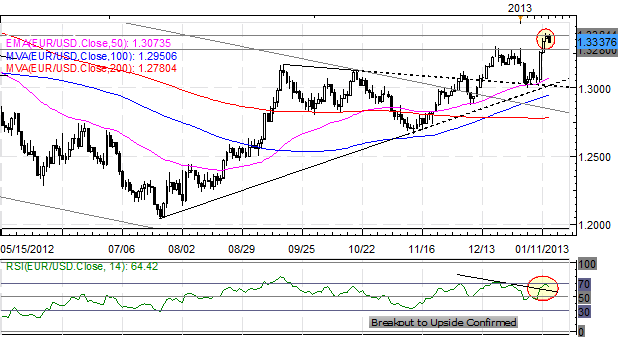

EURUSD: No change, though it should be noted that a bearish piercing candle is forming today: “The pair has continued higher, cutting through the May 2012 high at 1.3280 and running into the next leg up, the March 2012 high at 1.3380/85. Last week I said: “the RSI downtrend on the daily chart has been broken, despite price holding below the May/December highs at 1.3280/3310. Coincidentally, focus is on buying dips.” This remains to be the case even as price has started to catch up to momentum. Support comes in 1.3280/3310, 1.3120/45, 1.3070/75 (50-EMA), and 1.3000 (January low). Resistance is 1.3380/85 (mid-March swing high) and 1.3485 (late-February swing high).”

USDJPY: No change: “The pair’s rally has continued to its highest level since June 2010, essentially leaving the door open for a run above 90.00. Given BoJ policy, any dips seen in the USDJPY are viewed as constructive for further bullish price action (though I would like to clarify that this view is only valid until the BoJ meeting on January 22; the market remains very net-short the JPY, so a near-term top marked by an event seems possible (think the US Dollar bottoming the day after QE3 was announced)). Resistance comes at 89.10/35 (daily high, weekly R1) and 90.10/15 (monthly R2). Support comes in at 88.40 (monthly R1) and 87.00/40 (weekly pivot).”

GBPUSD: No change: “The pair has fallen back from 1.6300, again, though with no follow through yet, my levels remain the same (they haven’t changed since early-December). However, the pair is now coming into ascending TL support off of the July and November lows at 1.6000. Support is there and 1.5900 (200-DMA). Resistance comes in at 1.6085/90 (50-EMA), 1.6180, and 1.6300/10 (post-QE3 announcement high in mid-September).” It should be added that a break below 1.6000 could accelerate through the 200-DMA towards the most recent swing low, at 1.5820/25 set in mid-November.

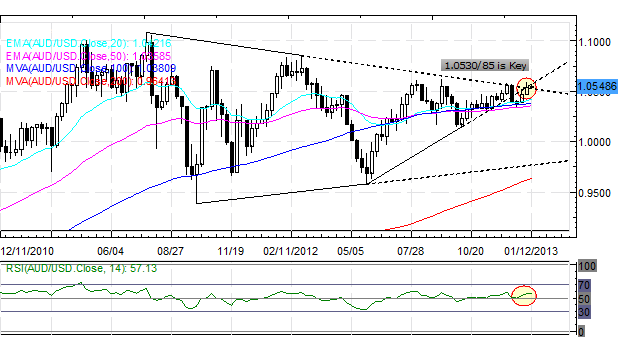

AUDUSD:No change: “The pair has broken the December highs and a break signals a push towards 1.0605/25. However, it’s worth noting that the daily RSI hasn’t pushed into overbought territory on any rally since February 2012. Accordingly, we’ll either see a move to new highs and with RSI confirming the breakout; or further consolidation/pullback is in order before the next leg higher. Support is at 1.0530/50 (weekly pivot, monthly R1), 1.0465/70 (weekly S1), and 1.0400/05 (weekly S2). Resistance is 1.0530/85 and 1.0605/25 (August and September highs).”

S&P 500: For the past several weeks I’ve maintained: “The S&P 500is back above a very significant zone of 1445/50 (descending trendline off of September and October highs, 100% Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension), and a move higher necessarily points to 1470/75.” With these levels to the upside breaking, a move above the September highs points to resistance at 1500 and 1520/25 (December 2007 high). Support comes in at 1450/55, 1425, 1400, and 1390 (200-DMA).

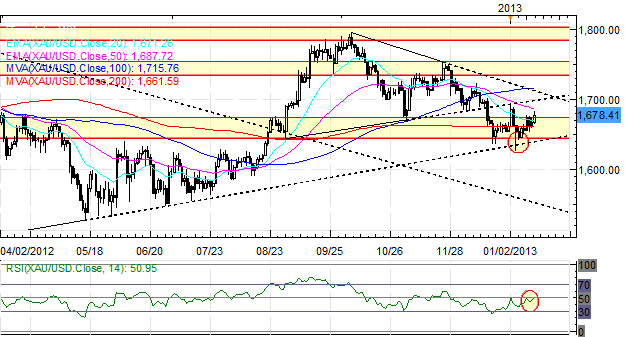

GOLD: No change: “Gold is at a make or break level right now, former Symmetrical Triangle support at 1630/40, and its lowest level since August, before the ECB and the Fed’s QE intervention hopes took hold. Additionally, when considering the move off of the September highs, a measured A-B=C-D (as expressed on the Daily) suggests that a bottom could be in place at these levels as well. Support is there at 1580. Resistance is 1690/95, 1735, 1755, and 1785/1805.”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance